Personal car used to travel between jobs. Personal car used to travel between jobs.

Personal car used to travel between jobs.

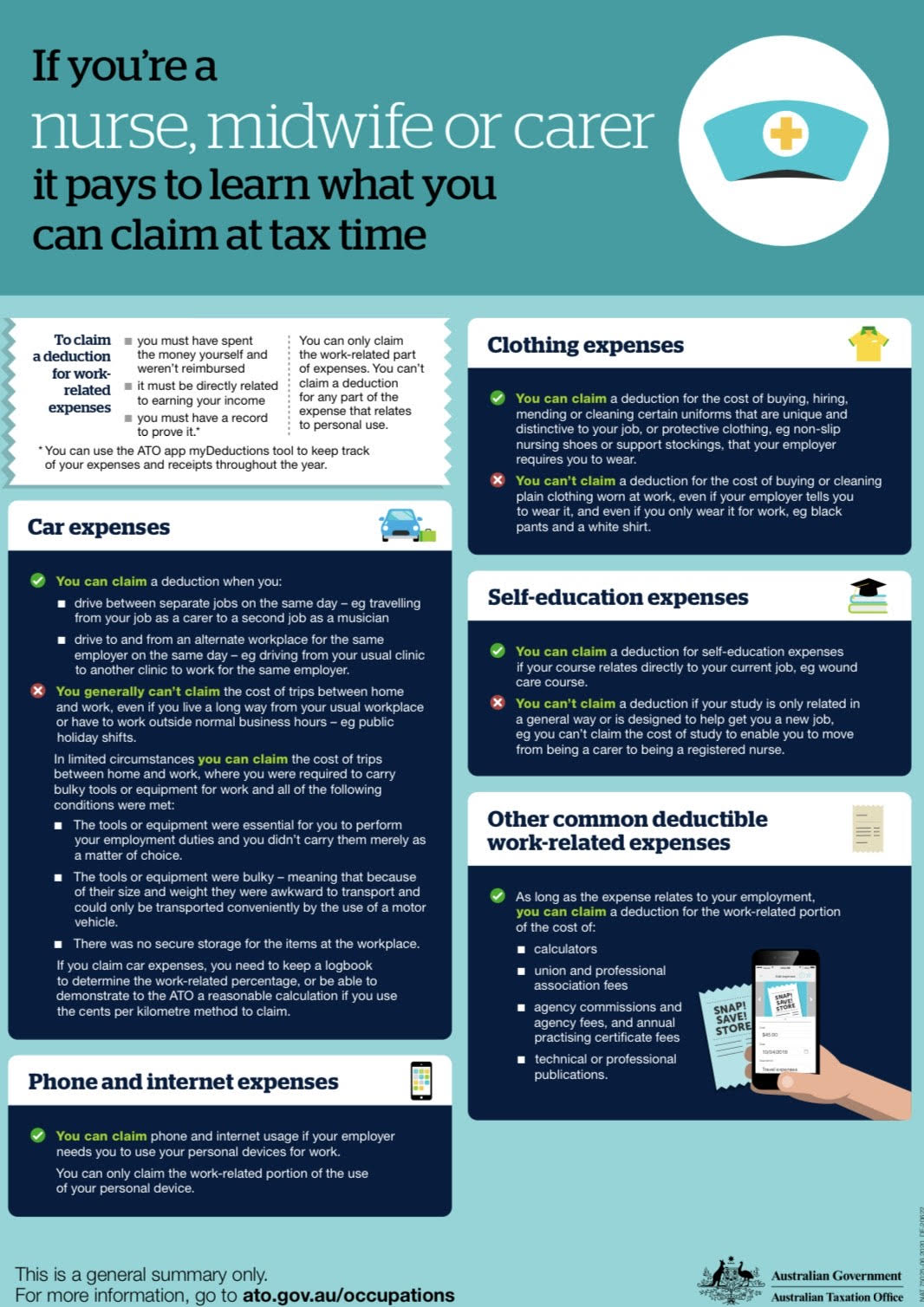

Tax deductions for nurses au. Instant tax refunds has compiled a comprehensive list of all the tax deductions for health professionals, including nurses, midwives, and other health professionals. The australian tax office (ato) has put forward a list of possible items upon which the nurses can claim a tax deduction. The list below covers all the possible items upon which the nurses can claim a tax deduction.

It is to be remembered that to ensure this deduction is made, you must have all required receipts with you in hand. Contact us for your taxation and accounting need 08 7078 8882 help@yogigroup.com.au 398 payneham road glynde sa 5070. Nurses can claim a deduction on the annual fees they may pay for membership to.

Nurses personal car expenses (estimation of. Tax deductions for nurses union fees and professional associations. Whether you�re a nurse, a bartender or an accountant, the deduction options for employees are limited.

Includes information on what you can and cannot claim, record keeping tips, and tax return mistakes. Traveling between home and work is generally considered private in nature, but. Lodging, meals, car rental, airfare, and parking fees and tolls are all deductible while working and in transit to and from your next work site.

Personal car used to travel between jobs. If you work as a nurse or other health professional, in a hospital, agency or private practice, some of the tax deductions you may be able to claim on your personal tax return are: Meals and travel tax deductions · when working overtime,.

Luckily for them, they can claim these expenses back as a deduction on their tax returns. Just for travel nurses if you work as a travel nurse, you may be qualified for special deductions due to the unique nature of your work life. With over 20 years of combined tax experience our tax agents are ensuring that you get the biggest tax refund possible.

Copyright © 2022 outsource to vineet | by vt. You can�t claim a deduction for any part of the expense that relates to personal use. Tax focus is a registered tax agent and certified public chartered accountant.

If you are not sure whether your expenses qualify as tax deductions, then contact us at 08 7078 8882 or help@yogigroup.com.au an accountant for yogi group accountants and business advisors will get back to you. Popular deductions nurses can claim: Nurses may also be entitled to general tax deductions that are not work specific, such as investment deductions or car expense deductions.

It is to be remembered that to ensure this deduction is made, you must have all required receipts with you in hand. The list below covers all the possible items upon which the nurses can claim a tax deduction. You can’t claim a deduction for the cost of buying or cleaning

Any amount you spend on materials you purchase as a healthcare professional or nurse. If you need advice, contact us at info@personaltaxspecialists.com.au. Nurse, midwife and direct carer specific deductions you can claim.

The australian tax office (ato) has put forward a list of possible items upon which the nurses can claim a tax deduction. What can nurses claim as tax deductions? A handy checklist for nurses to help you collect together all the receipts, tax invoices and supporting documents you’ll need to do your tax return.

Enrol in australia’s leading tax course | fast track courses announced register now In today’s video i share 5 deductions that nurses could use when completing their tax returns. A checklist of tax deductions nurses can claim during tax time.

C) satisfies the substantiation rules. It’s important to have an understanding of what deductions you. What are the most common tax deductions for nurses and healthcare workers?

Overtime meals travel expenses personal car usage overnight accommodation costs uniforms and protective clothing repair and cleaning of uniforms and protective clothing safety items: Your work outfit has to be specific to the work you do as a healthcare professional, pharmacist,. You have to itemize deductions, and even then,.

The work related expenses that nurses and health professionals may be able to claim as tax deductions include: Tax time isn’t fun for anyone, but everything from overtime meals, travel, clothing (and repairs and laundering of uniforms), shoes, accessories (such as fob watches and a briefcase), personal protective gear (including gloves, safety glasses, vests, aprons and stockings), technology (mobile phone, laptop,.