Even though consultants do not have the same benefits as employees, tax is deducted at source up to 10.3%. Food, except in certain circumstances;

Recruitement charges will be come under profession charges.

Tax deductions for recruitment consultants. One of my new clients, who owns a recruiting business, was amazed when i showed him the tax money he could save. For every $1,000 of deductions, he saved $460 in cash. This would drop you into a lower tax bracket if you earned $120,000 but spent $40,000 on deductible expenses.

Being a member of your local chamber of commerce can also be deductible, if you can prove it’s essential to finding new clients. This was because he was in the 46% tax bracket (between federal, state, social security, and medicare taxes). In addition, the deduction is gradually phased out for consultants whose taxable income exceeds the.

Training and courses for new skills; If you have to use a phone for work, the purchase and monthly service bill are tax deductible! Tax return take control of your finances sign up to get the latest tax tips, information on personal finance and other key resources sent straight to your email.

Taxes/licenses (line 23) business taxes (e.g. While there are many ways to do this (like taking odometer readings before and after trips), the easiest method is to use an app like stride that records mileage while you drive: Your share of fica if you have employees) can be deducted.

Under which section 194c or 194j ,tds on recruitment charges will be deducted. Things like air fare, rental cars, taxi fare, food, and lodging are all deductible as long as primary purpose of your trip is business. As a rideshare driver, you can deduct the complimentary goodies that you offer your passengers like bottled waters, mints and halloween candy.

Tax deductions for independent consultants. Food, except in certain circumstances; Consultants whose income exceeds rs.10 lakh have to be audited by a ca.

Recruitement charges will be come under profession charges. Payments are to be made after deduction of the taxes, within duration of 30 days of the date of invoice once the candidate has joined the company, by cheque in favor of “kv recruitment consultants”. If you drive to meet with clients, or go to their places of business, then you can take advantage of the vehicle deduction.

The tax on salary is deducted on basis of tax slab while in case of consultants the tax is deducted at 10%. The advertising agencies shall have to deduct tax at source at the rate of 5 per cent under section 194j while making payments to artists, actors, models, etc. The deduction will have to be made under section 194c at the rate of 1 per cent.

Records you need to keep. The internal revenue services has declared tax deductions for 2022 along with tax tables for various slabs. There is a long list of expenses that can be deducted also.

Income and allowances to report. Sometimes there�s a bit of complexity to the booking of expenses involved, as with travel and entertainment limits, but recruiting is a normal business function and expenses definitely impact income. Perhaps even more relevant, however, is that the various licensing fees you pay can also be deducted.

The society of professional consultants, for example, is related to business. We enter into a contract with the recruitmrnt firms that we will hire through there firm against which they will charge some fee on the basis of %age of ctc. If you paid to have a booth at a job fair, campus hiring event or industry networking mixer be sure to present these costs to your accountant as these are tax deductible.

Optimize tax outgo employees have to depend on their employer to structure their salary. If you earn your income as a recruitment consultant, this information will help you to work out what: However consultants have to take care about their advance taxes are submitted on time to avoid any interest on tax.

Common deductions of it consultants: Before he gets a tax consultant to the duties, let us understand the changes about tax deductions that are applicable from the current year. Even though consultants do not have the same benefits as employees, tax is deducted at source up to 10.3%.

Any other work related communications like requests other than mentioned in agreement must be submitted in writing. Your taxable income might be only $80,000. Even fees for networking groups can be.

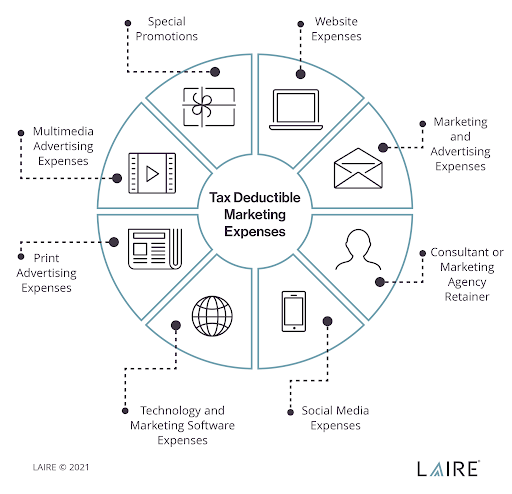

For consultants, this could apply to common office supplies, such as paper, pens, etc. If you paid to post a job ad online, in a newspaper, on the radio, those advertising expenses are tax deductible. Employment taxes including social security, fica, futa and state unemployment taxes of the employer’s share, are tax deductible.

He said 46% was much higher than his profit from his recruiting. There have been truly exceptional practices that you�re not likely to exp. Here are the 16 consultant tax deductions you should keep track of throughout the year: