We have a progressive tax system in canada > what nursing expenses are tax deductible be allowed deduct. As long as it is primarily for medical purposes, the cost of nursing care that you receive (whether you’re visiting your spouse or your dependent) is deductible as a medical expense.

Income and allowances to report.

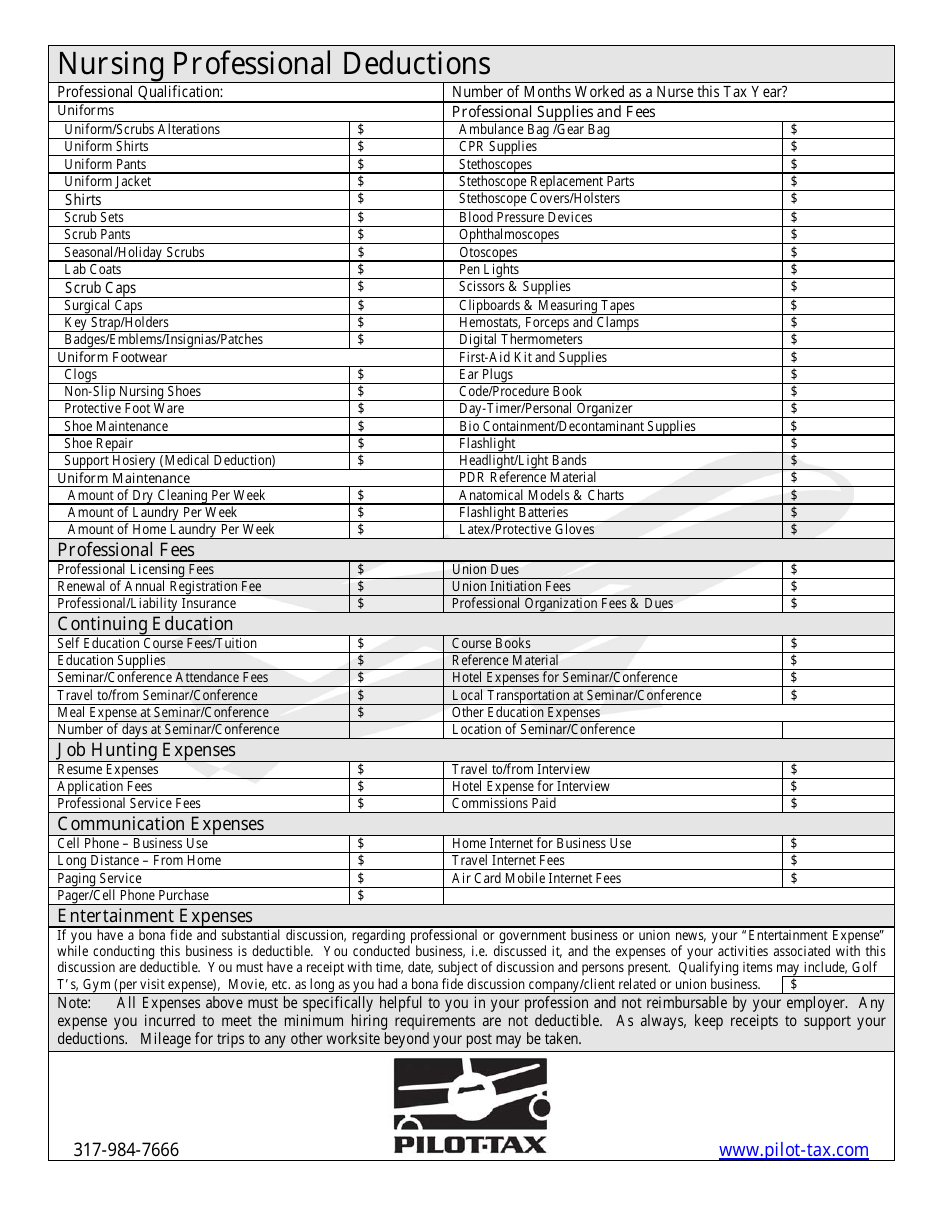

Tax deductions for nurses in canada. Moving expenses if you’ve relocated for work, you may be eligible to claim a wide range of moving expenses for you and your family. As a result, your taxable income (agi) will be reduced. Common tax deductions for nurses.

See the reference to form t2201 on the chart. In alberta the starting wage is $30 but with previous experience that would be different we get taxed about 25% on our wages. Also, medical or dental expenses may also be deducted as an itemized deduction on irs form 1040 when your schedule a is signed.

You can claim your registration fees minus the gst and your union dues. Watch are nursing home costs tax deductible in canada video Carrying charges, interest expenses, and other expenses.

It’s usually possible for nurses to deduct certain costs that are related to their work such as: Uniforms, such as uniforms or medical shoes, and scrub coats (which can’t be deducted when your wages are under the table). 32 minutes agoa tax deduction for medical care premiums paid out of pocket from your health insurance can be enjoyed from the proceeds of your premiums.

Travel between hospitals/medical practices during their shift. What can nurses claim on taxes canada? Deduction for cpp or qpp enhanced.

Claim on how many treatments they wish to receive, as long as the claim is for $2,000 in annual eligible costs for a maximum $8,000 in. In many cases, nurses are required to: Nurses can claim credit for the cost of annual licensing fees.

I know in alberta and manitoba you can�t claim your uniforms or equipment purchases unless you�re incorporated as a business. Work clothes (uniform only, i.e. We have a progressive tax system in canada > what nursing expenses are tax deductible be allowed deduct.

Most people do not have the opportunity to write off their work clothing, but nurses do to an extent. Even so, your employer cannot make you. You can deduct the tuition fees if the certification exam you are taking will be part of a professional examination.

If you earn your income as an employee nurse or midwife, this information will help you to work out what: Tax incurred on each additional dollar of income claim the deduction can cover attorney fees and court costs incur! As long as it is primarily for medical purposes, the cost of nursing care that you receive (whether you’re visiting your spouse or your dependent) is deductible as a medical expense.

Your work outfit has to be specific to the work you do as a healthcare professional, pharmacist, or nurse. Nurses, for example, may claim the cost of yearly licensing fees on schedule 11 as a tuition amount. You can and can�t claim as a work.

Are assisted living expenses tax deductible in canada? Only the portion of your monthly bill used to pay attendant care salaries can be deducted. Income and allowances to report.

Travel from a hospital to a second job (or vice versa) therefore, these trips will generally qualify as tax deductions for nurses. Vehicle mileage & travel expenses #1: Accommodation and meals (if away from home overnight) travel expenses and parking fees.

Besides using such items as stethoscopes and pen lights, you must pay license fees too. Nurses and midwives may be able to claim car expenses. You can claim expenses for continuing education with receipts.

There can be a claim for nursing home expenses that is deductible. If you are reimbursed from your employer for these fees, they are not eligible expenses. Find deductions, credits, and expenses you can claim on your tax return to help reduce the amount of tax you have to pay.

If you, your spouse, or your dependent is in a nursing home primarily for medical care, then the entire nursing home cost (including meals and lodging) is deductible as a medical expense. Authorized medical practitioners for the purposes of the medical expense tax credit. Yes, in certain instances nursing home expenses are deductible medical expenses.

If you believe this list is not up to date, you may request changes. License fees paid by nurses can be refunded. Eligibility for the disability tax credit may be a requirement to claim fees for salaries and wages as medical expenses.

If your profession requires you to pass a certification examination, claim a deduction using the receipts for the tuition fees. 2 hours agois fertility treatment tax deductible in canada? $2,397 3% of your dependant�s net income (line 23600 of their tax return) note the maximum provincial or territorial amount you can claim for medical expenses may differ depending on where you live.

New grads can also claim their crne fee and interim registration. The following list identifies the health care professionals recognized by the canada revenue agency as medical practitioners for the purposes of the medical expense tax credit. However, you cannot do this if your employer reimburses the amount.

List of common expenses and tax deductions for nurses you to deduct as much ( or the. Helping business owners for over 15 years. Attendant care costs, including those paid to a nursing home, can be used as medical expense deductions on your tax return.

You need to include a detailed statement of the nursing home costs. Costs of computer consumables (printer ink, software, usbs etc.) decline in value for depreciating assets (for items costing in.