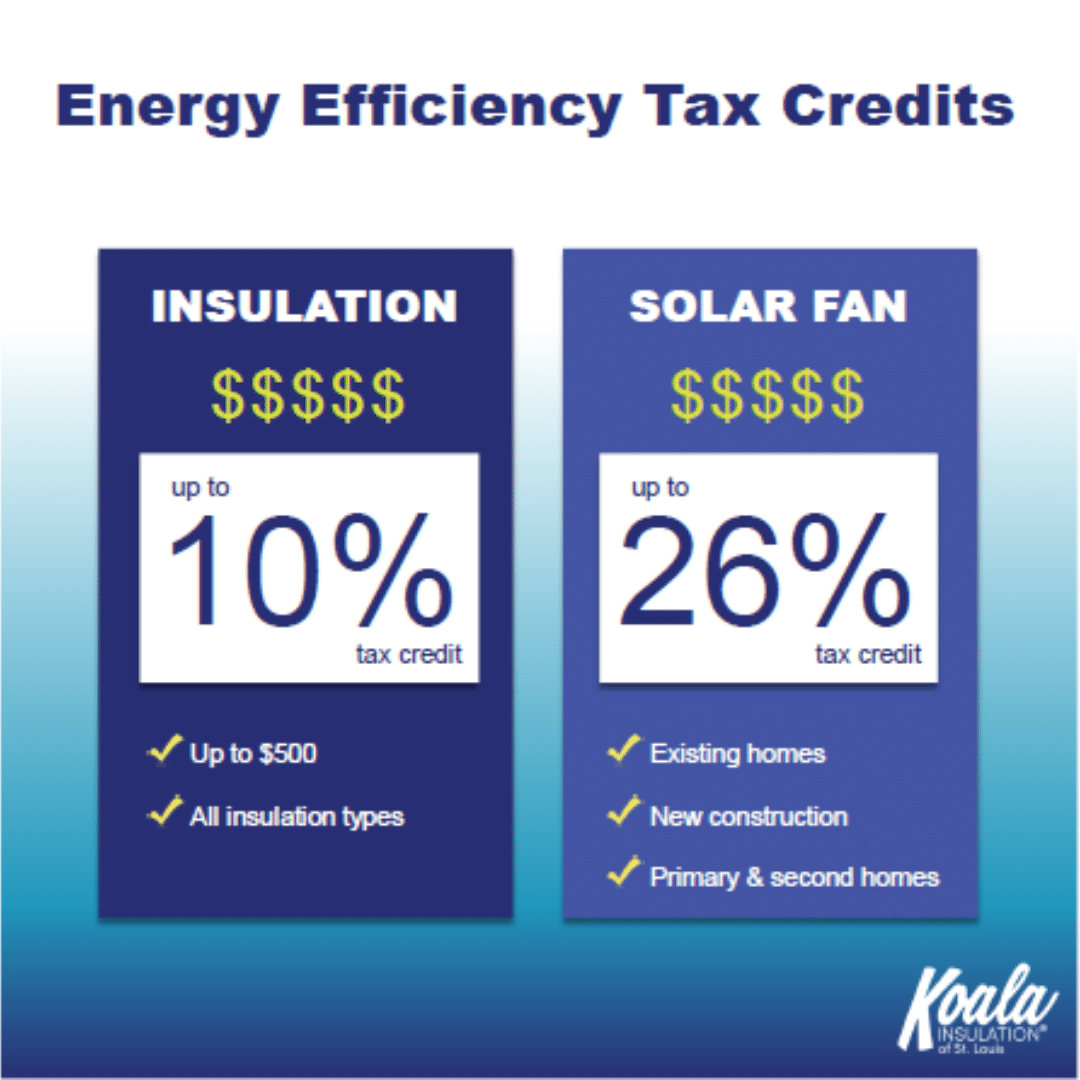

It offers a credit against federal income tax of 10% of the cost, up to $500 (not including installation.) There’s also no upper limit on how much you can claim.

These credits have been extended through december 31, 2021 and are retroactive back to december 31, 2017.

Tax deductions for new insulation. This credit is worth a maximum of $500 for all years combined, from 2006 to its expiration. There would be no deduction allowed for the cost of installing the new insulation. The solar credits were extended to 2019 and then are available on a reduced basis until 2021.

If you increase the energy efficiency of your home, you may be eligible for federal energy efficiency tax credits. This doesn’t cover labor, but only insulated materials. How do you apply for the tax credit?

You can claim a tax credit for 10% of the cost of qualified energy efficiency improvements and 100% of residential energy property costs. For this credit, the irs distinguishes between two kinds of upgrades. The credit is worth up to $500, and it can be claimed on your taxes for the year in which the insulation was installed.

There’s also no upper limit on how much you can claim. This will save government funds in two ways. The federal consumer energy efficiency tax credit can be applied to a wide range of house.

For example, you can get a tax credit if you purchase insulation materials for your walls or attic. Is there a deduction for insulation? Idaho residents with homes built or under construction before 2002, or who had a building permit issued before january 1, 2002, qualify for an income tax deduction for 100% of the cost of installing new insulation or other approved energy efficiency improvements in an existing residence.

The internal revenue service offers a tax credit that lowers your tax bill by the actual amount of the. Learn more about the tax credit. A tax deduction of up to $1.80 per square foot is available to owners or designers of commercial buildings or systems that demonstrate a 50% reduction in energy usage accomplished solely through improvements to the heating, cooling, ventilation, hot water, and interior lighting systems.

In 2018, 2019, 2020, and 2021, an individual may claim a credit for (1) 10% of the cost of qualified energy efficiency improvements and (2) the amount of the residential energy property expenditures paid or incurred by the taxpayer during the taxable year (subject to the overall credit limit of $500). Deductions several insulation and sealant products qualify for a tax credit. If a new insulation is being installed to make sure the property meets the minimum standards, then the costs associated with this install are likely be considered as an improvement to the building and of capital nature.

Making insulation tax deductible will reduce the cost of insulating rental properties and lower the need for higher rental prices. It offers a credit against federal income tax of 10% of the cost, up to $500 (not including installation.) The insulation tax credit is a federal tax credit available to homeowners who upgrade their home insulation.

Here’s how the program works when adding or upgrading home insulation: Any insulation added must be in addition to, not a replacement of, existing insulation. Of that combined $500 limit,

The maximum saver’s credit available is $4,000 for joint filers and $2,000 for all others. According to the national association of realtors, the most recent tax credit covers 10% of material costs up to $500. You can get a tax credit from the federal government by qualifying for an energy star.

The value of the insulation tax credit does not include installation costs. The legislation continues the credit available to homeowners who add or retrofit/upgrade the insulation in their homes. It will reduce increases in the accommodation supplement and decrease health spending as increases in the level of insulation reduce hospital admissions.

If you add to your home’s insulation, you can receive a tax credit of 10% of the cost up to $500. With this credit, homeowners can claim 10% of eligible home improvements (excludes labor/installation fees). Financing energy efficiency improvements financing insulation costs is another approach, if you want to avoid any immediate out of pocket expenses.

When you claim federal tax credits and deductions on your tax return, you can change the amount of tax you owe. Use form 8880 and form 1040 schedule 3 to claim the saver’s credit. Ad answer simple questions about your life and we do the rest.

All these credits were valid through the 2016 tax year. Green energy systems may also be eligible for tax credits. These credits have been extended through december 31, 2021 and are retroactive back to december 31, 2017.

Homeowners can be eligible for a tax credit of up to $500 or 10% of qualified energy efficiency improvements, such as insulation. This is once again good news for homeowners, new home builders and the environment. The installations must be designed for either a primary or secondary residence.

These green tax credits were extended, and if you make the purchase and installation before december 31 st, 2019, you can claim back 30% of the total purchase and installation price. Deductions can reduce the amount of your income before you calculate the tax you owe. The federal government offers a tax credit for updating your home�s insulation.

From simple to complex taxes, filing with turbotax® is easy. To be eligible for the credit, you must own your home and your insulation must meet certain requirements. Talk with a tax professional to make sure the siding and insulation are covered by the tax credit.

Credits can reduce the amount of tax you owe or increase your tax refund, and some credits may give you a refund even if you don�t owe any tax. (new construction does not apply.)