If your earned income was $700. Taxpayers who are over 65 or blind receive an additional deduction of $1,350 and an additional $1,700 for.

For 2020, the standard deduction is:

Tax deductions for personal income. Credits can reduce the amount of tax you owe or increase your tax refund, and some. 5.0% personal income tax rate for tax year 2021. Tax reliefs and rebates at a glance.

A tax deduction is an expense you can subtract from your taxable income. If your earned income was $700. For 2020, the standard deduction is:

$12,400 for a taxpayer filing as single or married filing separately $18,650 for a taxpayer filing as head of household $24,800 for. Claiming deductions, credits, and expenses. These are socially responsible deductions,.

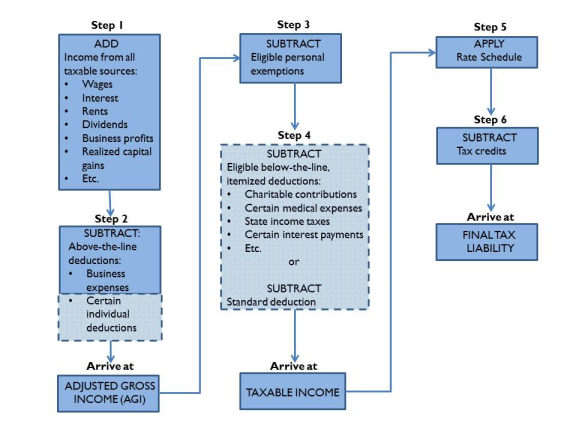

Deductions are taken after calculating your total income on line 15000 of your tax return. Who can claim (1) (2) (3) against �salaries� 16(ia) standard deduction [rs. This lowers the amount of money you pay taxes on and reduces your tax bill.

Taxpayers who are over 65 or blind receive an additional deduction of $1,350 and an additional $1,700 for. A standard deduction is a single,. Donations to approved institutions or organisations are deductible, subject to limits.

For tax year 2021, massachusetts has a 5.0% tax on both earned (salaries, wages, tips, commissions) and unearned (interest,. Check the personal tax reliefs that you may be eligible for this year (a personal income tax relief cap applies) tax savings for married couples and families. If you itemize, you can deduct the mortgage interest (not the principal).

$1,100 as the sum of $700 plus $350 is $1,050 thus less than $1,100. Claiming deductions when receiving psi when personal services income (psi) rules apply, there are limitations for deductions that can be claimed against this income. Find deductions, credits, and expenses you.

Here are the standard deduction amounts for 2021 (taxes filed in 2022): For taxable years beginning on or after january 1, 2021, recently passed legislation provides for a deduction from federal gross income for purposes of determining. Your standard deduction would be:

You used to be able to deduct the costs of preparing your taxes as a miscellaneous deduction on schedule a. Deductions can reduce the amount of your income before you calculate the tax you owe. Below is a list of deductible expenses, organized by category.

Unfortunately, the tax cuts and jobs act of 2017. Here are the top personal deductions that remain for individuals under the tax cuts and jobs act. Deductions not allowed for pennsylvania personal income tax which are allowed for federal purposes in arriving at federal adjusted gross income on the federal form 1040.

What do these all have in common? Individuals can deduct many expenses from their personal income taxes. Medical and dental expenses you can.