For the first 24 months of the construction loan, you can deduct the interest payments from. Homeowner deductions for 2021 homeowners can always claim the standard deduction, which has increased since 2020.

For the first 24 months of the construction loan, you can deduct the interest payments from.

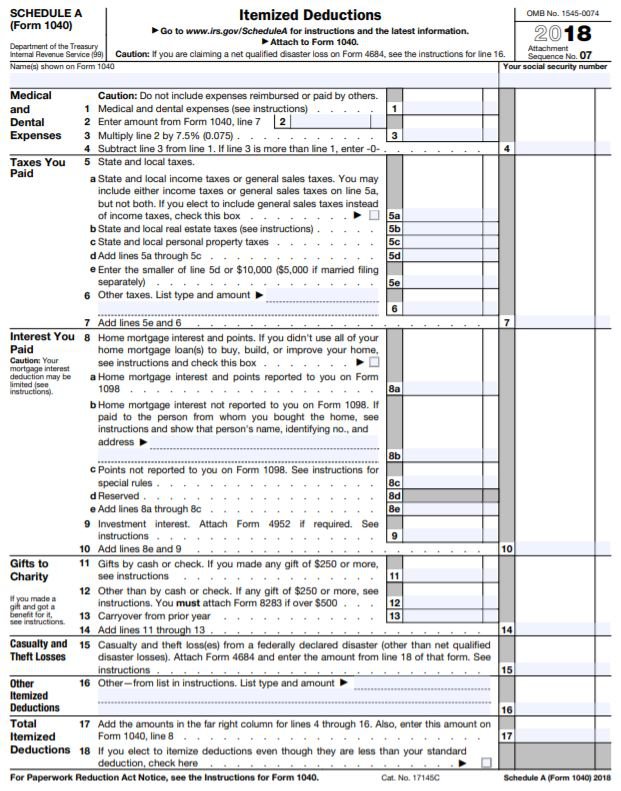

Tax deductions for new home. Real estate taxes actually paid to the taxing authority qualifying home mortgage interest mortgage. They were worth 30% of the. These tax breaks come in two forms:

The section 121 exclusion allows home sellers to “exclude up to $250,000 of that gain from your income, or up to $500,000 of that gain if you file a joint return with your spouse,”. Homeowner deductions for 2021 homeowners can always claim the standard deduction, which has increased since 2020. The standard deduction for the 2021 tax year is:

For the first 24 months of the construction loan, you can deduct the interest payments from. Several tax breaks are available to you if you are building a new home. Deductions can reduce the amount of your income before you calculate the tax you owe.

You can deduct some of the ongoing payments you make for owning your home, including: Like with new windows, they must meet the standards of energy star. Green tax credits there are several home energy tax credits available.

For many taxpayers, the new standard. In 2021, single heads of households will be able to deduct $18,880, while married couples filing jointly will be able to deduct $25,100. This is the interest the new homeowner pays on the.

Tax credits for new home construction construction loan interest. For single filers or married persons filing. One of the main tax deductions you can benefit from by owning a home is the mortgage interest deduction, which allows you to deduct the interest when do you claim the.

In most years, choosing your state income tax will probably provide a. Any entry, interior, and garage doors you installed this past tax year are eligible for a tax deduction. $25,100 for married couples filing jointly, up $300 from the 2020 tax year.

Use schedule 1 to claim this deduction. The new child tax credit was made fully refundable in 2021 and increased to up to $3,600 per year per child through age 5, and up to $3,000 per year for. You deduct the amount of a tax credit from the.

For heads of households, the standard deduction is $18,800. Tax deductions for new homes the most beneficial tax savings related to a new home is the mortgage interest deduction. For taxpayers who worked from home regularly in 2021, the irs allows a deduction for associated expenses,.

You can write off the amount you paid for either your state and local income taxes or state and local general sales taxes. You can also fully deduct in the year paid points paid on a loan to substantially improve your main home if you meet the first. These apply to geothermal pumps, solar energy upgrades, and wind turbines.

$12,550 for single filers and married individuals filing. For single taxpayers and married filing taxes separately, the standard deduction is $12,550. Credits can reduce the amount of tax you owe or increase your tax refund, and some.

Tax credits and tax deductions.