The mortgage interest deduction — one of the main tax benefits for homeowners — allows you to deduct the interest you pay on your mortgage to buy, build or improve your main or second home. For additional tax information for homeowners, please see irs publication 530.

If the home counts as a personal residence, you can generally deduct your mortgage interest on loans up to $750,000, as well as up to $10,000 in state and local taxes (salt).

Tax deductions for purchasing a home. You can only claim the deduction if your gross income is $80,000 or less for single filers and $160,000 or less for joint filers. However, your deduction for state and local taxes paid is capped at $10,000 for 2018 through 2025. For additional tax information for homeowners, please see irs publication 530.

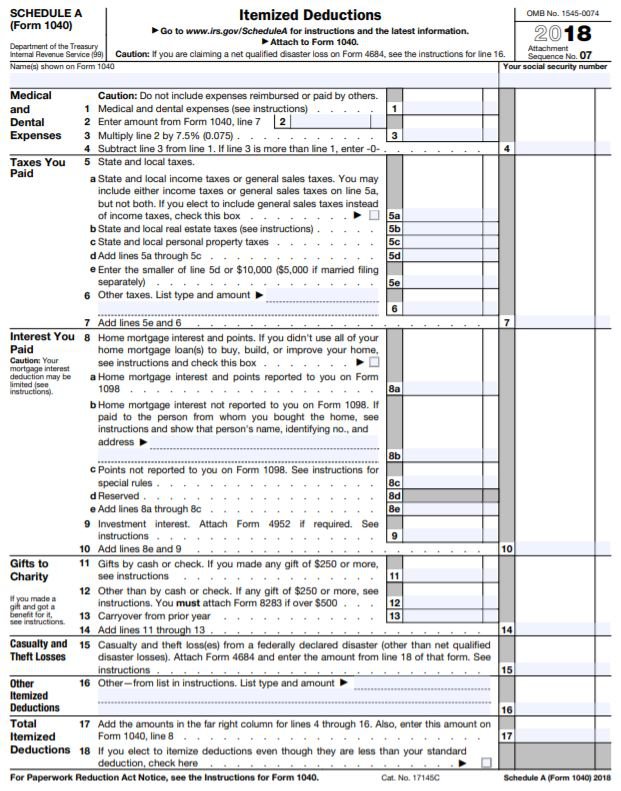

The only settlement or closing costs you can deduct on your tax return for the year the home was purchased or built are mortgage interest and certain real estate (property) taxes. Schedule 1 and form 8917, tuition and fees deduction. The internal revenue service (irs) provides several tax breaks to make homeownership more affordable.

For most people, the biggest tax break from owning a home comes from deducting mortgage interest. $12,550 for single filers and. Just remember that under the 2018 tax code, new homeowners (and home sellers) can deduct the interest on up to only $750,000 of mortgage debt, though homeowners who got their mortgage before dec.

Common tax deductions include those for mortgage interest, mortgage points, and private. You must spread throughout the loan what you don�t pay or if you don�t use the home as a residence. To claim the deduction, you need to complete two tax forms:

For tax year prior to 2018, you can deduct interest on up to $1 million of debt used to acquire or improve your home. Other than deductions for homeowners, some of the most common. Another home buying tax deduction is apportioned mortgage interest.

For example, if you�re charged $1,000 in points on a residential loan and pay $750 of it at closing, you can write off $750 in the year of the closing, but must take the rest of the $250 throughout the loan�s life. And the total amount of the mortgages for your first home and vacation home cannot exceed the $650,000 or $1 million amounts mentioned above. This amount of prorated mortgage interest can be written off.

Instead, that amount will be shown on the settlement sheet. Deductible expenses can range from mortgage insurance to property taxes, and there are even deductions for having a home office. The second significant tax change to be aware of as a new home buyer is that the standard deduction has doubled.

You can deduct the interest paid on up to $750,000 of mortgage debt if you’re an individual taxpayer or a married couple filing a joint tax. The standard deduction for the 2021 tax year is: You can also fully deduct in the year paid points paid on a loan to substantially improve your main home if you meet the first.

For individual filers, the amount is now $12,000, and it’s up to $24,000 for married couples. Discover tax deduction new home purchase for getting more useful information about real estate, apartment, mortgages near you. You won�t get a 1098 report listing these taxes.

Don’t forget to include any taxes you may have reimbursed the seller for. The mortgage interest deduction — one of the main tax benefits for homeowners — allows you to deduct the interest you pay on your mortgage to buy, build or improve your main or second home. The tax law even allows you to rent out your vacation home for up to 14 days a year without paying taxes.

You do not need to itemize to claim the tuition and fees deduction. These are taxes the seller had already paid before you took ownership. The following can be eligible for a tax deduction:

(startup stock photos / pexels) mortgage interest deduction. If you use part of the refinanced mortgage proceeds to substantially. If you buy at the.

For the first time buyer, there is an additional deduction on interest on home loan under section 80ee of inr 50000, deduction on payment of stamp duty under section 80c along with principal repayment and interest deduction under section 24. There is speculation that this will have a significant impact on the value of homeownership. These can be deducted in the year you buy your home if you itemize your deductions.

$25,100 for married couples filing jointly, up $300 from the 2020 tax year. The first tax benefit you receive when you buy a home is the mortgage interest deduction, meaning you can deduct the interest you pay on your mortgage every year from the taxes you owe on loans up to $750,000 as a married couple filing jointly or $350,000 as a single person. If the home counts as a personal residence, you can generally deduct your mortgage interest on loans up to $750,000, as well as up to $10,000 in state and local taxes (salt).

For tax years after 2017, the limit is reduced to $750,000 of debt for binding contracts or loans originated after december 16, 2017.