Fortunately, there are a few scenarios in which home improvements may not be a huge burden to your wallet. With the standard deduction, you can reduce your taxable income by a standard amount.

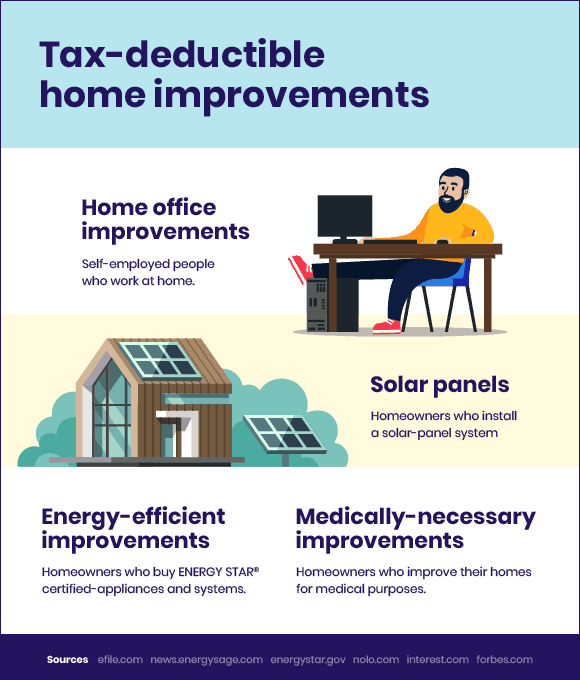

However, installing energy efficient equipment on your property may qualify you for a tax credit, and renovations to a home for medical purposes may qualify as a tax deductible medical expense.

Tax deductions for renovating home. Business owners who work from a dedicated home office u2013 meaning it’s not used for any other purpose besides business u2013 can deduct repairs made to their office in the year they are made. For single and married individuals filing taxes separately, the standard deduction is $12,550. Although home improvements cannot be deducted, they may be depreciated.

It is generally not deductible for federal income taxes to deduct the cost of improvements to a residential property. Tax deductions on home improvements interest that is payable on loans taken for home improvement are tax deductible up to rs.30,000 per annum. Answer simple questions about your life and we do the rest.

Fortunately, there are a few scenarios in which home improvements may not be a huge burden to your wallet. What renovation expenses are tax deductible? What is the home renovation tax credit?

You may qualify for a home renovation tax deduction on the sales tax for the materials you purchased. There may be a way to depreciate home improvements, even though they cannot be subtracted. Thereof can you write off.

Can you claim home renovations on tax return? These include additions such as wheelchair ramps or elevators. However, all of the following must apply:

You can deduct only the amount of eligible medical and dental expenses that is more than 7.5 percent of your adjusted gross income. The maximum amount of the credit is $1,000 per tax year and is calculated as 10% of the qualifying renovation expense (maximum $10,000 in expenses). What you spend on renovations can be subtracted from your income as part of your standard mortgage interest deduction.

U201cthen, the cost of improvements you make to your home office is deductible.u201d. , renovation of a home would not be an expense that can be deducted from federal taxes, but there would be several ways that one can use home renovations and improvements to minimize your taxes. Ad turbotax® makes it easy to get your taxes done right.

Home office repairs and renovations. Home improvements on a personal residence are generally not tax deductible for federal income taxes. Second, home improvements, made for medical reasons, can be deducted from your income.

You’re using the optional sales tax tables. Essentially, you take the deduction over several years from between three and 27 percent. This simply means you deduct the expenditure over a period of time ranging from three to two and a half years.

This works out to a little over 2 percent for the first few. The credit is a refundable tax credit, which means if the credit is higher than the taxes you owe, you’ll receive the difference as a refund. Some equal a home renovation tax credit, which lowers your tax bill directly, while others come with a tax deduction, allowing you to reduce your taxable income accordingly.

You’re claiming the deduction for state and local sales taxes instead of the deduction for state and local income taxes. In any case, it seems, in the u.s.a. Aside from the increase in cost, renovating your home could also increase its basis, or amount of the financial investment.

Repairs are the two principal categories when considering tax deductions, they are not all you should look out for. There are some simple steps that are needed to apply for a home improvement loan and to get the tax benefits. With the standard deduction, you can reduce your taxable income by a standard amount.

Before we get into the idea of tax deductions and all the other technical financial terms. However, installing energy efficient equipment on your property may qualify you for a tax credit, and renovations to a home for medical purposes may qualify as a tax deductible medical expense. What other home improvements could be tax deductible?

For married couples filing jointly, the standard deduction is $25,100. For heads of households, the standard deduction is $18,800. So long as your renovations address specific needs of a people with disabilities or medical conditions, they’re deductible.

Renovations are not limited to capital improvements, and you can find other tax deductions for renovating your home. Typically, these are changes out of a genuine need such as senior living or physical disabilities. Costs incurred to implement accessibility modifications in your home are an eligible medical deduction on your federal income tax under “medical and dental expenses”.

The capital gains from the sale of the home are reduced if it is sold soon after. To be eligible for depreciation on home renovation and improvement expenses, you must utilize a part of your house for purposes other than a personal residence. To determine the size of the profit, your goal should be to increase the basis as much as possible.