Tax your current year now. Tax your current year now.

Property owners can claim capital works deductions for the costs of structural improvements done on a rental property.

Tax deductions for rental properties australia. If you rent out a property to friends or relatives at a rate that is lower that the market rate, you must apportion your expenses in the same ratio. Deductions to help save tax on rental income. Keep records right from the start.

The rent must be declared in the year it is received. According to section 203 of the irs code, you may reduce the amount of rental income by subtracting the expenses incurred during preparation of your property for rental, as well as those incurred in maintaining it. It’s important to note that you only claim rental property tax deductions for the period of the year that the property was tenanted or actively advertised as available for rent.

Your rental property is said to be �negatively geared� if your deductible expenses are more than the income you earn from the property. Rental expenses paid on an overseas rental property such as property agent fees, property and landlord insurances, repairs and maintenance costs, council rates, water rates, etc paid overseas are deductible in australia, as would be the case if the expenses were paid in australia. N which rental income is assessable for tax purposes n which expenses are allowable deductions n which records you need to keep n what you need to know when you sell your rental property.

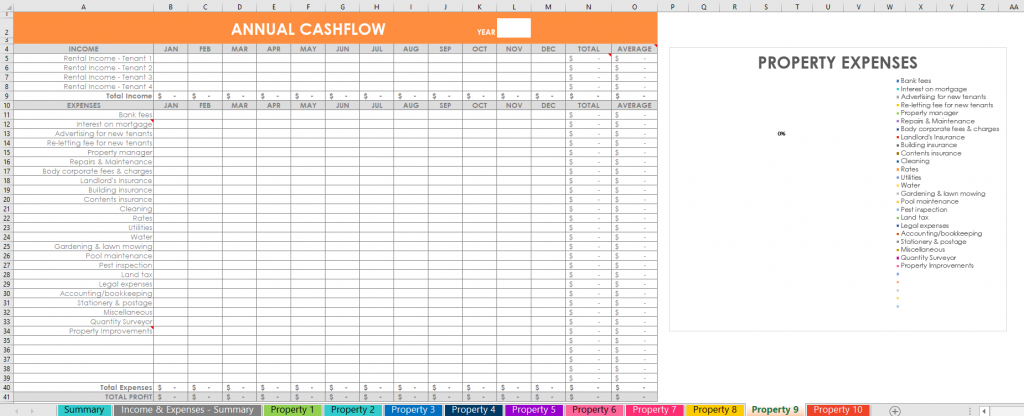

Australia’s property tax system includes council rates, which can get deducted within the year they got paid, taking note that the claim covers only the periods the property got rented. Rental property expenses are deductions (from your taxable income) of expenses relating to the owning and operating a rental property. Work out what expenses you can claim as deductions.

Work out if you need to pay tax instalments throughout the year. There are broadly two types of rental tax deduction: From the day you first purchase a property for rental, you will have tax deductions.

If you rent at below market rent (to family or friends perhaps), you can only claim deductions up to the amount of rent charged. Under the terms of the lease, your tenant does not have to pay this bill. Deductions are generally be spread over a period of 25 or 40 years.

This can be extended to overseas or interstate rental properties, but some apportionment of expenses will be required if part of the purpose of travel is for a holiday. Many, but not all, of the expenses associated with rental One of the first pieces of information you will receive is a settlement statement from your conveyancer, this will have the purchase price of the property stamp duty and pro.

The lion�s share of the available tax deductions is generally the interest portion of a mortgage connected with the property. 1 day agoincome from rental properties is taxable; You can generally claim an immediate deduction in the current income year for:

Rental property owners are entitled to a tax deduction whenever they travel to inspect their rental property. So all paperwork needs to be kept. You can deduct the expenses if they are deductible rental expenses.

Come tax time, you must have already spent money on these purchases to qualify. To understand what the process is for hiring or selling vacant land, go to the property information. 1.2 interest claims interest paid on the loan used to purchase the property is deductible, provided that all the money borrowed was used to purchase the property.

If you did not own the property you would not incur the expense. When you rent a property, you can deduct land and building taxes. Some of the main types of expenses you can claim include management/maintenance costs, borrowing expenses and depreciation.

Total taxable rental profits equal the taxable profit your rental income. Rental properties 2021 ato.gov.au 3 rental properties 2021 will help you, as an owner of rental property in australia, determine: Rent income is defined as allowed expenses, and profit profit equals rental income.

Tax your current year now. And there are lots of them! Consider the capital gains tax implications if you sell.

In addition to mortgage interest, you can deduct origination fees and points used to purchase or refinance your rental property, interest on unsecured loans used for improvements and any credit card interest for purchases related to your rental property. Property management and maintenance expenses advertising for tenants (whether it’s directly paid by you or charged by the real estate agent) body corporate fees strata title fees and charges cleaning gardening and lawn mowing pest control security patrol fees 2. For example, your tenant pays the water and sewage bill for your rental property and deducts it from the normal rent payment.

These include major renovations and building extensions. The ato states that investment expenses can be claimed as tax deductions as long as they are used on parts of the house that are treated as an investment property. However, it does not mean all of the money collected by your tenants is taxable either.

The overall tax result of a negatively geared property is a net rental loss. How is tax calculated on rental property? For example, if you pay insurance on your rental property, it is an expense you pay to earn income from the property.

Lastly, look at your tax rate. The second way is to deduct your personal allowance. Borrowing expenses you can�t claim.

Property owners can claim capital works deductions for the costs of structural improvements done on a rental property. Works out the number of days between 3 july 2014 and 30 june 2015 (363) step 2: