You can claim depreciation once your property is available for rent, even if. A replacement is almost always an improvement—not a repair—for tax deduction purposes.

Brought to you by stessa, the free financial tool for landlords.

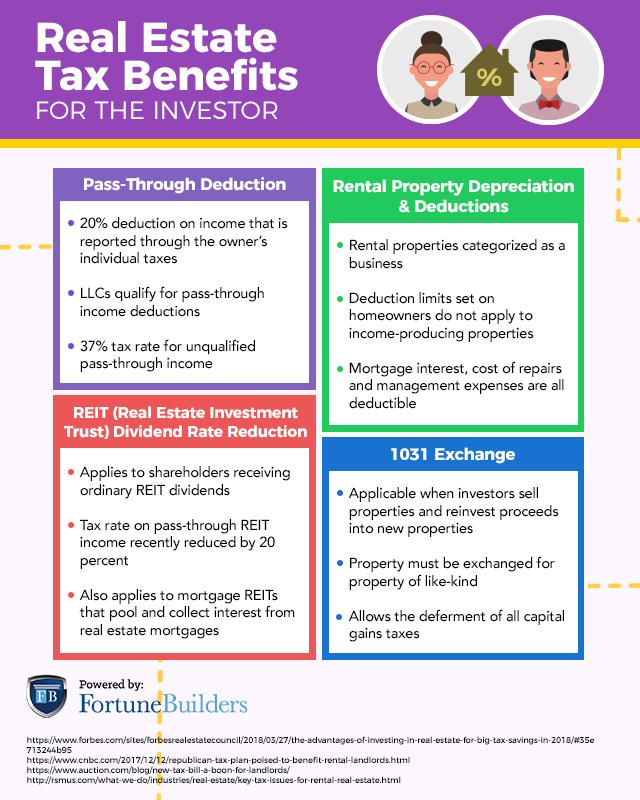

Tax deductions for new rental property. Real estate by income deduction so, if you are making $100,0000 or less, you can write off up to $25,000 a year in passive rental real estate losses. However, these limits do not apply to rental businesses, so you can deduct all mortgage interest on rental properties as a business expense. Turbotax® premier is the resource needed to file your investor taxes easily & confidently.

Tax write off for rental property #1: Although there’s a new limit on the property tax deduction ($10,000, or $5,000 if married filing separately, for property taxes and. Different deductions are available from the irs.

Tips on rental real estate income, deductions and recordkeeping. Depending on your rental property’s location, they can range anywhere from a few hundred dollars to hundreds of thousands. If your state has rental licensing requirements, you can also deduct any accompanying landlord or vacation rental license fees.

There is no law that says that if something in your rental property is broken it has to be replaced. However, remember that the irs says that these expenses must generally be accepted within the rental industry and should be ordinary in nature. The new tax law changes that to 100 percent, meaning you can deduct the full cost of property such as appliances and furniture all in one year.

To qualify for this deduction, you must meet these conditions: It entitles landlords to reduce their taxes by deducting rental expenses from their income. If your rental property is considered a business, the qbi deduction could save up to 20 percent of your income.

Rental tax deductions are special deductibles given to rental property owners in the united states. All rental income must be reported on your tax return, and in general the associated expenses can be deducted from your rental income. Maintenance repairs utilities advertising office supplies property taxes sales tax insurance mortgage interest

If your state has rental. Rental owners frequently overlook the deduction, he notes. The qualified business income (qbi) deduction allows many rental property owners to deduct 20% of the income from a rental property business from the total taxable business income amount.

If your income is above $100,000, then the deductions go down by 50 cents for every dollar of income until it eventually phases out at the $150,000 income level. There are deductions for many things, such as interest on your mortgage, repairs to your home, and insurance plans. The deduction is for small business owners who perform at least 250 hours of serve for the vacation rental property.

2018 tax rules under rules that go into effect for tax year 2018, you can also deduct more expenses under a section of the tax law known as section 179. You can find the exact tax rate in your area by checking your escrow summary or inquiring with your tax professional. That means if you spend $30,000 remodeling the kitchen and a bathroom in your newest rental property, you may be able to deduct the entire $30,000 from your tax bill for the current year.

Click to see full answer. Under the new rules, you can do this with up to $1 million in new property used for certain allowable business uses, including providing lodging to your tenants. A replacement is almost always an improvement—not a repair—for tax deduction purposes.

Demand for rental properties will increase You�ll obtain the best tax results if you patch, mend, or fix things that are broken, instead of replacing them. Almost every state and local government collects property taxes.

Brought to you by stessa, the free financial tool for landlords. Ad we�ll search hundreds of tax deductions to get every dollar you deserve. If you own rental real estate, you should be aware of your federal tax responsibilities.

If a rental property is used more than 50% of the time for commercial rental, there is no section 179 penalty. Ad download our free 2022 tax guide for landlords & maximize your deductions. This change is bound to encourage more landlords to upgrade their properties—or purchase more.

One of the many benefits of owning a rental property is being able to deduct normal operating expenses from gross rental income to reduce taxable net income. You can claim depreciation once your property is available for rent, even if. 9 rental property tax deductions:

What is the deduction for mortgage interest on rental properties in u deduct mortgage interest on a rental property 2020? As rental property owners, you can deduct the depreciation on your rental property. If you are a cash basis taxpayer, you report rental income on your return for the.

You can claim a tax deduction for a second or third property as long as you live there for at least 14 days out of the year and it is not rented out longer than that. You are renting out your primary residence for more than 14 days of the year While most of these may be deductible, a few ordinary expenses for rental properties include:

You should note that the irs limits the deduction of state and local income, as well as sales and property taxes to a combined deduction of $10,000 ($5,000 for married taxpayers. The government allows landlords to offset this loss by “depreciating” the value of the structures and other improvements on a rental property. However, the total amount of deductions for state, local and property taxes still cannot exceed $10,000, including the tax on your primary residence.