The credit covers 100% of the first $2,000 in approved expenses and 25% of the second $2,000 in expenses,. The student loan interest deduction one useful tax break for college graduates and their parents is the student loan interest deduction.

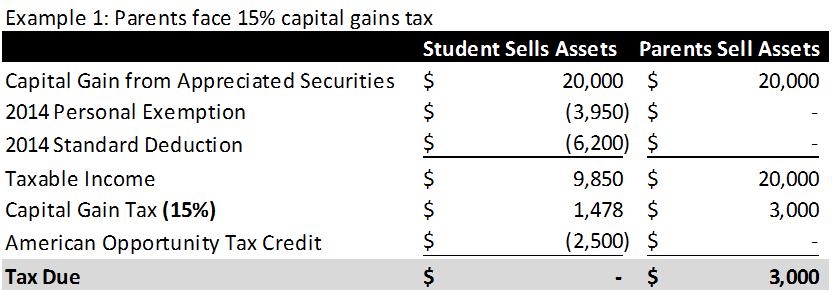

The american opportunity credit is a credit available to parents of college students who claim their student.

Tax deductions for parents of college students. On the bright side, parents with multiple dependents in college could qualify for up to $2,500 per student. The deduction is worth either$4,000. Of course, their income must.

Generally, a parent can claim your college student children as dependents on their tax returns. For your 2021 taxes (which you file in. If you’re eligible for the american opportunity tax credit and have a minimal tax.

The american opportunity tax credit and the lifetime learning credit. Tax deductions some filers may be eligible to deduct tuition and fees for qualified education expenses, which can reduce the amount of your income subject to tax by up to. Who can claim an education credit?

Tax deductions for parents of college students. While college students did not qualify for stimulus checks, households that are eligible for the tax credits could get $500 for kids aged 18 to 24. The credit covers 100% of the first $2,000 in approved expenses and 25% of the second $2,000 in expenses,.

Qualifying students can receive credits of up to $2,500 per year. And for many parents, it seems as if we go from changing diapers to packing the kids up to go off to college. However, to claim a college student as a dependent on your taxes, the internal.

Unfortunately, there are not many credits or deductions for older dependents, such as college students. There are two education credits available: What college expenses are tax deductible for parents?(solved) college tuition and fees are tax deductible on your 2019 tax return.

4 tax credits and deductions for college students and parents 1. Generally, you can claim the tuition and fees deduction for qualified higher education expenses for an eligible student if your modified adjusted gross income is below $80,000 ($160,000 if. American opportunity tax credit (aotc):

The american opportunity credit is a credit available to parents of college students who claim their student. The student loan interest deduction one useful tax break for college graduates and their parents is the student loan interest deduction. According to collegeboard.org, students and their parents saved about $17.9 billion on their federal income taxes through tax credits and deductions for education expenses in 2013 (the.

This credit went through a few iterations before becoming a. What this means is that you can claim up to a $2,500 credit for any qualified expenses per year (for the first 4 years) for every college student you are supporting.