Turbotax® premier makes it easy to import, upload, and accurately report your investments. The deduction can then be taken over multiple years.

Here are the basic rental property tax deductions in canada.

Tax deductions for rental property canada. Advertising that tries to attract people to your rental property. Although this may not make up for the lack of income, it is a beneficial silver lining. Generally, interest is the most lucrative deduction for landlords.

The specifics on how to keep your taxes minimal will depend on the property, income generated and expenses available to deduct. Travel expenses do you need to travel a lengthy distance in order to visit your rental property? A guide to rental property tax deductions in canada advertising.

Here are the basic rental property tax deductions in canada. These expenses may include mortgage interest, property tax, operating expenses, depreciation, and repairs. Brought to you by stessa, the free financial tool for landlords.

The cra also clarifies when during the financial year these deductions must be made. If you receive rental income from the rental of a dwelling unit, there are certain rental expenses you may deduct on your tax return. Well, if you paid the average amount for property tax in ontario (approximately $2,281), you’d be able to deduct $570.25 from the rental income that you generated.

You cannot deduct the cost of the property when you calculate your net rental income for the year. Rental property was available for rent for up to two years at a time, so you may deduct its property taxes. Claiming expenses on rental properties.

Ad turbotax® makes it easy to get your rental taxes done right. Come tax time, you must have already spent money on these purchases to qualify. Also, you can include the money you may have paid as a finder’s fee as part of the deductions.

All rents collected from a specific property make up your gross rental income. The deduction is called capital cost allowance (cca). Advertising expenses you can deduct all property advertising costs, including the cost of advertising your property on canadian radio stations, newspapers, and televisions.

Do you know what rental property tax deductions apply in canada, and what to do when tax season comes around? Please contact the association of homes and land administrators to find more about vacant. Your rental property can be deducted from your property taxes for its location on land and building.

Did you pay any insurance premiums towards its coverage? If you advertise your rental property in magazines, newspapers, websites, and other similar places, go. Advertising if you advertized your rental property on magazines, newspapers, websites, and other similar places, go ahead and claim a tax deduction for all the fees you paid towards the same.

Rental expenses you can deduct advertising. The normal deductions on rental income here is a list of the other things you can deduct according to the canada revenue agency: At the end of the month, you usually expect some rental income, and come tax time, the authorities expect you to declare all of it.

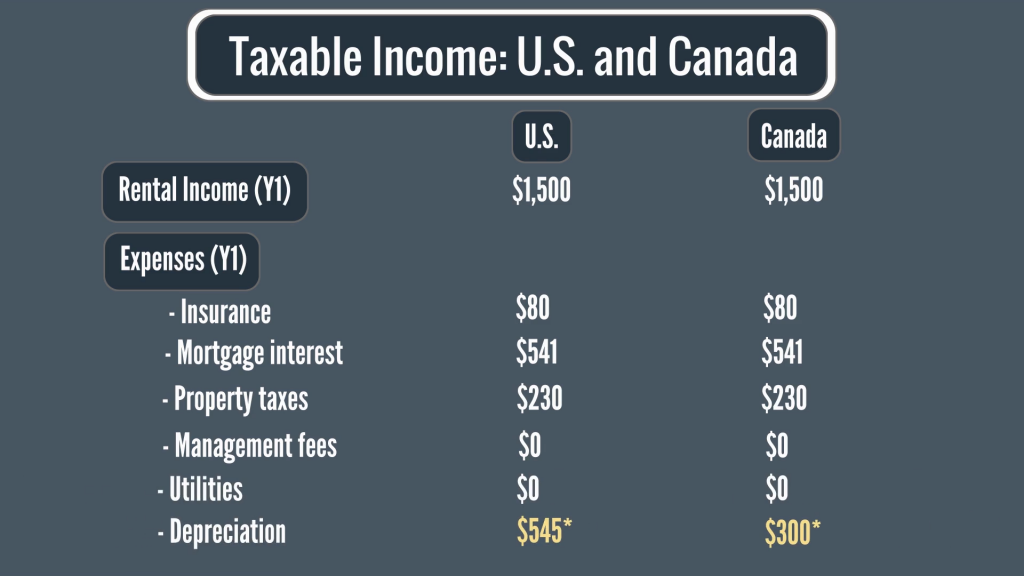

The rental income remaining (if any) is what you pay tax on. So you don’t need to have any tenants yet. Examples are always a great way to highlight the significance of these typically unclaimed tax deductions.

You can deduct capital cost allowance against the rental income to reduce your taxable income to zero if you have enough undepreciated capital cost remaining. You can deduct the premiums you pay on your rental property for the current year. Tax payments, insurance premiums, condo fees, utilities, and advertising are commonly included in the list of deductible expenses.

Below is a list of rental property tax deductions in canada that you can go ahead and claim right now. Be sure to get a month end report of your property and its expenses. You probably own one or several rental properties in canada or rent out a few rooms in your home.

Forms and publications report a problem or mistake on this page The canada revenue agency (cra) has made the deductions for meals a veritable minefield. If your answer is yes.

Is your property (s) insured? You can deduct expenses for advertising, including advertising in canadian newspapers and on canadian. Yet another recurring expense related to the maintenance and upkeep of your rental.

This should be done on form t776. Typically, cra views any meal or accommodation expense in relation to the rental property as a personal. In the statement of real estate rentals schedule, you will deduct all of your expenses from your gross rental income.

$4,300 (on $146,000 at 3% over 20 years) Ad download our free 2022 tax guide for landlords & maximize your deductions. You can take this deduction by calculating the expected lifespan of the property.

Rental income rates and common deductions in alberta range from 25% to 48%. Some expenses can be deducted in full if it is spent to maintain the rental property, these expenses are called current. The deduction can then be taken over multiple years.

Turbotax® premier makes it easy to import, upload, and accurately report your investments. Your insurance on the property. In addition to mortgage interest, you can deduct origination fees and points used to purchase or refinance your rental property, interest on unsecured loans used for improvements and any credit card interest for purchases related to your rental property.

Expenses that qualify for tax deductions on rental property in canada the cra establishes exactly which expenses can be deducted from your rental income. Visit defining the pattern for residential building soft costs if you are interested in finding out more. However, since these properties may wear out or become obsolete over time, you can deduct their cost over a period of several years.