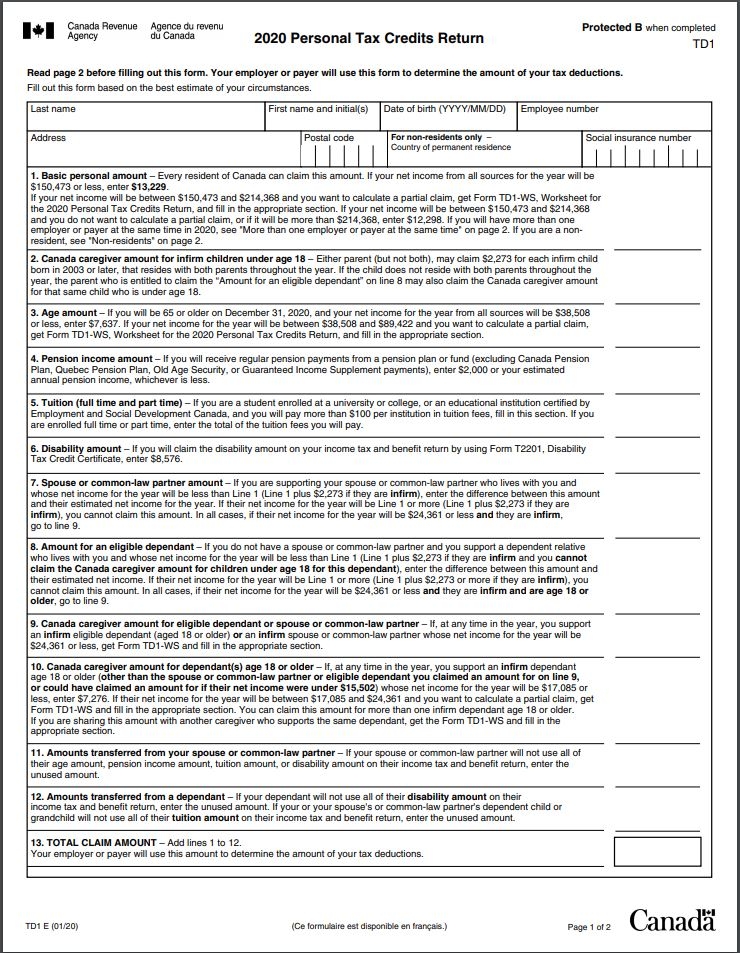

You can claim your registration fees minus the gst and your union dues. Is there any tax breaks for nurses?

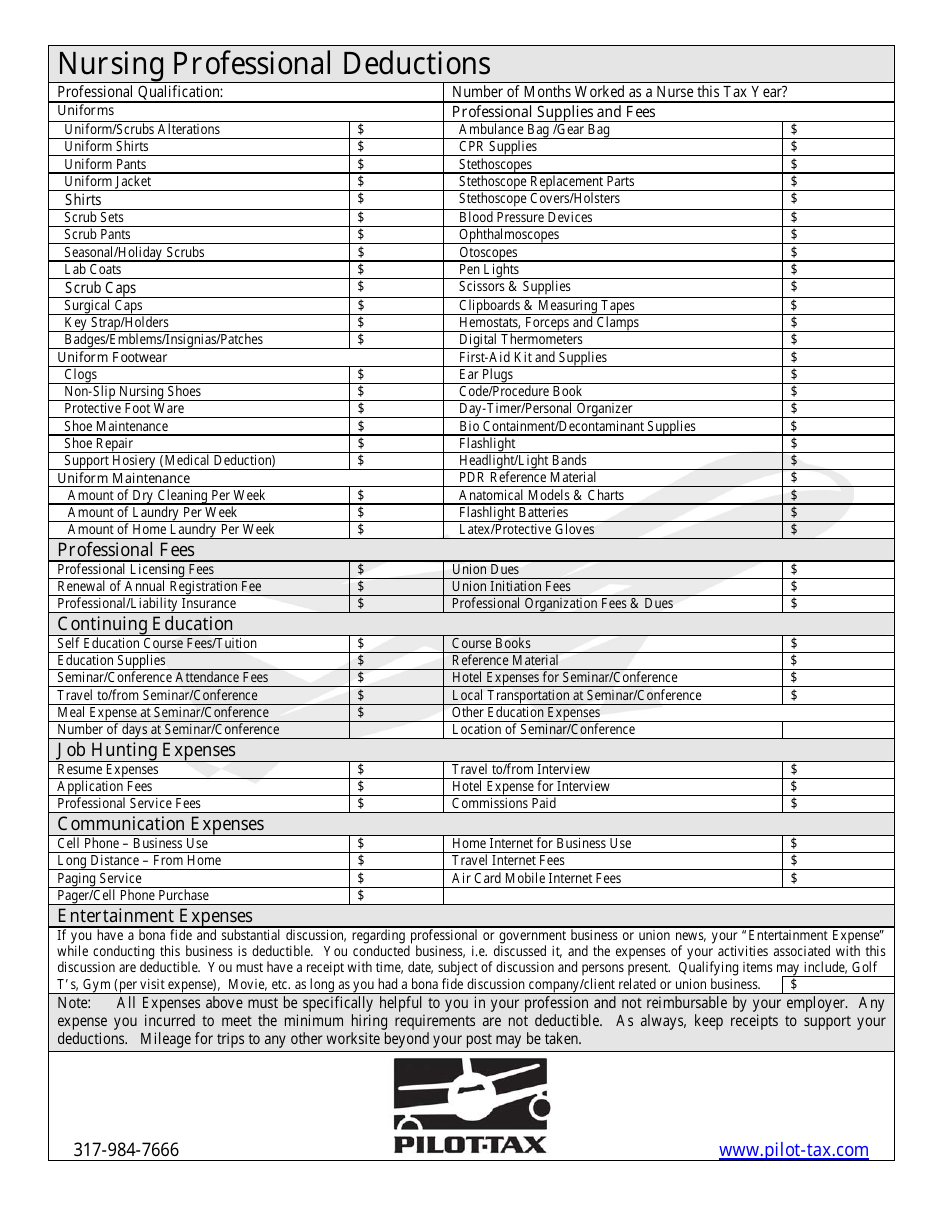

Deductions, expenses | as you prepare for this tax season, be sure to consider, at a minimum, this list of potential deductions.

Tax deductions for nurses canada. With a good tax accountant or an aptitude for reading the tax filing instructions, you could find plenty of deductions—continuing education, licensure fees, uniform expenses, unreimbursed mileage, liability insurance, tuition and more. You need to include a detailed statement of the nursing home costs. Know about tax deductions for nurses.

Union/professional dues and licensing examination fees. There can be a claim for nursing home expenses that is deductible. Costs of computer consumables (printer ink, software, usbs etc.) decline in value for depreciating assets (for items costing in.

You have to itemize deductions, and even then,. It’s usually possible for nurses to deduct certain costs that are related to their work such as: Nursing incorporates of broad care of patients of any age, gatherings and groups and nurses are one of those people who serve us to their best taking thought of the way that care given to us is effective.

Claim the total of the following amounts related to your employment that you paid (or that were paid for you and reported as income) in the year: Knowing which deductions or credits to claim is challenging, so we created this handy list of 53 tax deductions and tax credits to take this year. The costs of educational courses, as well as educational material and travel expenses you incur as part of job training, are tax deductible.

Line 21200 was line 212 before tax year 2019. Only the portion of your monthly bill used to pay attendant care salaries can be deducted. There is no possibility of negotiating a higher bill rate based on a particular travel nurse’s salary history or work experience.

Everything from routine dental visits to prescriptions to doctors’ fees. You can claim expenses for continuing education with receipts. Uniforms, such as uniforms or medical shoes, and scrub coats (which can’t be deducted when your wages are under the table).

Common tax deductions for nurses. You can claim your registration fees minus the gst and your union dues. List of potential tax deductions for nurses.

Accommodation and meals (if away from home overnight) travel expenses and parking fees. Medical expenses can add up quickly in the run of a year. Especially because the ato is remarkably good at detecting mistakes with this and you could be penalised later.

Annual dues for membership in a trade union or an association of public servants. Vehicle mileage & travel expenses #1: Remember, legitimate ato tax deductions for nurses only include expenses you’ve paid for yourself where you haven’t received a reimbursement.

Therefore, it only reduces your tax bill a bit, and it’s not as powerful as a credit. Family, child care, and caregivers deductions and credits. Work clothes (uniform only, i.e.

Whether you�re a nurse, a bartender or an accountant, the deduction options for employees are limited. Repair and cleaning of uniforms and protective clothing. 6 top missed tax credits and deductions.

Attendant care costs, including those paid to a nursing home, can be used as medical expense deductions on your tax return. Regularly nurses need to buy things for the care of patients. I know in alberta and manitoba you can�t claim your uniforms or equipment purchases unless you�re incorporated as a business.

Much like the “tuition and fees deduction” mentioned above, this deduction can reduce the amount of your income subject to tax by up to $2,500. Posted on january 13, 2010. If you work as a nurse or other health professional, in a hospital, agency or private practice, some of the tax deductions you may be able to claim on your personal tax return are:

June 18, 2017 6,087 views. If your employer paid, don’t claim it. As long as it is primarily for medical purposes, the cost of nursing care that you receive (whether you’re visiting your spouse or your dependent) is deductible as a medical expense.

Is there any tax breaks for nurses? Generally, if you have an allowance, you can deduct the entire cost of it from your taxable income when you�re filing your taxes. You can deduct the fees you pay for your state nursing license, as well as costs associated with licensing, such as board examinations.

Deductions, expenses | as you prepare for this tax season, be sure to consider, at a minimum, this list of potential deductions. Most people do not have the opportunity to write off their work clothing, but nurses do to an extent. You could itemize those deductions as long as their total.

New grads can also claim their crne fee and interim registration. Besides using such items as stethoscopes and pen lights, you must pay license fees too. Watch are nursing home costs tax deductible in canada video

Common health & medical tax deductions for seniors in 2021 the work related expenses that nurses and health professionals may be able to claim as tax deductions include: