One point equals 1% of the loan amount, so if you paid 2 points on a $100,000 loan, for example, you would have paid $2,000. If you completed a mortgage refinance in 2020, you may be realizing the benefits of lower payments and possibly a lower rate.

Points paid by the seller.

Tax deductions for refinance. You closing costs are not tax deductible if they are fees for services, like title insurance and appraisals. Accountants call this process “amortization.” let’s use the above $200,000. One point equals 1% of the loan amount, so if you paid 2 points on a $100,000 loan, for example, you would have paid $2,000.

You can deduct these items considered mortgage interest: There are a number of tax deductions that you can take advantage of if you refinance a mortgage loan. Talk to an accountant about your eligibility for the following deductions if you are unsure:

You will need to remember to spread the deduction over the life of the loan. Funds provided are less than points. Taxpayers may deduct points only for those payments.

Yes, refinance points are tax deductible. You can deduct points paid for refinancing generally only over the life of the new mortgage. For example, if you earn $50,000 a year before taxes and you have $5,000 worth of deductions, youd only pay taxes on $45,000 of your income.

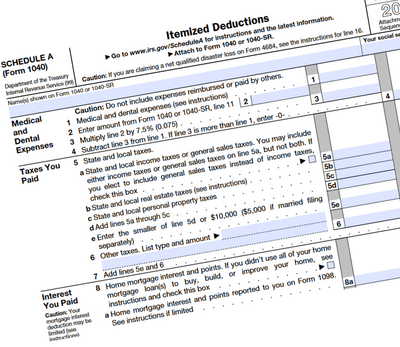

How to claim refinancing tax deductions. The irs will let you deduct just about every closing cost. You may be able to deduct certain costs, like mortgage interest, but only if.

Mortgage insurance premiums — for contracts issued from 2016 to 2021 but paid in. If you paid points when you refinanced your mortgage, you may be able to deduct them. If you take that same $100,000 value property (and again subtract the $10,000 for the value of the land for a cost basis of $90,000) and add $5,000 in refinance closing costs, the new cost basis is $95,000, beginning in the tax year that you complete.

When you refinance your home mortgage on a first or second home, you can continue deducting your mortgage interest just as you did with your previous. Learn what deductions you’re eligible for and how to claim them here. However, if you use part of the refinanced mortgage proceeds to improve your main home and you meet the first six requirements stated above, you can deduct the part of the points related to the improvement in the year you paid them with your own funds.

Deduction allowed ratably deduction allowed in year paid home improvement loan. Each year you have deducted $67 dollars on your taxes. $ 12,400 for individual and married filing jointly.

Common closing cost expenses include: The refinance costs noted above are added to the cost basis and included in the depreciation. But no, they are not deductible in full for the year paid.

You can only deduct closing costs for a mortgage refinance if the costs are considered mortgage interest or real estate taxes. In the past borrowers were able to deduct refinance costs for tax purposes. A note on mortgage tax deductions.

The irs allows you to deduct the interest paid on up to $1 million in mortgage debt, on either your primary or secondary home, or the two combined. Ad turbotax® makes it easy to get your taxes done right. Special situations original issue discount.

And if you are looking for possible deductions on your federal income taxes, there are plenty of reasons to read on about form 1098. Refinance loans are treated like other mortgage loans when it comes to your taxes. Should i refinance my mortgage?

Appraisal fees (if required by the lender) the costs associated with obtaining a mortgage on rental property are amortized (spread out) over the life of the loan. If you completed a mortgage refinance in 2020, you may be realizing the benefits of lower payments and possibly a lower rate. The rules for deducting interest on a mortgage refinance changed with the tax cuts and jobs act that went into effect on january 1, 2018.

So if you have a $750,000 mortgage on your primary home and $250,000 mortgage on a vacation home, you can deduct all your mortgage interest. $ 18,650 for head of households. You can often deduct the full amount of interest you paid on your loan in the last year, if you did a standard refinance on a primary or secondary residence.

$ 24,800 for married filing jointly. Unfortunately, you cannot tax deduct your closing costs on your refinance mortgage for your personal residence. Believe it or not, tax season is already here.

If you are refinancing a mortgage on a rental or investment property, the rules are different. You reduce the overall amount of money that you need to pay taxes on when you take a deduction. As when you refinance your primary home, you can deduct eligible interest, points, and property taxes when you refinance a rental.

Answer simple questions about your life and we do the rest. You may qualify for several deductions in the year you refinance the mortgage on your rental property and beyond. You can deduct interest on a loan in excess of your existing mortgage if you use the proceeds to.

Discount points deduction (if purchased at closing to reduce your interest rate) closing costs You pay them upfront to get a lower interest rate during the period when you�re repaying the loan. Appraisal fees loan preparation fees

What is a refinance tax deduction a deduction is an expense that can lessen your tax burden. If you are looking for safe refinance tax deductions then keep reading. When you pay off your first refinance loan with the second, you can deduct the remaining $1665 in mortgage points that same year.

Points paid by the seller. After five years you have deducted a total of $335, but you decide to move into a loan with a better interest rate.