According to the irs, take note that land can’t. Deductible expenses for rental property a landlord is allowed to deduct any reasonable expenses used in the conduct, maintenance and managing of her rental properties.

Over time, wear and tear lower the value of your.

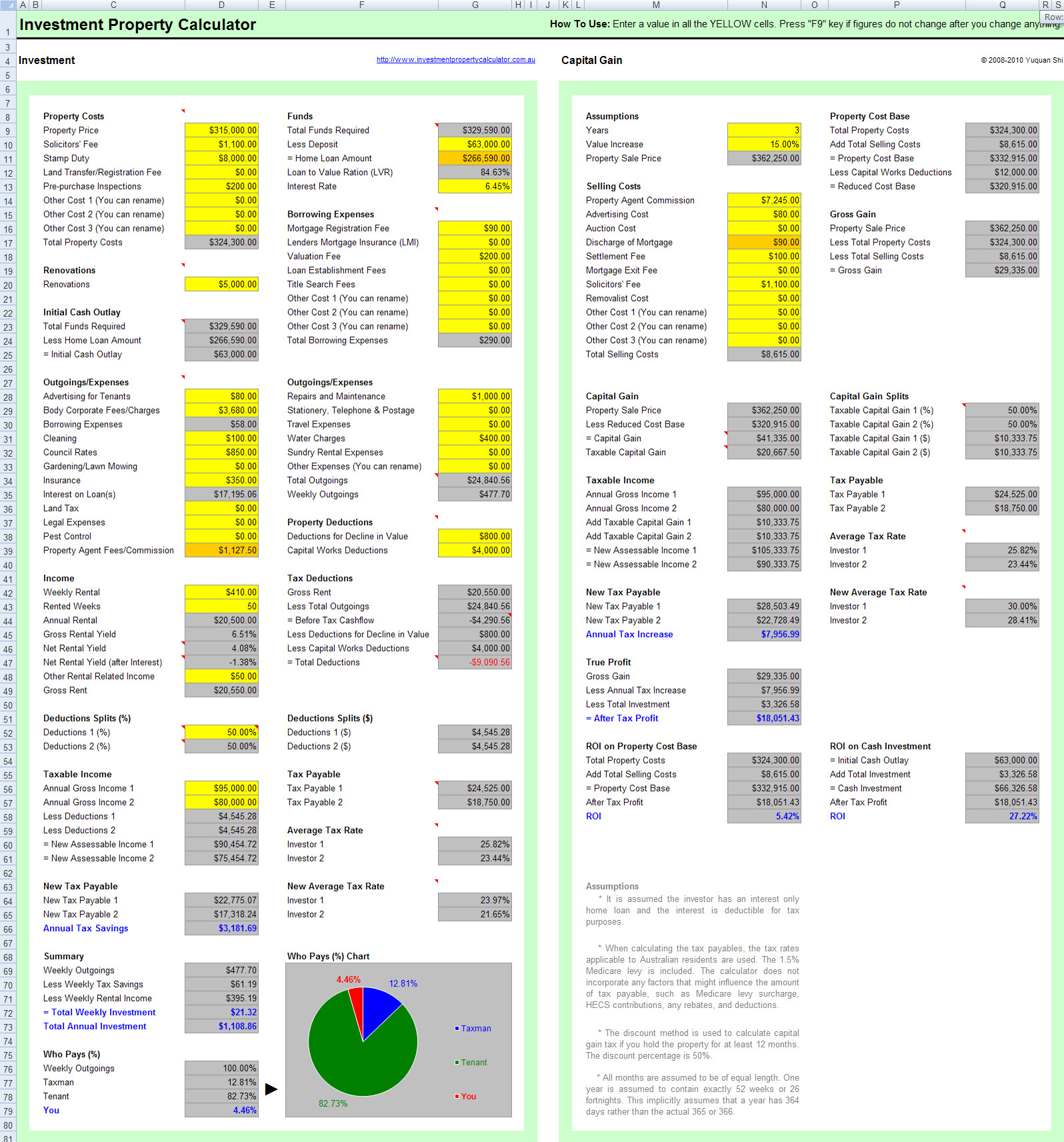

Tax deductions for rental property calculator. For rental properties, the useful life is 27.5 years, while the useful life of commercial property is 39 years. How to claim rental property tax deductions. Answer a few questions to get a free estimate of your 2022 tax refund.

For rental property owners, interest can be. If a rental property is used more than 50% of the time for commercial rental, there is no section 179 penalty. These expenses may include mortgage.

The landlord income tax calculator is designed to be intuitive to use, its all about making income tax easy to calculate and understand. If you receive rental income from the rental of a dwelling unit, there are certain rental expenses you may deduct on your tax return. Answer a few questions to get a free estimate of your 2022 tax refund.

For the 2021 tax year, the rate is 56 cents per mile and for the 2022. This calculator will help you to estimate the tax benefits of buying a home versus renting. Here are the top 8 rental property tax deductions that landlords can take advantage of.

Ad our free tax calculator is a great way to learn about your tax situation. So, if your asset is valued at $300,000 and the cost of your land is $100,000, subtract the. Be 100% confident filing your taxes this year when you file w/ turbotax®.

This basic investment property calculator (free for personal use) is built based on ato rental property spreadsheet. The easiest way to calculate mileage tax deductions is by using the standard mileage rate set by the irs. Even if you’re running your rental property business out of an apartment that you rent, you’re still able to take this deduction.

In general, you should file rental property tax deductions the same year you pay the expenses using a schedule e form. Calculator use use this calculator specifically to calculate depreciation of residential rental or nonresidential real property related to irs form 4562 lines 19 and 20. You can take this deduction by calculating the expected lifespan of the property.

For example, if you own a rental property that. Ad our free tax calculator is a great way to learn about your tax situation. Get your max refund today.

^ 27.5 year straight line depreciation. The short version is that landlords can deduct 20% of their rental business income from their taxable business income amount. Over time, wear and tear lower the value of your.

Rental property tax deduction worksheet rental property tax deduction worksheet use this worksheet to easily calculate your total rental property tax deductions. Your tax deduction may be limited with high gross income. The deduction can then be taken over multiple years.

Deductible expenses for rental property a landlord is allowed to deduct any reasonable expenses used in the conduct, maintenance and managing of her rental properties. Ad free for simple tax returns only with turbotax® free edition. Depreciation is based on the value of the building without the land.

For your convenience current redmond mortgage rates are. The calculator allows you to apply expenses to. Home loan tax benefit calculator.

According to the irs, take note that land can’t.