The best way to make money in real estate is to actually cut on expenses. Most real estate investors purchase rental property for the monthly income, potential appreciation in property value over the long term, and the available tax deductions.in this article, we’ll take a quick look at how deductions on a rental property work, then review 30 rental property tax deductions, including a.

Most real estate investors purchase rental property for the monthly income, potential appreciation in property value over the long term, and the available tax deductions.in this article, we’ll take a quick look at how deductions on a rental property work, then review 30 rental property tax deductions, including a.

Tax deductions for real estate. Many clients who make this special election on their tax return, and who have some rental properties can create thousands of dollars in tax deductions that lead to zero tax liability at the end of the year. If you drive 10,000 miles or more annually for your real estate business, it’s likely you’ll get the greatest tax benefit by taking the standard mileage deduction. List of tax deductions for real estate agents and brokers.

Some other tax deductions for real estate agents include fees to license boards such as state broker commissions or registration fees with local municipalities. One of the most advantageous things about investing in rental properties is the deductions you can take at tax time. Do you qualify for real estate tax breaks?

Rules for the property tax deduction By qualifying for certain deductions, you can reduce the amount of taxes owed to the irs. The cost of all driving you do for your real estate business, with the important exception of commuting to and from your home to work, is tax deductible.

Property marketing online and newspaper ads, photography, staging, and signage are all tax deductible. People seeking profitable investments that provide a steady stream of income often invest in real estate. Here is our complete guide to property tax deductions for 2020.

These can be deducted in full provided you have a receipt proving their cost. I always tell investors to treat […] The complete rental property deductions checklist.

August 27, 2015 by jorge vazquez. For the 2021 tax year, the standard mileage rate is $0.56 per mile. All rental income must be reported on your tax return, and in general the associated expenses can be deducted from your rental income.

To start the blank, utilize the fill & sign online button or tick the preview image of the blank. Real estate is a great way to invest in a physical asset that usually gains in value over time, while also producing an income. If we ask any real estate investor about the best part of investing in property, we bet they would say the investment property tax deductions!.

You must own the property to qualify for the deduction. Here are the most common tax deductions taken by real estate pros: As members gather their tax information for their filings, questions arise about the deduction for health insurance premiums.

Top 10 tax deductions for real estate investors. Deductible real property taxes don�t include taxes charged for local benefits and improvements that directly increase the value of the real property, such as assessments for sidewalks, water mains, sewer lines, parking lots, and. Now, imagine above all the other rental costs, a real estate investor must pay taxes in full.

Real estate agents can deduct qualifying education expenses on their schedule c or e. If you own rental real estate, you should be aware of your federal tax responsibilities. The property tax deduction is available only if you itemize.

Professional fees & dues telephone expenses supplies & expenses association dues cellular calls advertising, signs, flag & banners license fax transmissions appraisal fees Most real estate investors purchase rental property for the monthly income, potential appreciation in property value over the long term, and the available tax deductions.in this article, we’ll take a quick look at how deductions on a rental property work, then review 30 rental property tax deductions, including a. Employees may be eligible to deduct unreimbursed training and education expenses on their schedule a, subject to the 2% limit.

Deductible real property taxes include any state or local taxes based on the value of the real property and levied for the general public welfare. Generally, to be deductible, items must be ordinary and necessary to your real estate profession and not reimbursable by your employer. How you can fill out the real estate agent tax deductions worksheet pdf form on the web:

Real estate tax deductions, real estate taxes real estate tax deductions. Real estate tax deductions can have a major impact on how much tax you pay each year. Licences & fees your state license renewal, mls dues, and professional memberships, are deductible.

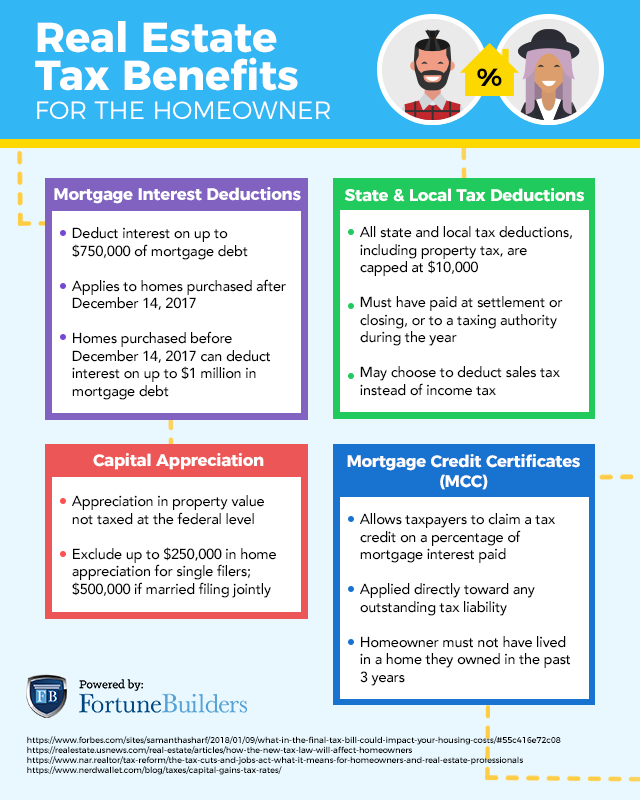

The single most claimed tax deduction for all small businesses is car and truck expenses. If you’re going to claim a deduction, make sure you can provide documentation that this is a real expense. There is a $10,000 cap on how much you can deduct, per the tax cuts and jobs act of 2017.

The best way to make money in real estate is to actually cut on expenses. With the standard auto deduction, every mile you drive for your business can be deducted from your taxes. You can pay directly or through an escrow account with the lender that holds your mortgage.

Third, the “professional heritage” classification allows taxpayers to deduct 100% of all real estate losses against normal income.