It is $11.7 million per person for 2021. If you are a nonresident alien, you cannot claim the standard deduction.

Peter contributes $15,000 to superannuation and claims a tax deduction of $15,000 in his australian tax return.

Tax deductions for non residents australia. However, to benefit from making a pdc to super, Effectively connected income, after allowable deductions, is taxed at graduated rates. As a foreign resident, you must lodge a tax return in australia.

Where assessable income exceeds allowable income tax deductions, australian taxation is payable on the excess. Peter contributes $15,000 to superannuation and claims a tax deduction of $15,000 in his australian tax return. In australia, tax deductions help keep taxable income low and increase the tax refund that you receive at the end of the financial year.

Foreign residents’ capital gains tax the 2017 budget measure to deny access to foreign and temporary tax residents to the cgt main residence exemption from 7:30pm (aest) on 9 may 2017 excludes properties held prior to this date until 30 june 2020. Nonresident alien income tax return. If you are a nonresident alien, you cannot claim the standard deduction.

This interest is not included in assessable income, but you will need to provide your bank with an overseas address otherwise tax will be withheld by your financial institution at a much higher. You don�t have to be citizen or permanent resident of australia to be treated as australian resident for tax purposes. Further information for non residents

The estate exemption is only $60,000. The formula used to calculate taxable income. Keep in mind that if you use your vehicle for both work and personal purposes, you can only.

Therefore, as peter earns no employment income in australia, he will satisfy the 10 per cent test for the financial year. Deductions include loan interest, holding costs, estate agent’s fees, and repairs. This may involve more careful planning when you are considering whether to opt out of the deemed disposal rules.

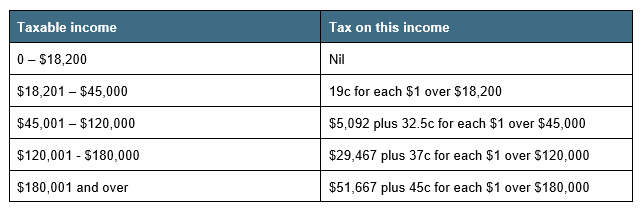

Pay 15% on their first $37,000; Australia has tax treaties with other countries and this may affect the amount of tax you need to pay. The financial year in australia ends on june 30 if the property is less than 20 years old, it could be worth getting a tax depreciation report.

Fdap income is taxed at a flat 30 percent (or lower treaty rate, if qualify) and no. This report outlines how much you can write off for the decline in value of the building and the assets inside it. So it will impact relatively few people.

Fringe benefits tax (fbt) where an employer has an obligation to withhold payg in relation to their employees, fbt obligations must also be considered. Individuals who aren’t australian residents are eligible to make personal deductible contributions (pdc) to super, provided they meet the requirements to make these contributions. Allow us to find you the perfect home loan.

Fbt applies to some benefits provided to employees (or their family or. Refer to publication 519, u.s. It is $11.7 million per person for 2021.

These are the same rates that apply to u.s.