For more information about reporting your llc on your federal income ta return, please refer to this link: Nor is it subject to the $10,000 annual limit on deducting property tax paid on a main or second home.

Deduction #5 show detail home office deduction

Tax deductions for real estate llc. There are several deductions specific to business owners and real estate investors, such as: In our example, all expenses other than the funeral bill, credit card balances, and other debts qualify as administration expenses. The following are some of the most common llc tax deductions across industries:

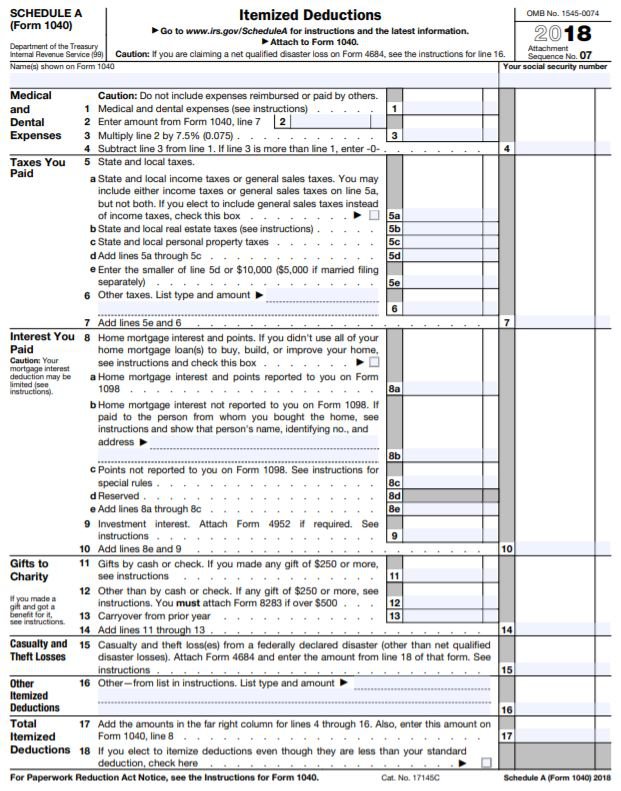

However, this deduction is limited for people whose business is providing personal services, which includes real estate agents and brokers. If you are a cash basis taxpayer, you report rental income on your return for the year you receive it,. An investor can also deduct property taxes paid on a vacant land as a personal itemized deduction on schedule a.

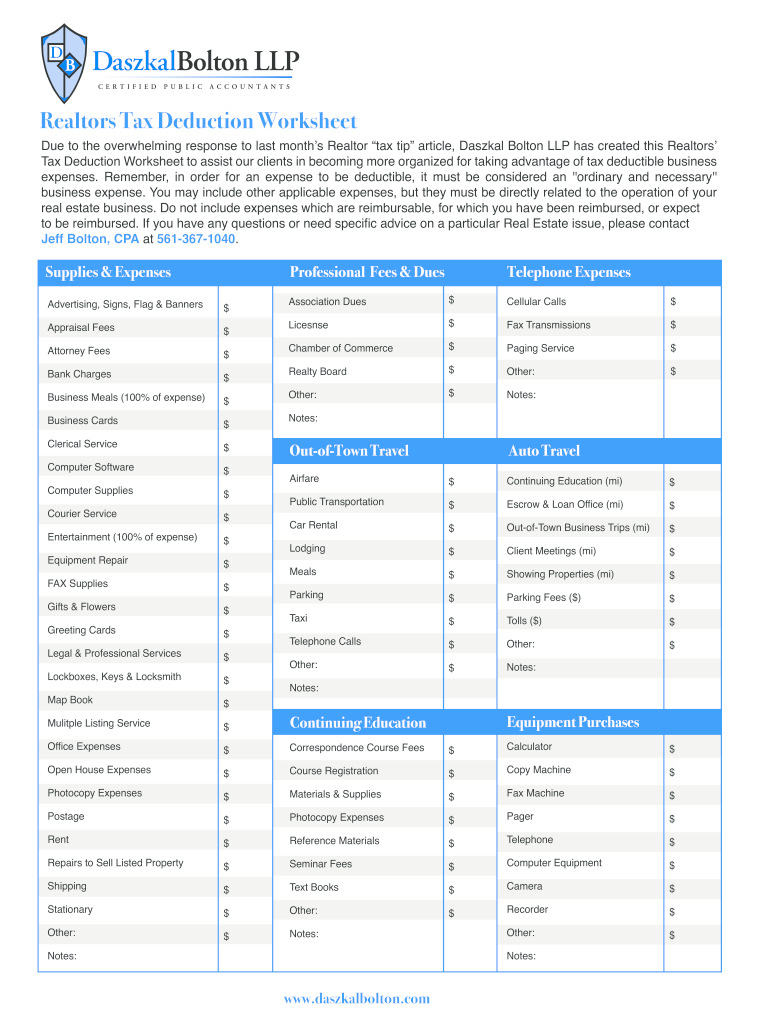

It started with finding a great certified public accountant (cpa) who not only filed taxes but. Your state license renewal, mls dues, and professional memberships, are deductible. Doing good is good for tax purposes.

Should your taxable income be above these thresholds, a complicated calculation will be used to determine. To account for this deemed loss in value, the investor may recoup his or her initial investment ( basis ) through depreciation deductions over the. The $10,000 limit, enacted for 2018 through.

Additionally, if you run your company out of a home office, you may even be eligible for other additional deductions, such as utilities, repairs and maintenance, or dwelling insurance costs. For this article, we partnered with a certified public accountant firm that specializes in real estate investment, the real estate cpa, to provide you an overview of the rental property tax deductions available for your rental income. So if you paid $5,000 in state and local taxes and $10,000 in property taxes, you can deduct $5,000 of the property taxes.

You will use this to prepare schedule e. If you paid $1,000 in state and local taxes and $10,000 in property taxes, $9,000 of the taxes would be deductible. Before we jump into all of the deductions, it’s also important to note that maximizing your real.

12 biggest tax write offs for llc businesses 1. State and local income and property taxes up to$10,000 (this includes your real. If you actively participate in or are a real estate professional, you are able to deduct more of a loss on the current year than if your real estate investment is passive income.

Or $5,000 if married filing separately. For tax accounting purposes, improved real estate (real estate with buildings on it) is considered to lose value. If your estate is in a 33% income tax bracket and these are taken as.

Renting out your second residence. Real estate agents can deduct legal and professional fees to the extent they are an ordinary part of and necessary to operations. Mortgage interest on as much as $750,000 in principal.

These administration expenses total $32,000. Llc and corporation tangible property (section 179) deductions section 179 of the internal revenue code permits the deduction of up to $1 million (in the year of purchase) of the cost of tangible personal property to be used in the business. There are special rules that define active participation.

Any interest expenses that you incur which are associated with capital used to buy rental real estate are classified as deductions. Startup costs include all costs incurred to get your business up and running. Deduction #5 show detail home office deduction

Deduction #4 show detail advertising expense the irs allows you to deduct reasonable advertising expenses that are directly related to your business activities. The maximum deduction allowed for state, local and property taxes combined is $10,000. Property taxes and insurance paid on an investment property (which cannot be deducted on a personal residence) mortgage interest (which can be deducted for both a personal residence and an investment property) property management fees

Examples include the money you spend on: All rental income must be reported on your tax return, and in general the associated expenses can be deducted from your rental income. Deduction for losses if you work in real estate.

An llc that operates out of a home office can deduct a proportion of the amount spent per month on the home. 115 popular tax deductions for real estate agents for 2022 finding a great cpa. Nor is it subject to the $10,000 annual limit on deducting property tax paid on a main or second home.

You’ll learn valuable tax strategies you can implement now to minimize your upcoming tax bill—and maximize. First, add up any of these itemized deductions you�re entitled to: Medical expenses that exceed 10% of your adjusted gross income (agi).

The total deduction allowed for all state and local taxes (for example, real property taxes, personal property taxes, and income taxes or sales taxes) is limited to $10,000; If your are considered active participants in your rental property, you will be able to offset up to $25,000 of passive rental losses against ordinary income. This deduction is not limited to the amount of net investment income.

However, those estate tax deductions that qualify as administration expenses can be deducted on your estate’s income tax return. For more information about reporting your llc on your federal income ta return, please refer to this link: One of the major benefits of having your property owned by an llc is that you will be able to take certain deductions on your taxes that you otherwise would not be eligible for.

If you are using a mortgage company, they will send you a form 1098 at the end of the year detailing how much interest you paid them over the course of the year. Llcs can deduct the amount paid to rent their offices or retail spaces. (this special ability to deduct passive rental losses is limited by agi).