The ontario income tax salary calculator is updated 2022/23 tax year. Though we technically are not claiming rent on our taxes, the amount of rent, property taxes, or long term housing costs paid by you throughout the year is used to help calculate your benefit.

Some of the common tax deductions in ontario include:

Tax deductions for ontario. Writing off something on your taxes is simple, it means you are deducting an amount to reduce your taxable income. If you are looking to calculate your salary in a different province in canada, you can select an alternate province here. The ontario tax reduction lowers or eliminates the income tax you may pay in ontario.

Mortgage interest if you have your property rented for a whole year, you can deduct up to 100% of the mortgage interest. Please note that you can also use the payroll deductions online calculator (pdoc). The ontario income tax salary calculator is updated 2022/23 tax year.

Most requested disability tax credit medical expenses moving expenses digital news subscription expenses home office expenses for employees canada training credit family, child care, and caregivers deductions and credits Income tax deducted if you receive employment income or any other type of income, your employer or payer will deduct income tax at source from the amount paid. Both the land and the building are deductible property tax expenses.

This is not a tax deduction, but rather a tax credit to consider. Td1on 2022 personal tax credits return provincial: Everything from routine dental visits to prescriptions to doctors’ fees could earn.

$155,625 or less enter $14,398; Age amount tax credit reduced when income exceeds: Remember, deductions reduce the amount of income your taxes will be calculated on.

Some of the common tax deductions in ontario include: There are over 400 deductions and credits that the cra outlines. Age amount tax credit (65+ years of age) $7,713.00:

Medical expenses can add up quickly in the run of a year. 5 rows in the ontario tax deductions table, the provincial tax deduction for $615 weekly under. Find deductions, credits, and expenses you can claim on your tax return to help reduce the amount of tax you have to pay.

Section a (available in both html and pdf formats) contains general information. Gst/hst credit the goods and services tax/harmonized sales tax credit (gst/hst credit) is a refundable tax credit available to families with children. Landlords can deduct the cost of property taxes, provided the rental was available for the period covered by the property tax.

$11,141 workers’ compensation wsib maximum insurable: Your employer or payer will calculate how much income tax to deduct by referring to your total claim amount on form td1, personal tax credits return and using approved calculation methods. Though we technically are not claiming rent on our taxes, the amount of rent, property taxes, or long term housing costs paid by you throughout the year is used to help calculate your benefit.

To assist us with the costs of being a parent, the canadian revenue agency (cra) has provided a number of ways for families to save money through tax deductions and tax credits. Sections b to e (available in pdf format only) contain the payroll deductions tables for canada pension plan contributions, employment insurance premiums, and federal and ontario provincial tax deductions. You can write off a number of different items on your taxes including employment expenses, legal expenses, etc.

We’ve rounded up the most popular 20 to help you make the most out of your taxes and get the best refund. The 7 tax deductions ontario business owners can claim for in 2018 Here are our top 6 most often missed tax credits and tax deductions.

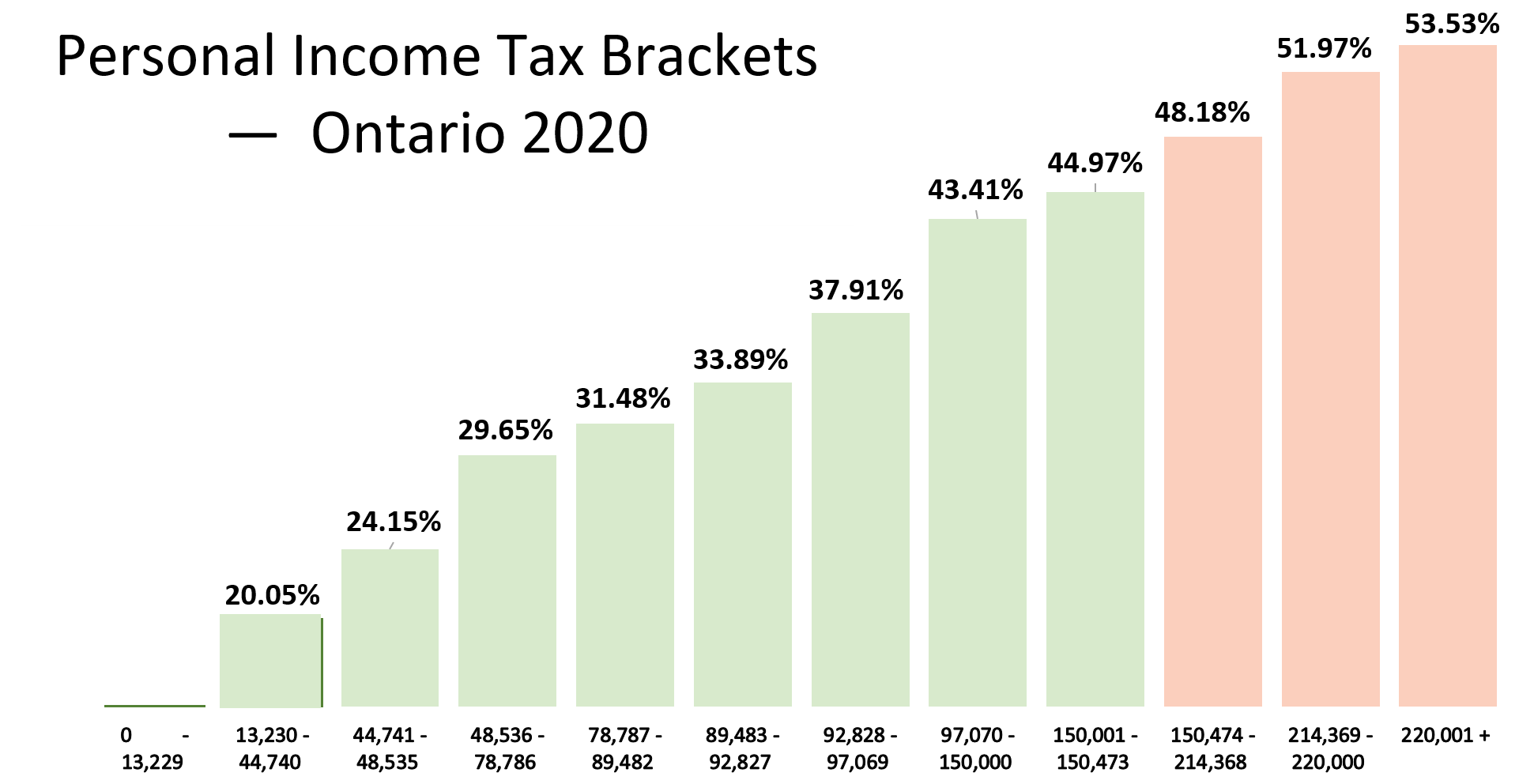

Ontario personal income tax brackets and tax rates in 2021; 101 rows capital gains deduction: With literally hundreds of tax credits and tax deductions available to eligible canadian taxpayers, it can be easy to overlook one or two.

A tax credit reduces the amount of tax payable. Income tax calculations and rrsp factoring for 2022/23 with historical pay figures on average earnings in canada for each market sector and location. This also applies to the period during which the unit is rented.

For deductions based on different income levels, see: 2 hours agoin the region of ontario, canada, a person with earnings of $52,000 will owe $11,432 in taxes. $26.67 an hour is how much per year?

The government introduced a new refundable tax credit called the canada training credit, which may be used for eligible tuition and fees paid for courses taken in 2020 and subsequent taxation years. Ontario residents can claim 20% of their eligible 2022 accommodation expenses, for example, for a stay at a hotel, cottage or. Taxes in general are taxed at a rate of 22 per cent on average.

If you live in ontario, you may qualify for the ontario energy and property tax credit (oeptc), that is a part of the ontario trillium benefit. As a result, you’ll make $40,568 per year or $3,381 each month in net pay. The amount of your reduction depends on:

Where you lived at the beginning and end of the tax year how many dependants you have your marital status. What is the average salary in canada?