Wayne said the bill is intended to reduce nebraska’s recidivism rate by incentivizing companies to hire felons within the first year after they are released from prison. Payments made to you for rendering security services outside of your regular employment may be considered self.

Are correctional officers able to take a per day deduction for meals or being in a locked facility, without a lunch?

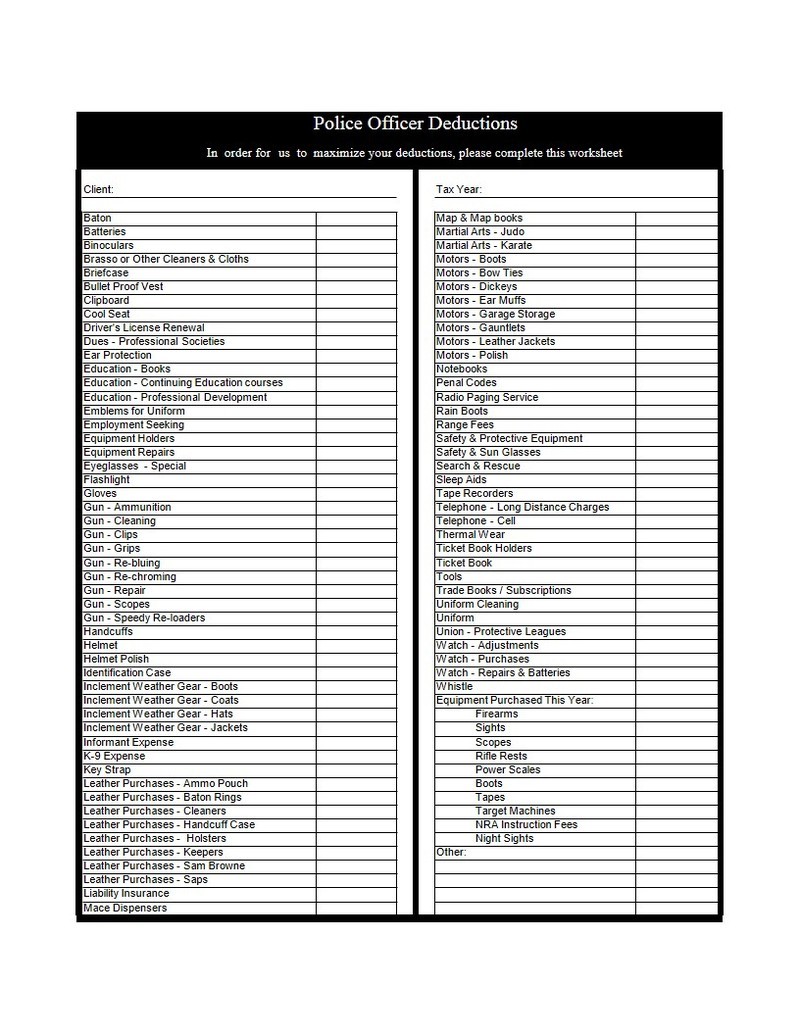

Tax deductions for prison officers. Ask your own tax question. If so, what amount and under what section o the tax code is it in. If you earn your income as a guard or security employee, this information will help you to work out what:

Each government service has different requirements for how to apply for this deduction. First, i recommend you call us to confirm that you may qualify, and then we’ll give. How do i make sure i get this deduction?

If it�s cash, you can deduct as much as your whole agi (up from 60 percent ) in 2020; That plus the pen & int and the fact that the irs has up to three years after a return is filed can mean some hefty fines. District court in seattle, to a year and a day in prison for 14 counts of aiding and abetting the filing of false tax returns, announced u.s.

I also click yes to health insurance being deducted by the police pension and didn�t received a credit. The officers said they are entitled to ask for loans of up to n$5 000 which are paid back with interest but most of the time their requests are not approved. Subtract the amount of any qualified retired public safety officer distribution from the gross distribution and enter the difference in box 2a, taxable amount.

Payments made to you for rendering security services outside of your regular employment may be considered self. If you work as a security guard, some of the tax deductions you may be able to claim on your personal tax return are: Wayne said the bill is intended to reduce nebraska’s recidivism rate by incentivizing companies to hire felons within the first year after they are released from prison.

Select the other / roth button. He was sentenced to 22 1/2 years in prison. The tax deduction is available not only to retired police officers but to firefighters, ambulance crews, probation officers, police chaplains, prosecuting.

Meals and travel the cost of buying meals when you work overtime, provided you have been paid an allowance by your employer (you can claim for your meals without having to keep any receipts, provided you can show how you have calculated the. Prisons), and for training purposes. Motor vehicle travel between different work sites (e.g.

I�m new here, please be nice reference: Turbo tax gave him the $3,000 income deduction and now irs is questioning the deduction. If the employer’s cost is met by.

Jean mpouli worked for 25 years as an aviation inspector for the federal aviation administration (faa), while on the side he ran a tax. This $3,000 pso deduction comes right off the top, it directly reduces your adjusted gross income, even if you don’t exceed 7.5% of your income in expenses. January 19, 2022 — a resident of pacific, washington, was sentenced today in u.s.

You can’t claim a deduction if your study is only related in a general way or is designed to help get you a new job outside of the police. For every $1000.00 lost in deduction it can mean up to 100 to 200 dollars of tax maybe more that has to be paid. Tax deductions for correctional officers business bad debts car and truck costs when getting to and from work sites to another work site employee pay and remuneration, for example, rewards or commissions legal and expert charges, for example, bookkeeping or.

Correctional officer tax deductions australia. If you go with the standard deduction rather than itemize, there�s an exception in 2020 due to the pandemic and cares act. The deduction would apply to wages paid during the first 12 months of the individual’s employment, and the total deduction per employee could not exceed $20,000.

Hi, can i claim the $3000 retired public safety officer exclusion? Floyd died at the scene. I click yes on the form and didn�t get the credit.

Income and allowances to report. Good luck guys some of you are really going to need it. Otherwise, the limit for other deductions is usually 50 percent of your agi at most.

My husband is a retired corrections officer. Archive view return to standard view. Correctional officers protect deducts at tax time.

Are correctional officers able to take a per day deduction for meals or being in a locked facility, without a lunch? Croupiers may also be entitled to general tax deductions that are not work specific, such as investment deductions or car expense deductions. We know how busy you are keeping everyone safe, so we thought we’d show our appreciation by compiling a list of all the tax deductions you can claim at tax time.

As bystanders gathered on a nearby sidewalk and pleaded with officers to let floyd up, thao kept them at bay. Tax deductions for guards and security employees make sure you get a tax return you deserve by being aware of all the expenses guards and security employees can claim. The moment you sign your employment.

Chauvin was convicted last spring in state court of murder and manslaughter for floyd�s killing. You can and can�t claim as a work. The deduction includes the cost of coverage for the officer, her spouse and her kids.

Tax focus is a registered tax agent and certified public chartered accountant. With over 20 years of combined tax experience our tax agents are ensuring that you get the biggest tax refund possible. The smaller of the amount of the premiums or $3,000 can be excluded (subtracted) from the gross distribution.