You can contact elections ontario by email (electfin@elections.on.ca) or phone (1‑866‑566‑9066). Resources for labor and agricultural organizations.

(2) the amendments to ors 316.102 (credit for political contributions) by section 49 of this 2019 act apply to tax years beginning on or after january 1, 2020, and before january 1, 2026.

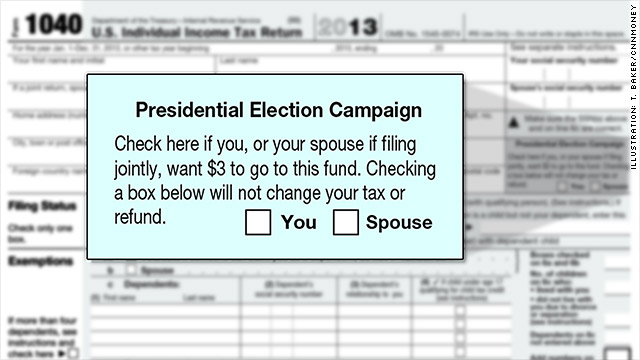

Tax deductions for political campaigns. The refund is the amount of your contributions up to $50 for individuals or $100 for married couples (if you file a joint political contribution refund application). A state can offer a tax credit, refund, or deduction for political donations. Federal political contributions are donations that were made to a registered federal political party or a candidate for election to the house of commons.

For 2021 contributions, you must apply by april 18, 2022. For contributions to be honored as an official contribution, the receipt must reside with you. The maximum credit is $50 (for single or married separate filers) and $100 (for married filing joint returns if both spouses made contributions of $50 or more) regardless of the amount of the contribution.

No, the political organization may only deduct those expenses that are directly related to earning taxable income. Resources for labor and agricultural organizations. Indian companies and other persons are allowed to give donations but not in cash.

You can apply for a refund any time after making your contributions but no later than the following deadlines: Individuals may donate up to $2,800 to a candidate committee per election, up to $5,000 per year to a pac and up to $10,000 per year to a local or district party committee. The tax rate for amounts over $750 is 33%.

The economics literature often uses the term pigouvian taxes in the place of corrective taxes. This contribution is eligible for deduction while computing the total income of the company or individual. So, political donations aren’t tax deductible.

If you are looking for potential tax deductions, you may want to look elsewhere. Approach to regulating campaign finance.9 current law places a $2000 ceiling on donations from individuals to political candidates.10 this limit is supplemented by a $5000 ceiling on donations from individuals to political 4. Information about official receipts and contributions to, and spending by, registered political parties, constituency associations, candidates, leadership contestants, and third party advertisers is published by elections ontario.

The brennan center for justice keeps track of these tax incentives for political donations and recommends a small donor tax credit system that could apply to local, state, or federal races. Campaign donation, political contribution, tax deduction. (2) the amendments to ors 316.102 (credit for political contributions) by section 49 of this 2019 act apply to tax years beginning on or after january 1, 2020, and before january 1, 2026.

Business travel expenses those that travel for business purposes, such as attending conferences or traveling to meet with clients, can deduct certain travel expenses. You can leave a response, or trackback from your own site Commercial enterprises aggregate broadcast advertisement spending substantially affects usa’s political election outcomes and thus affects government policies.

This entry was posted on wednesday, september 5th, 2012 at 5:47 pm and is filed under tax deductions and credits. Resources for social welfare organizations. Political campaigns may not deduct their expenses, a rule spelled out clearly in irs publication 529:

Arkansas the natural state grants tax credits for state—not federal—campaign contributions of up to $50 for an individual ($100 for a couple), and it can be spread over multiple candidates, political action committees approved by arkansas, and parties. Political contributions are not tax deductible, though; A 75% tax deduction may be claimed for $400 contributed, a 50% rate for any contribution that is $400 or more and a 33% rate for each contribution that is $400 or more.

Political advertising expenses (such as lobbying or sponsoring political campaigns) are not deductible. All four states have rules and limitations around the tax break. You can receive up to 75 percent of your first $400 of donation as credit, followed by 50 percent of any amount between $400 and $750 and 33.3 percent of amounts over $750.

Arkansas, ohio and oregon offer a tax credit, while montana offers a tax deduction. Ohio like arkansas, ohio only allows for contributions to candidates in statewide elections. How do i claim political contributions?

You can contact elections ontario by email (electfin@elections.on.ca) or phone (1‑866‑566‑9066). They include donations to political campaigns, efforts to influence lawmakers on potential legislation, or any other communications that attempt to influence politicians or political functions. Resources for charities, churches, and educational organizations.

Transportation costs, such as plane, bus, or train tickets Taxpayers from taking a trade or business expense deduction for any amount paid or incurred (1) for participation in, or intervention in, any political campaign on behalf of any candidate for public office or (2) in connection with any attempt to influence the general public, or segments thereof, with respect to legislative matters, elections, (1) a credit may not be claimed under ors 316.102 (credit for political contributions) for tax years beginning on or after january 1, 2026.

Political or lobbying expenses are expenditures that attempt to influence politics. These expenses include registration fees, qualification and legal fees, as well as advertising. Political contributions are made to cover the expenses made by the political party mainly for election campaigns.

Political broadcasting expenditures are not tax deductable but often what is or is not political broadcasting cannot be clearly delineated. Individuals cannot deduct contributions made to political campaigns on their federal tax returns, regardless of whether they itemize or claim the standard deduction. In most states, you can’t deduct political contributions, but four states do allow a tax break for political campaign contributions or donations made to political candidates.

You can follow any responses to this entry through the rss 2.0 feed.