Interest on home equity loans and home equity lines of credit can be deducted, but only if. There are several tax benefits of owning a home that homeowners can utilize if they itemize their deductions correctly.

A simpler and easier way to estimate your home office.

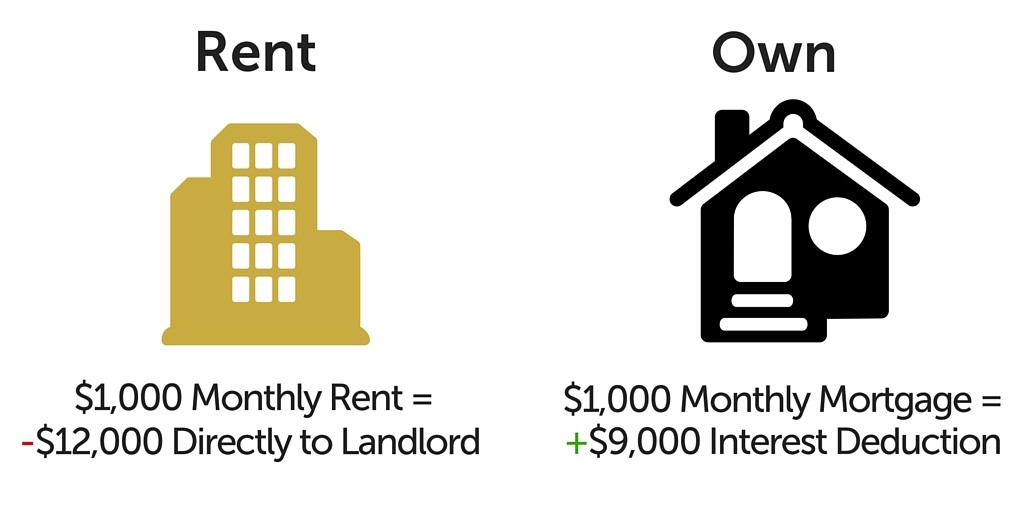

Tax deductions for owning a home. These expenses may include mortgage interest, property tax, operating expenses, depreciation, and repairs. If all of your itemized deductions for 2020 add up to less than $12,400 if you�re single, $18,650 for head of household or $24,800 for. There are several tax benefits of owning a home that homeowners can utilize if they itemize their deductions correctly.

A simpler and easier way to estimate your home office. And the total amount of the mortgages for your first home and vacation home cannot exceed the $650,000 or $1 million amounts mentioned above. Each mortgage payment includes an interest rate, which is where tax filers get their deductions from.

Unless your home is huge, it will be hard for an irs auditor to believe you actually dedicated 50% of your home exclusively to your business. Mortgage interest you can deduct the interest you pay on up to $750,000 of mortgage debt ($375,000 if married filing. Homeowners have long been able to deduct property taxes on their federal tax returns.

For individuals, the deduction is now $12,550 (up $150 from 2020), and it’s $25,100 for married couples filing jointly (up $300 from 2020). You can deduct the ordinary and necessary expenses for managing, conserving and maintaining your rental property. Interest on home equity loans and home equity lines of credit can be deducted, but only if.

Ordinary expenses are those that are common and generally accepted in the business. Homeowners can deduct interest expenses on up to $750,000 of mortgage debt from their income taxes, though when they itemize these deductions, they forgo the standard deduction of $12,550 for individuals or married couples filing individually, $18,800 for head of household & $25,100 for married filing jointly. The tcja put a $10,000 cap on salt deductions for single taxpayers and married couples filing jointly.

Your main home secures your loan (your main home is. However, your deduction for state and local taxes paid is capped at $10,000 for 2018 through 2025. If you own your own business and work from home you may be able to deduct part of your home costs as long as you have a dedicated room or rooms in your home that are exclusively used for business purposes.

However, the rules changed with the tax cuts and jobs act of 2017 and the amount that is eligible for a deduction has been reduced. Mortgage interest unless your case is that rarest of rare cases, you can probably deduct all of your home mortgage interest. Here, we’ll discuss the most common federal tax breaks for homeowners.

The only tax deductions on a home purchase you may qualify for is the prepaid mortgage interest (points). The interest you pay on your mortgage is deductible (in most cases) if you own a home and don’t have a mortgage greater than $750,000, you can deduct the. What expenses can’t i deduct?

Other than deductions for homeowners, some of the most common itemized tax deductions include: A portion of every mortgage. In general, you should file rental property tax deductions the same year you pay the expenses using a schedule e form.

The deduction also went up. This is usually the biggest tax deduction for homeowners who itemize. Plus, if you’re ever audited, you’ll have to provide proof for every deduction you claim.

If the home counts as a personal residence, you can generally deduct your mortgage interest on loans up to $750,000, as well as up to $10,000 in state and local taxes (salt). The process will be much more manageable if you keep detailed records of all income and costs related to the property as they occur. You can receive a tax deduction for the interest you’ve paid on.

From 2018 through 2025, homeowners may deduct a maximum of $10,000 of their total payments for: State or local income taxes and sales taxes charitable donations medical and dental costs that aren’t reimbursed To deduct prepaid mortgage interest (points) paid to the lender if you must meet these qualifications:

Buying and owning a home tax benefits 1. Homeowners also enjoy a deduction for state and local taxes (salt). This is the biggest deduction available for homeowners.

Here are the most common deductions: Types of deductions most of the favorable tax treatment that comes from owning a home is in the form of deductions. Are closing costs still tax deductible?

For individuals, the deduction is now $12,400 ($12,200 in 2019), and it’s $24,800 for married couples filing jointly ($24,400 in 2019), plus $1,300 for each spouse aged 65. This $10,000 limit applies to both single and married taxpayers and is not indexed for inflation. Property tax, and state income tax or state and local sales tax.

This change hurts taxpayers that live in states with high property taxes like new york, new jersey, california, and massachusetts. Tax deductions for homeowners mortgage interest. The tax law even allows you to rent out your vacation home for up to 14 days a year without paying taxes.

Deductible costs might include insurance premiums, a portion of the utilities, home repairs and more.