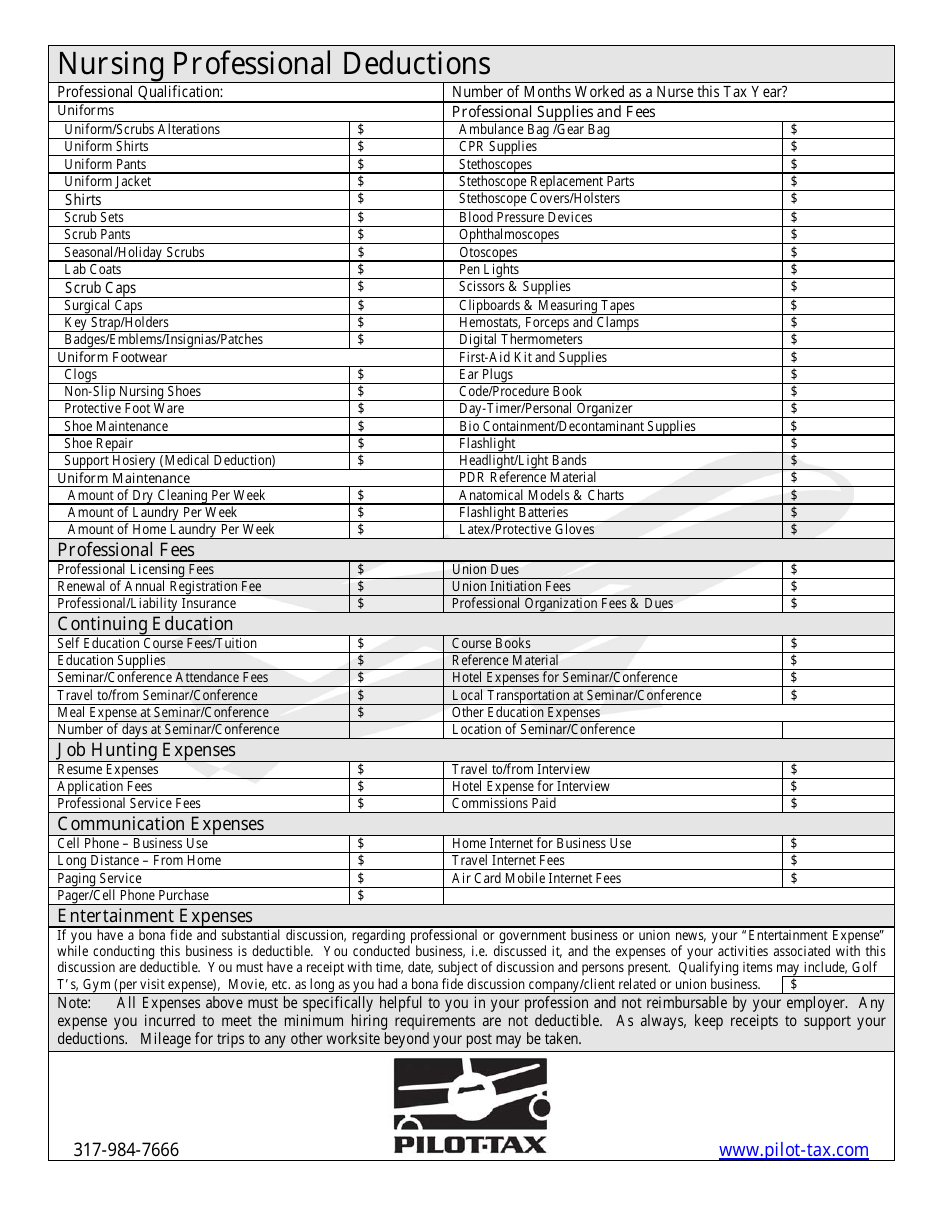

Tax time isn’t fun for anyone, but everything from overtime meals, travel, clothing (and repairs and laundering of uniforms), shoes, accessories (such as fob watches and a briefcase), personal protective gear (including gloves, safety glasses, vests, aprons and stockings), technology. Yes indeed, that dreaded time is rapidly approaching us all again.

Medical expense deductions relating to nursing homes and home care qualified medical expenses are generally deductible as an itemized deduction on an individual’s income tax return.

Tax deductions for nursing expenses. 21 hours agoeach taxpayer can deduct up to $300 for the 2021 tax year. Tax deductions for nursing assistant training school expenses. Percentages may change every year so make sure to check the exact figure with a certified tax professional.

Nurse tax deductions what can nurses claim as tax deductions? Tax deductions and credits for nursing students the most important tax benefits for students to consider include the tuition deductions and/or credits. As an example, if your agi is $50,000, you’ll need more than $3,750 in itemized medical expenses to qualify for a deduction.

However, many past nursing deductions now fall under miscellaneous deductions. Then add that to the rest of your qualifying medical expenses for the tax year. Tax deductions are where you cover your bases for anything else.

Next, calculate the amount spent on home care that exceeds 7.5% of the amount of your agi. Carefully documenting your tax home is important. Robert qualifies as a chronically ill individual because he is unable to perform at least two adls.

The cares act included a special tax provision for the 2020 tax year, which allowed individual and joint filers to deduct up to $300 on. Any amount you spend on materials you purchase as a healthcare professional or nurse. From simple to complex taxes, filing with turbotax® is easy.

When you have lived in an assisted living community for three months or longer, some or all of your assisted living expenses may be eligible for a medical expense tax deduction. Professional expenses travel nurse income has a tax advantage. Remember, legitimate ato tax deductions for nurses only include expenses you’ve paid for yourself where you haven’t received a reimbursement.

Tax deductions for nursing home expenses. Tax deductions for nursing home expenses healthc financ manage. You can deduct continuing education (ce) programs that are required to keep/renew your license or continued employment.

The costs of educational courses, as well as educational material and travel expenses you incur as part of job training, are tax deductible. Assisted living expenses may also be deductible if an individual requires supervision due to a cognitive impairment, such as alzheimer’s or another form of dementia. The money you spend on your job or maintaining your nursing license may also be deductible from your adjusted gross income.

Tax time isn’t fun for anyone, but everything from overtime meals, travel, clothing (and repairs and laundering of uniforms), shoes, accessories (such as fob watches and a briefcase), personal protective gear (including gloves, safety glasses, vests, aprons and stockings), technology. Mesh terms financing, personal / legislation & jurisprudence*. Especially because the ato is remarkably good at detecting mistakes with this and you could be penalised later.

Most individuals are unaware how expansive the term,. Which means nursing students are not permitted to deduct the cost of their tuition in a nursing program. To calculate your total medical expense tax deduction, start by analyzing your qualifying nursing home expenses.

Yes indeed, that dreaded time is rapidly approaching us all again. Companies can reimburse you for certain expenses while working away from your tax home. Yes, in certain instances nursing home expenses are deductible medical expenses.

This percentage applies to seniors as well as those still working on a regular basis. Internal revenue code section 213 allows for tax deductions for any medical costs that surpass 7.5% of a person’s adjusted gross yearly income. The new tax reform laws did away with job expenses at the federal level, which smith explains on his website, but a handful of states still allow job expense deductions, such as new york, california, alabama, hawaii, and arkansas, so there may be additional tax deductions you can make if you’ve worked in a qualifying state.

Medical expenses are generally excluded under this category from irs income taxes if they exceed 7 percent of total taxable income. These must be considered as you determine if standardized or itemized deductions are most beneficial for your taxes. These credits or deductions generally cover things like qualifying tuition, books, and other university fees/expenses.

If your employer paid, don’t claim it. Tax deductions up to 5% of an individual’s adjusted. Tax deductions for nursing home expenses.

Medical expense deductions relating to nursing homes and home care qualified medical expenses are generally deductible as an itemized deduction on an individual’s income tax return. Ad answer simple questions about your life and we do the rest. Your work outfit has to be specific to the work you do as a healthcare professional, pharmacist,.

If you, your spouse, or your dependent is in a nursing home primarily for medical care, then the entire nursing home cost (including meals and lodging) is deductible as a medical expense. Note that your medical expense deduction is the sum total of all your qualifying medical expenses minus 7.5 percent of your adjusted gross income. You can deduct the fees you pay for your state nursing license, as well as costs associated with licensing, such as board examinations.