It is held by the employer until they do their bas (business activity statement) either every month, quarter or year. In the pr state information form, set up state codes but do not specify a deduction in the tax dedn field.

You can check any option if it applies to you.

Tax deductions for payg employees. The system uses the payg calculations provided by the australian tax office, this set method is the method required by all software payroll products. About the pr routines form. The employee agrees in writing, and it’s principally for their benefit.

You do this by collecting pay as you go (payg) withholding amounts from payments you make to: You can enter this same information in the pr employee dedns/liabs form; The expenses must directly relate to earning your income.

Suitable tax deductions for high payg employee. From 1 july 2017 all individuals under 75 years (including those aged 65 to 74 years who meet the work test) are now eligible to claim a tax deduction for personal super contributions made into an eligible. Finally, your take home pay after deducting income tax and medicare.

You no longer need to ‘salary sacrifice’ super contributions in order to reap tax savings. In the gl account field, enter the gl account to credit for this deduction code. Taxing termination payments there are several taxes that might affect you if you have employees:

After you have calculated gross pay for the pay period, you must then deduct or withhold amounts for federal income tax withholding, fica (social security/medicare) tax, state and local income tax, and other deductions. In the routine field, enter payg tax or press f4 to select it from a list. I�m new here, please be nice reference:

On that form you can also override the calculation or. Why does payg tax on employee dividends truncate the cents? (australia only) use the filing status tab in the pr employees form to set up employee filing statuses for payg tax withholding.

You must have spent the money yourself and weren�t reimbursed. In the pr state information form, set up state codes but do not specify a deduction in the tax dedn field. Assigning that deduction code to your employee(s) to set up pay as you go (payg) withholding:

In the pr state information form, set up state codes but do not specify a deduction in the tax dedn field. It is held by the employer until they do their bas (business activity statement) either every month, quarter or year. Why does payg tax on employee dividends truncate the cents?

Payments where an australian business number (abn) has not been quoted in. The method provided by the ato truncates cents from the tax calculation. How do i pay preferred superannuation dividends for employees?

When you use the auto calc method the cents will be truncated. You must have a record to prove it (usually a receipt). • prior to the 2018.

In the pr employees form, assign the payg deduction code for each employee. This includes payg income tax withholding, court ordered garnishee orders etc. Manually adjusting payg amounts reported on payment summaries;

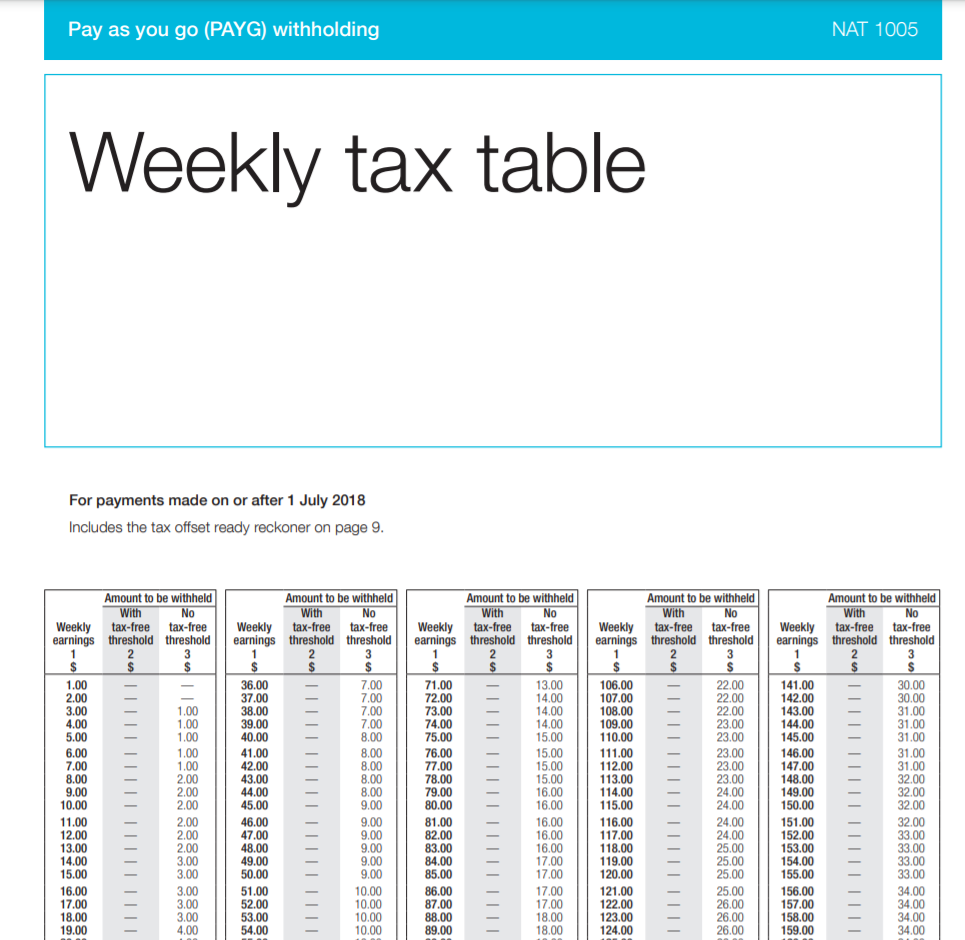

In the pr federal info form, in the payg deduction field, enter the payg deduction code (1). If you are an employer or another withholding payer, the tax withheld calculator helps you work out the tax you need to withhold from payments you make to employees and other workers including working holiday makers. Pay as you go (payg) withholding payroll tax fringe benefits tax employment termination payments.

It is added together with gst collected from sales and put against any gst paid on purchases. In addition to withholding federal and state taxes (such as income tax and payroll taxes), other deductions may be taken from an employee’s paycheck and some can be withheld from your gross income. In the pr employees form, assign the payg deduction code for each employee.

Other workers, such as contractors, that you have voluntary agreements with • employees who work from home can no longer claim tax deductions for their unreimbursed employee expenses or home office costs on their federal tax return. Pay as you go withholding (payg) if you have employees, you usually withhold money for tax from any payments you make to them.

Payg is deducted from an employees wage each pay period. By law or a court order it is allowed, or by the fair work commission. Archive view return to standard view.

Payroll hr and employee vista help last updated: If the payg withholding rules require you to withhold an amount from a payment you make to a worker, you must: An employer can only deduct money if:

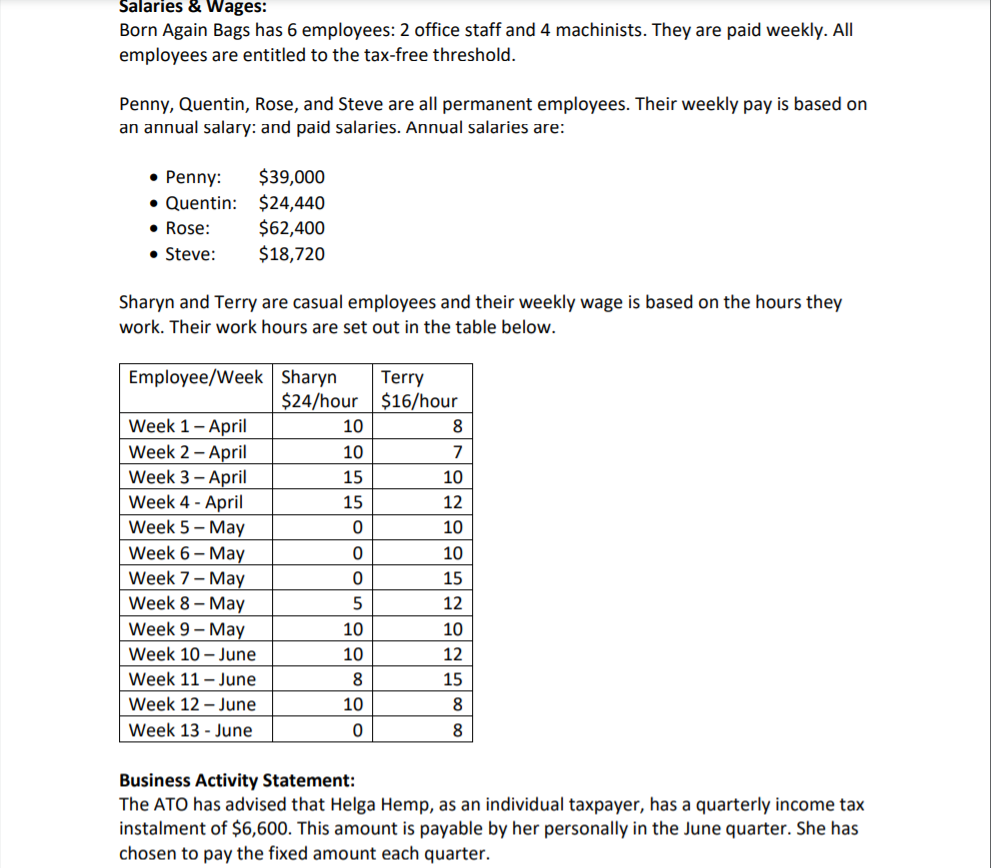

Payments to employees, company directors and office holders. For more information about australian payg collections system payroll deductions and employee benefits taxation, visit the tax withholding guide by the ato and excerpts from the payrollserviceaustralia.com.au publication by payroll services australia. You can only claim deductions for payments you make to your workers (employees or contractors) from 1 july 2019 where you have complied with the pay as you go (payg) withholding and reporting obligations for that payment.

In the addl info tab, set up automatic ap updates for the code, making sure to select the separate ap transaction per employee check box. So, how can payg employees maximise the amount they get back in tax? You can check any option if it applies to you.

These are known as “pretax deductions” and include contributions to retirement accounts and some health care costs. Taking money out of an employee’s pay before it’s paid to them is called a deduction. Employee payments & payg deductions don’t appear on business activity statement;