This means you can now deduct your mileage and the business use of your car. Expenses paid on clients behalf 12 13.

Many real estate professionals pursue professional development through classes, trade shows, conferences, or coaching.

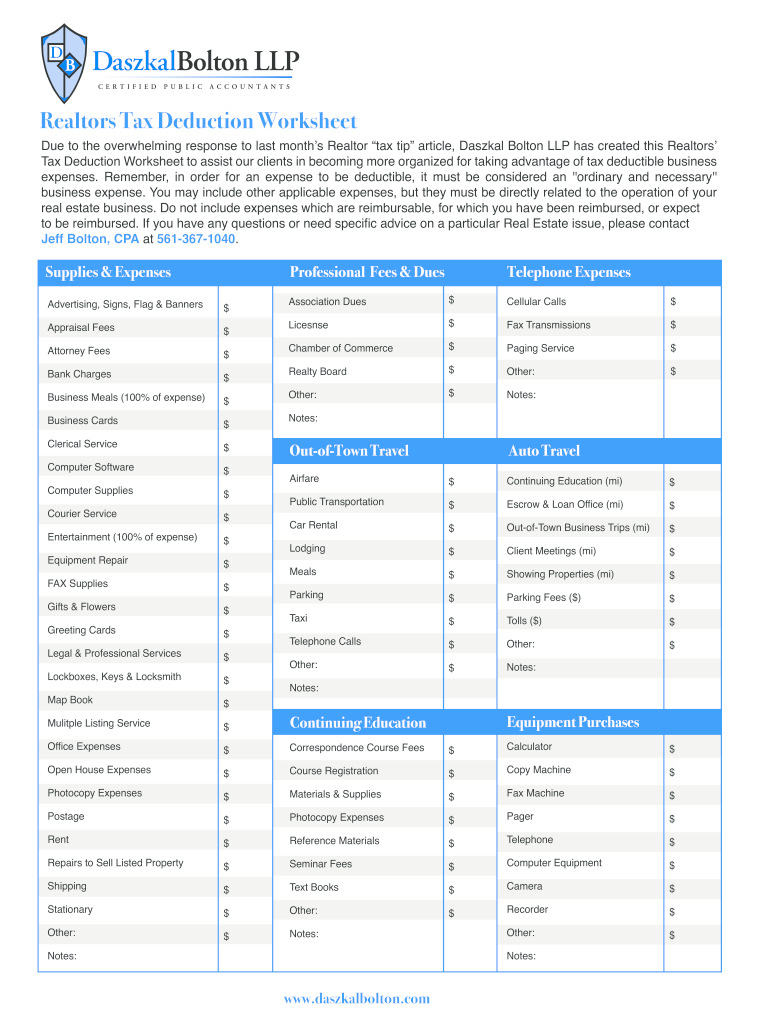

Tax deductions for real estate agent. Business travel & meals 8 9. Allowable tax deductions you need to know here are some of the most common real estate agent and broker deductions: Many real estate professionals pursue professional development through classes, trade shows, conferences, or coaching.

In addition, fathom offers its agents a full monthly training calendar, at no cost. December 19, 2020 wordpress 0 comments. Property marketing online and newspaper ads, photography, staging, and signage are all tax deductible.

This means you can now deduct your mileage and the business use of your car. These deductions include, but aren’t limited to: Begin checkout » toggle navigation.

This is a short and easy guide about the so now will talk you real estate agent tax deductions checklist. Sales and open house signs and flyers; Above total does not include sales tax.

Real estate agent (11) tax deductions (1) write offs (1) The irs allows you to deduct either the actual expenses, such as fuel, maintenance, and repairs, or the miles that you drive throughout the year. As a real estate agent, your time and expenses from being on the road for business are business expenses.

Expenses paid on clients behalf 12 13. Real estate agents can deduct qualifying education expenses on their schedule c or e. Because there’s always a chance you may be audited, save your business receipts for at least three years after you file your taxes.

Most real estate agent marketing expenses will fall under the category of a tax deduction. Real estate agent car tax deduction 6.1 simple method (standard mileage deduction) 6.2 actual method 7 7. Other items include website development and maintenance,.

Employees may be eligible to deduct unreimbursed training and education expenses on their schedule a, subject to the 2% limit. You can print it off or pin it on pinterest for later. Commissions paid to other agents are deductible.

Business gifts ($25 deduction limit) 11 12. Substantially all payments for their services as real estate agents are directly related to sales or other output, rather than to the number of hours worked Home office deductions (if you work from home) internet and phone bills deductions health insurance premiums deductions business travel and meals deductions vehicle use deductions loan/credit interest deductions education deductions subscriptions and.

In real estate, that means your state license renewal, professional memberships, and mls dues. Keeping track of your business deductions can get exhausting, especially if you wrack up a lot of expenses. Fees, licenses, memberships, and insurance annual fees are a common cost of doing business and are deductible.

Licences & fees your state license renewal, mls dues, and professional memberships, are deductible. Home office deduction 8.1 simplified method for realtors 8.2 detailed method for realtors 9 10. 9 tax deductions every real estate agent should know.

Whether it’s sales and open house signs and flyers or business cards, these types of marketing materials are all tax deductions for real estate agents. Office rent and utilities 10 11. Marketing tax deductions for real estate agents.

If work in real estate, here are 16 common real estate agent tax deductions you should keep track of throughout the year: Continuing education and training costs for the maintaining and betterment of your real estate career are deductible.