This tax credit ranges from $3,750 to $7,500, depending on your income. If you’re both 65 or older, your deduction could be $27,800.

If you are legally blind, your standard deduction increases by.

Tax deductions for over 65. The internal revenue service (irs) gives seniors a more significant. The current irs deduction for individuals over the age of 65 is an additional $1,300 on top of the standard individual deduction. If you’re both 65 or older, your deduction could be $27,800.

For 2021, she gets the normal standard deduction of $12,550, plus one additional standard deduction of $1,700 for. You can claim the higher deduction only if your spouse is older than 65 and. Anyone 65 and older by december 31 of the tax year is entitled to a higher standard deduction than younger folks.

If you are legally blind, your standard deduction increases by $1,700 as. The specific amount depends on your filing status and changes each year. Were you 65 years of age or older on december 31 of last year?

What was the adjusted gross income of the applicant,. If you are legally blind, your standard deduction increases by. If you don�t itemize deductions, you are entitled to a higher standard deduction if you are age 65 or older at the end of the year.

If you are age 65 or older, your standard deduction increases by $1,700 if you file as single or head of household. 5 taxable social security income your social security benefits might or might not be taxable income. When you’re over 65, the standard deduction increases.

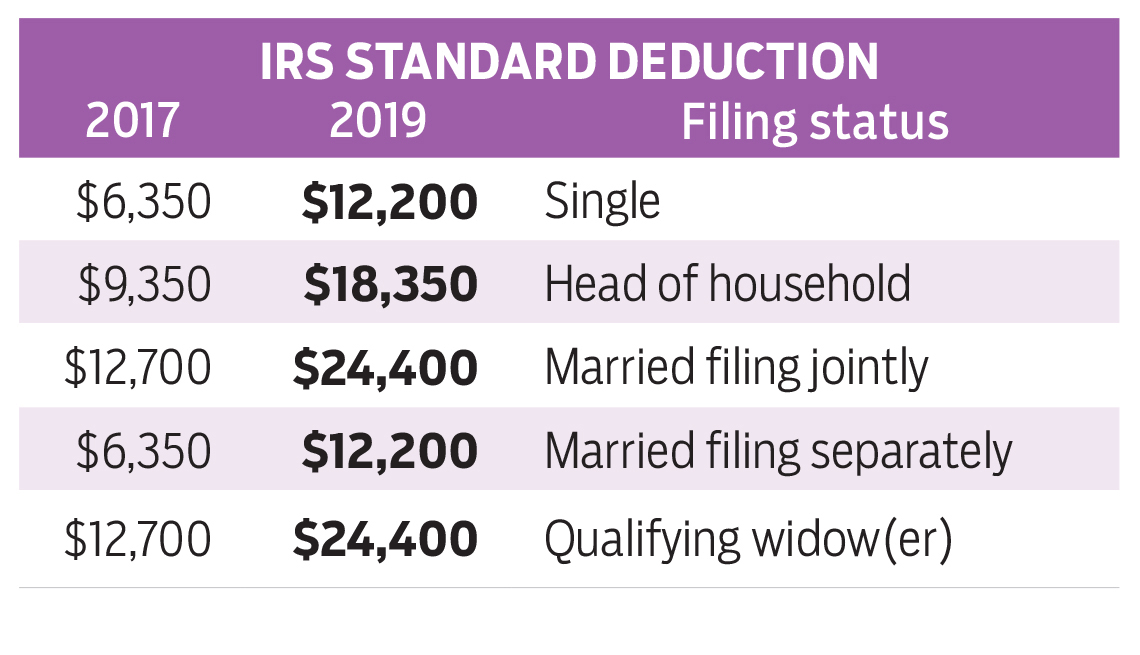

Exploring the standard deduction the internal. The standard deduction is a specific dollar amount that reduces your taxable income. 4 rows what is the extra standard deduction for seniors over 65?

If you are legally blind, your standard deduction increases by. If you are age 65 or older, your. For those 65 years of age or legally blind, the standard deduction was increased in 2021 to $1,700 for single filers or head of household, and $1,350 (per person) for married filing jointly, married.

This tax credit ranges from $3,750 to $7,500, depending on your income. Ellen is single, over the age of 65, and not blind. If you are age 65 or older, your standard deduction increases by $1,700 if you file as single or head of household.

Higher standard deduction for age (65 or older). If you fit the requirements, the credit for the elderly or the disabled could really brighten your tax day. If you are age 65 or older, your standard deduction increases by $1,700 if you file as single or head of household.

7 rows february 15, 2021 by standard deduction. For the 2021 tax year, seniors get a tax deduction of. For the 2021 tax year, the standard deduction is $12,550 for single filers and married.