See real estate professional under activities that aren’t passive activities, later. That said, there’s a pretty important caveat about professional memberships we need to discuss:

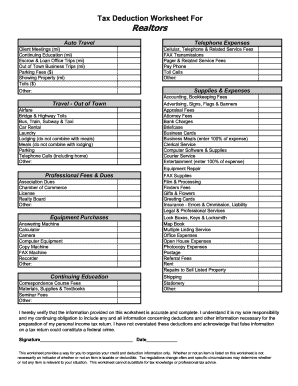

But when it comes to tax time, you’d be surprised to know there are many deductions you may be overlooking.

Tax deductions for real estate professionals. Website development and maintenance 5. Real estate agents can deduct legal and professional fees to the extent they are an ordinary part of and necessary to operations. See real estate professional under activities that aren’t passive activities, later.

Here are the most common tax deductions taken by real estate pros: In addition, fathom offers its agents a full monthly training calendar, at no cost. Can have more than $25,000 of active real estate losses • $100,000 modified agi test does not apply •.

Marketing tax deductions mean every dollar you spend on growing your real estate business is worth two or more dollars in tax savings. Marketing tax deductions for real estate agents. Tax rules for real estate professionals.

There are dozens of possible tax deductions for real estate professionals. The single most claimed tax deduction for all small businesses is car and truck expenses. That said, there’s a pretty important caveat about professional memberships we need to discuss:

But when it comes to tax time, you’d be surprised to know there are many deductions you may be overlooking. Any expense for your real estate business is deductible if it is: 1 day agocpa shows developers doing renovations or tear down rebuilds huge tax deductions / tax savings.

First, it establishes whether the taxpayer can deduct losses from real estate activities against ordinary income. For real estate agents, tax deductions in this category include renewal fees for your state license, the cost of professional memberships, and mls dues. National society of tax professionals real estate professional exception • the special $25,000 allowance limitation does not apply:

Huge tax savings for real estate developers doing renovations or tear down rebuilds. Other items include website development and maintenance,. If you were classified as a real estate professional, the combined $40,000 could be deducted from that $170,000.

This has now been limited to $250,000 in losses if single (and $500,000 if married) under the excess business loss limits introduced by the tax cuts &. In this blog post we explain ways in which meals and entertainment can be deducted by real estate professionals from their income taxes. The real estate professional status historically allowed real estate investors to take unlimited rental losses against their ordinary income.

These can be deducted in full or prorated based on how much they were used during the year. This would lower your overall taxable income to $130,000 for the tax year. These are fully deductible business expenses you must be aware of.

Second, it establishes whether income or gains from the real estate activities are subject to the. Continuing education and training costs for the maintaining and betterment of your real estate career are deductible. If you do this, you may not deduct this amount on your schedule a (you can�t deduct the same item twice).

Most real estate agent marketing expenses will fall under the category of a tax deduction. The portion of your dues that eventually goes to political advocacy and lobbying is not deductible, so you’ll need to account for this. Deduction #5 show detail home office deduction

Donating real estate will generally give taxpayers a valuable tax deduction based on the fair market value (fmv) of the asset donated. Whether it’s sales and open house signs and flyers or business cards, these types of marketing materials are all tax deductions for real estate agents. In real estate, that means your state license renewal, professional memberships, and mls dues.

Any production costs that go into producing these materials for you and your business can be deducted from your taxes. As a real estate professional, you’re likely used to juggling lots of data. Let’s take a deeper look into this.

Fees, licenses, memberships, and insurance annual fees are a common cost of doing business and are deductible. If you are a real estate professional then you can take a deduction on your income tax returns for bonus depreciation up to the limits allowed by the internal. Deduction #4 show detail advertising expense the irs allows you to deduct reasonable advertising expenses that are directly related to your business activities.

The importance of determining whether a taxpayer involved in real estate activities is a real estate professional is twofold. This includes website design and hosting fees, sem, ppc advertising, video production and other forms of media are all tax deductible. Mileage aside from your cell phone, a real estate agent’s best friend is their vehicle.

If you did not meet the real estate professional requirement, these losses could only be used to decrease your rental income. Meals with clients and with business colleagues are deductible, as are client gifts up to certain limits. An activity is a rental activity if tangible property (real or personal) is used by customers or held for use by customers, and the gross income (or expected gross income) from the activity represents amounts paid (or to be paid) mainly for the use of the.

The cost of all driving you do for your real estate business, with the important exception of commuting to and from your home to work, is tax deductible.