The deduction amount is based upon your modified adjusted gross income (magi) and filing status. During the internship i will have to rent a temporary apartment, pay for general travel expenses (train, bus tickets, and food), and keep paying rent for my apartment in.

Credits are usually more valuable than deductions.

Tax deductions for paid internships. A completed form 8917 is needed to claim this deduction. Your employer must treat you as a regular employee for tax purposes. Businesses could get an extra incentive to hire more interns through a proposal being heard in florida’s legislature.

Many interns can get a $2000 “credit” for the tuition they paid for the last semester of medical school (but only if the tuition was paid in the last year of school, as opposed to being paid the prior year. While this probably won’t include health insurance or a 401 k, there are other perks to be had. Unpaid work arrangements exist in law to allow someone to get experience or a person’s skills are tested before they are.

In turn, this will reduce your tax balance owing to the canada revenue agency (“cra”) at the end of the year. He was on a 7 month internship 100 miles away from both his home town and school. (b) expenditure incurred for the provision of training;

Logistically, paid interns often get similar fringe benefits to paid employees. Tax info for paid internships if you have a paid internship, there are some important things that you must communicate to your employer so that the correct taxes are withheld. Credits are usually more valuable than deductions.

Your rights and the law. The internship which is a part of curriculum of the university/ institution and for which the student is not paid any stipend is excluded from coverage. The lifetime learning credit, which refunds 20 percent of up to $10,000 of qualified expenses, providing students with up to $2,000.

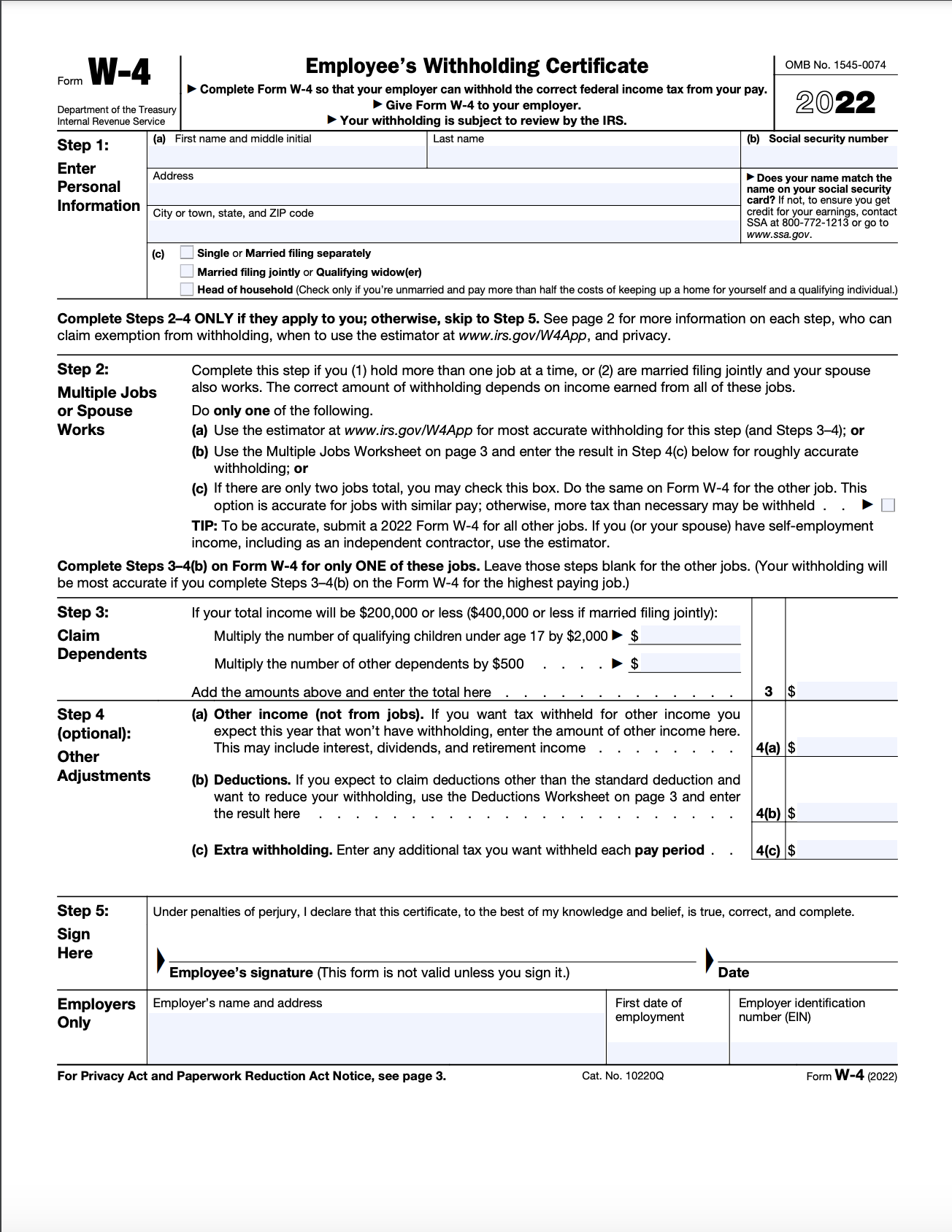

When you fill out the w‐4 form prior to beginning work at the company, you should type the following on a piece of paper and present it to the. The “internship tax credit program,” would reward up to $2,000 in tax credits for each intern an employer hires. My son is a college student and his major requires him to take a internship with a company in his field of study in which he gets credits for.

During the internship i will have to rent a temporary apartment, pay for general travel expenses (train, bus tickets, and food), and keep paying rent for my apartment in. The tax deduction value will be based on the nqf level of the learner. This is where you get credit (literally!) for your tuition payments.

However, you may be able to take a deduction for travel expenses if they are incurred while you are performing a service for the organization. Because they have no income, other than a parental allowance, they ordinarily do not file a tax return and can thus claim no deductions for internship mileage. The deduction amount is based upon your modified adjusted gross income (magi) and filing status.

Writing off mileage is difficult with regard to most internships for two reasons. (he pays for the credits also). After his internship, he returned to school.

The tuition and fees deduction, which allows students to deduct up. You can (a) treat the internship as part of your business income (schedule t2125 statement of business income), or (b) report it as ‘other income’ on line 130 of your income tax return. For items (b) and (c), the total deductions allowable for each student shall not exceed rm5,000.

Filing single, magi less than $65,000. Depending on the nature of the internship, your stage of employment and the surrounding circumstances, expenses might also be deductible on a schedule c. In one case, a mother paid for her daughter’s medical expenses.

Claim tax deductions for items you didn’t pay for. This means deducting taxes from your paycheck and paying employer payroll taxes, including unemployment taxes. He was paid like a regular employee with the company.

The college is required by us tax law to withhold 14% federal income tax and 5% state income tax from fellowship and internship payments to students who are nonresidents for us tax purposes, unless the recipient can claim an exemption provided by a us tax treaty. 17th december 2012 from india, mumbai. There has been different interpretations of the term internship for the purpose of coverage of esi and pf.

(a) monthly allowance paid to the students of not less than rm500 per student; Two credits and deductions to consider are: Depending on how you were paid for the internship will determine how you deduct the expenses.

Yes you can deduct the fees you had to pay for your temporary housing while you were working the internship. Schedule c is used to. You can deduct expenses that were paid by someone else.

Australia has a rigid set of rules about how unpaid internships and unpaid work can be conducted in a workplace. Either way is equally legitimate. For example, in some cases, you are allowed to deduct medical expenses if they are more than 7.5 percent of your adjusted gross income.

(c) meals, travelling expenses and accommodation for the students during the internship programme. According to business insider, filing circumstances determine tax four breaks below: Both are legal in australian workplace law, but there are limits.

The tax credits would only be awarded if businesses meet conditions. If you�re interning at a business that�s providing you with income (and in that case, congrats) then those are taxable wages just like any standard job. Those who do earn their own money and file returns likely can�t write off their mileage.