In this situation, both parents can attach form 8332 to their tax return. 11 yes no if yes, you must file an amended return to claim this credit, the nys eic, or nyc eic.

The deduction is up to $4,000 for higher education tuition and mandatory enrollment fees.

Tax deductions for non custodial parent. A recent case from the tax court explains the special “qualifying child” rule for children of divorced parents. However, you must still meet the other requirements. Dependent exemption, child tax credit, dependent care.

Certain individuals may claim a tax credit for their dependent children. In this situation, both parents can attach form 8332 to their tax return. If you are paying your child�s student loans, you can deduct the interest if you meet the requirements.

The noncustodial parent can usually claim the tax breaks below as long as the support and the custody requirements of the noncustodial parent rule are met. Under this circumstance, your child will still be considered a qualifying child for the credit. If the non custodial parent is eligible for eic on themselves the program will compute that automatically.

The noncustodial parent can usually claim the tax breaks below as long as the support and the custody requirements of the noncustodial parent rule are met. It makes sense to minimize taxes. You can claim the child and dependent care credit if otherwise eligible.

Child support payments are not tax deductible by the payer and they are not taxable income to the recipient. The deduction is up to $4,000 for higher education tuition and mandatory enrollment fees. The custodial parent can also usually claim these breaks.

Only the parent using the dependency tax exemption can claim the child tax credit. The majority of these credits and child tax deductions are available only to the custodial parent. At the time of publication, you may deduct 35 percent of expenses paid, up to a maximum of $3,000 per child and a total of $6,000 for two or more children.

The deduction is up to $4,000 for higher education tuition and mandatory enrollment fees. Earned income tax credit this tax credit is refundable, meaning you could receive money back after the credit is deducted from the amount of taxes you owe. The incomes of the parties.

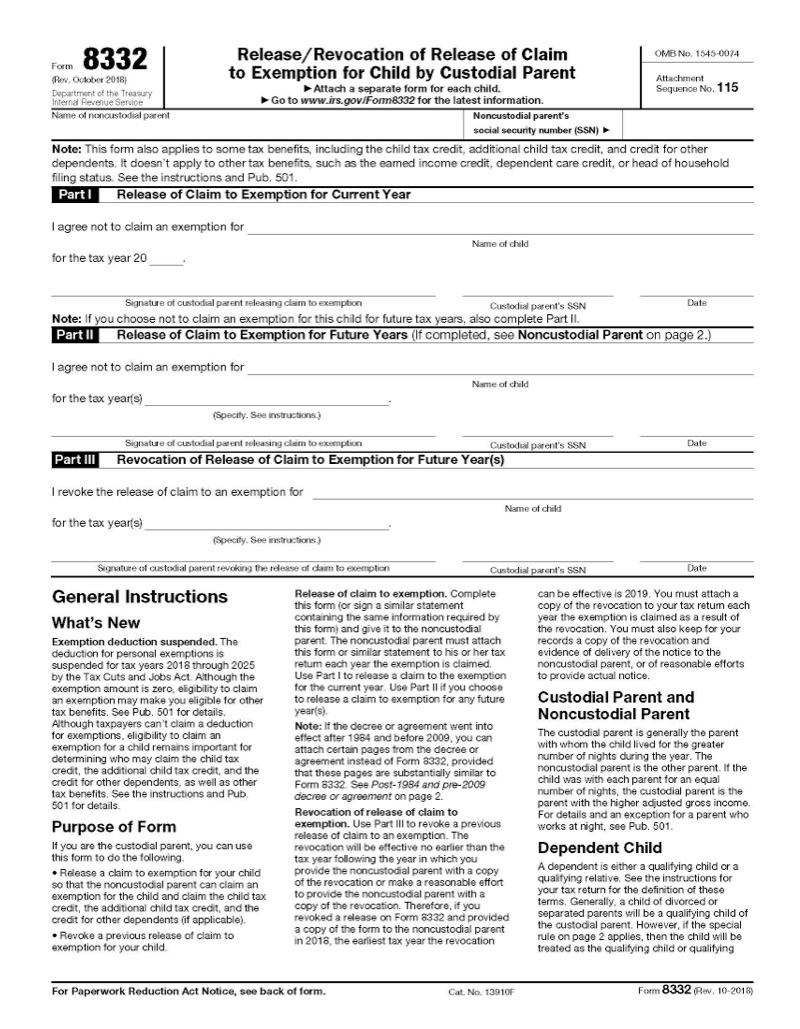

Without a signed release, however, the noncustodial parent. In order for the noncustodial parent to claim the child as a dependent, the custodial parent generally must provide the noncustodial parent with either form 8332, release/revocation of release of claim to exemption for child by custodial parent, or a similar statement (containing the same information required by the form). Briefly, there are 5 tax benefits of having a child dependent:

A divorce decree may grant a noncustodial parent the “right” to claim a child as a dependent. Also, if eligible, they might be able to qualify to claim the child tax credit. The custodial parent gives up the exemption by signing a form 8332:

12 do you want the tax department to compute your noncustodial eic and nys eic and give you the 11 yes no if yes, you must file an amended return to claim this credit, the nys eic, or nyc eic. The noncustodial parent must attach the form 8332 to the return.

Release / revocation of release of claim to exemption for child by custodial parent. Transferring the right to claim a child will sometimes free up some additional tax savings — which can be split between the parties or used to directly support the child. What if the parents have joint legal custody?

The custodial parent can also usually claim these breaks. That agreement became part of a court order. A married couple had a child, but later divorced.

Although it has been in place for decades, the rule still causes confusion, especially among clients. Do you pay child support? The tax consequences for each parent.

Only the custodial parent can claim: