If your employer pays you the exact amount for expenses you incur (either before or after you incur them), the payment is a reimbursement. What is induction and deduction in psychology?

However, it�s just as important to make sure you�re not falling victim to potentially risky schemes.

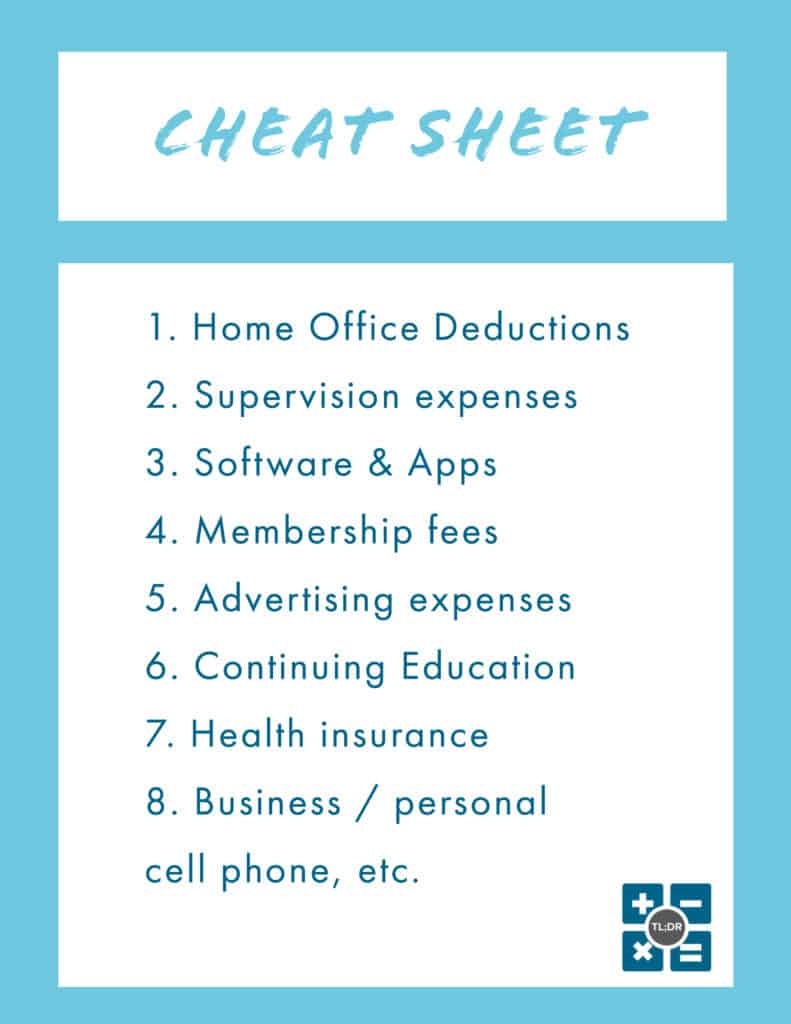

Tax deductions for psychologists. Designation, but you can do your job better with a psy.d., then you could argue that it would be tax deductible since it�s improving your skills in your current trade or business. However, it�s just as important to make sure you�re not falling victim to potentially risky schemes. One of the best tax deductions for therapists is the home office.

Your psychologist appointments are deductible as a medical expense, according to irs publication 502, but only to the extent it is for medical care. You can deduct the costs of your own psychotherapy as well by itemizing on your personal tax returns with one exception: From simple to complex taxes, filing with turbotax® is easy.

What is induction and deduction in psychology? This includes, for instance, subscriptions to online psychology magazines, as well as books that you purchase from the store to further research new methods of therapy. If your employees buy their own ce and submit receipts to you for reimbursement, then you need to set up an accountable plan.

If you receive a $1,000 tax deduction, you save only $220 off your final tax bill. For those who qualify, the deductions include: Note that the standard deduction for a couple that is married filing jointly in 2022 is $25,900.

People with higher incomes may not be allowed to deduct as much (or claim the deduction at all). I have never seen this rule applied to psychologists. At higher income levels, the deduction for sstbs is reduced and in some cases, eliminated.

Deductive reasoning works from the more general to the more specific. We’ve grouped tax credits into three general categories and tax deductions into two. Up to $4,000 of your tuition and fees expenses can

Deducting therapy practice marketing expenses. The specified service trade or business (sstb) classification doesn’t come into play as long as total taxable income is under $157,500 ($315,000 if filing jointly). A tax deduction shields some of your income from being taxed in the first place.

Tax deductions for professionals will also help you choose the best legal structure, with detailed information on limited liability companies, partnerships, and professional corporations. If your employer pays you the exact amount for expenses you incur (either before or after you incur them), the payment is a reimbursement. Selling the couch podcast and blog this ebook is dedicated to my wife.

You can also include the cost of psychologist appointments for your spouse or your dependents, if. Ad answer simple questions about your life and we do the rest. Buying up ad space in psychology today is a deductible advertising expense.

Psychologists investigate, assess and provide treatment and counselling to foster optimal personal, social, educational and occupational development. Inductive reasoning works the other way, moving from specific observations to broader generalizations and theories. In all other cases, you�ll use form 8995.

In logic, we often refer to the two broad methods of reasoning as the deductive and inductive approaches. Tax deductions for therapists the home office deduction for therapists. There are a variety of common business expenses that you can take deductions for in order to save at the end of the year.

Membership fees for professional organizations are deductible. Allowances and other employment income; After all, you�ve worked hard all year for your income;

On the other hand, if you can provide similar services without the psy.d. You can’t include the costs of psychotherapy that’s required as part of your. Tax deductible expenses for psychotherapists book, magazines, reference material business and malpractice insurance business meals cabs, subways, buses copying equipment/furniture gas and electric legal and professional fees memberships (professional organizations) messengers, private mail carriers,.

Let’s say you’re in the 22 percent tax bracket (because you earned $55,901 to $89,050). We don�t consider a reimbursement to be an. Every dime you spend on marketing your practice is fully deductible.

Nobody wants to pay more in income taxes than they absolutely have to. This means that the sum of your itemized deductions must be larger than $25,900 to justify itemizing. Can claim a deduction for your expense, if you�re eligible.

A tax deduction does not mean something is free.