Some other tax deductions for real estate agents include fees to license boards such as state broker commissions or registration fees with local municipalities. However, this deduction is limited for people whose business is providing personal services, which includes real estate agents and brokers.

You have two options when claiming real estate agent car tax deduction:

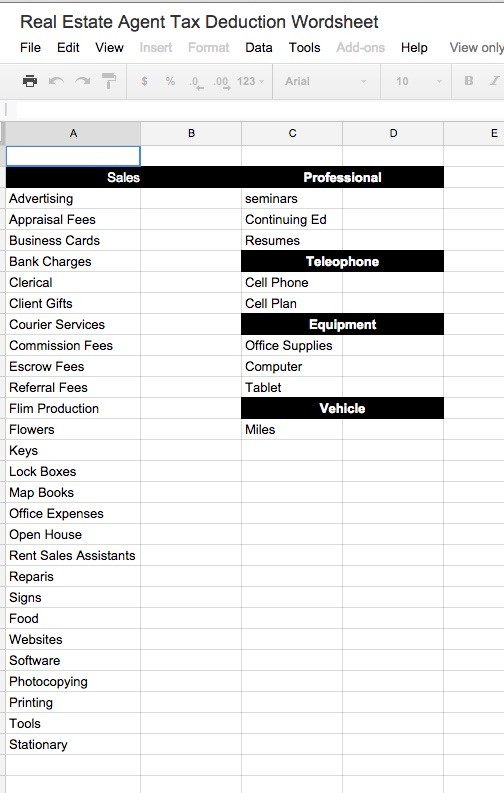

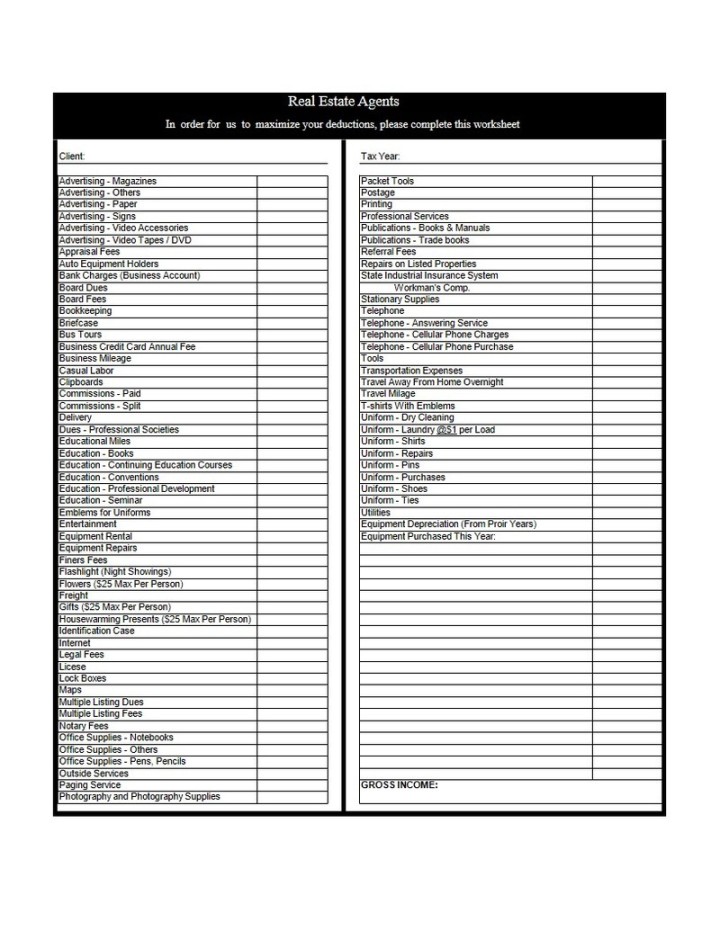

Tax deductions for real estate agents. All real estate agents should open up an ira and fund it every year to increase their nest egg while lowering their tax bracket (and taxable income) at the same time. Real estate agents can deduct qualifying education expenses on their schedule c or e. Begin checkout » toggle navigation.

Because there’s always a chance you may be audited, save your business receipts for at least three years after you file your taxes. This means you can now deduct your mileage and the. Above total does not include sales tax.

As a real estate agent, your time and expenses from being on the road for business are business expenses. Allowable tax deductions you need to know here are some of the most common real estate agent and broker deductions: Employees may be eligible to deduct unreimbursed training and education expenses on their.

In addition, fathom offers its agents a full monthly training. It’s important to record the mileage as it’s often one of the. Licences & fees your state license renewal, mls.

In real estate, that means your state. You have two options when claiming real estate agent car tax deduction: Simple method (standard mileage deduction) the simple method where you take a cost per mile for.

Fees, licenses, memberships, and insurance annual fees are a common cost of doing business and are deductible. Sales and open house signs and flyers; Continuing education and training costs for the maintaining and betterment of your real estate career are deductible.

However, this deduction is limited for people whose business is providing personal services, which includes real estate agents and brokers. These can be deducted in. If work in real estate,.

Some other tax deductions for real estate agents include fees to license boards such as state broker commissions or registration fees with local municipalities. Meals for real estate agents would be listed under the 50% deduction as opposed to the 80% deduction for department of transportation employees. Here’s a breakdown of the most common tax deductions for real estate agents and what each entails.