If a rental property is used more than 50% of the time for commercial rental, there is no section 179 penalty. A property that received its code compliance certificate after march 27 this year will be eligible to deduct interest for up to 20 years from the time the property�s code compliance certificate was.

Come tax time, you must have already spent money on these purchases to qualify.

Tax deductions for rental property nz. You’ll be entitled to claim a deduction for the costs of acquiring and improving that property at the time it is sold. The residential land withholding tax (rlwt) should be deducted at. 21 tax deductions for landlords 1.

The government is consulting on the design of these Come tax time, you must have already spent money on these purchases to qualify. There are 25 main rental property deductions that most real estate investors can take to reduce taxable net income.

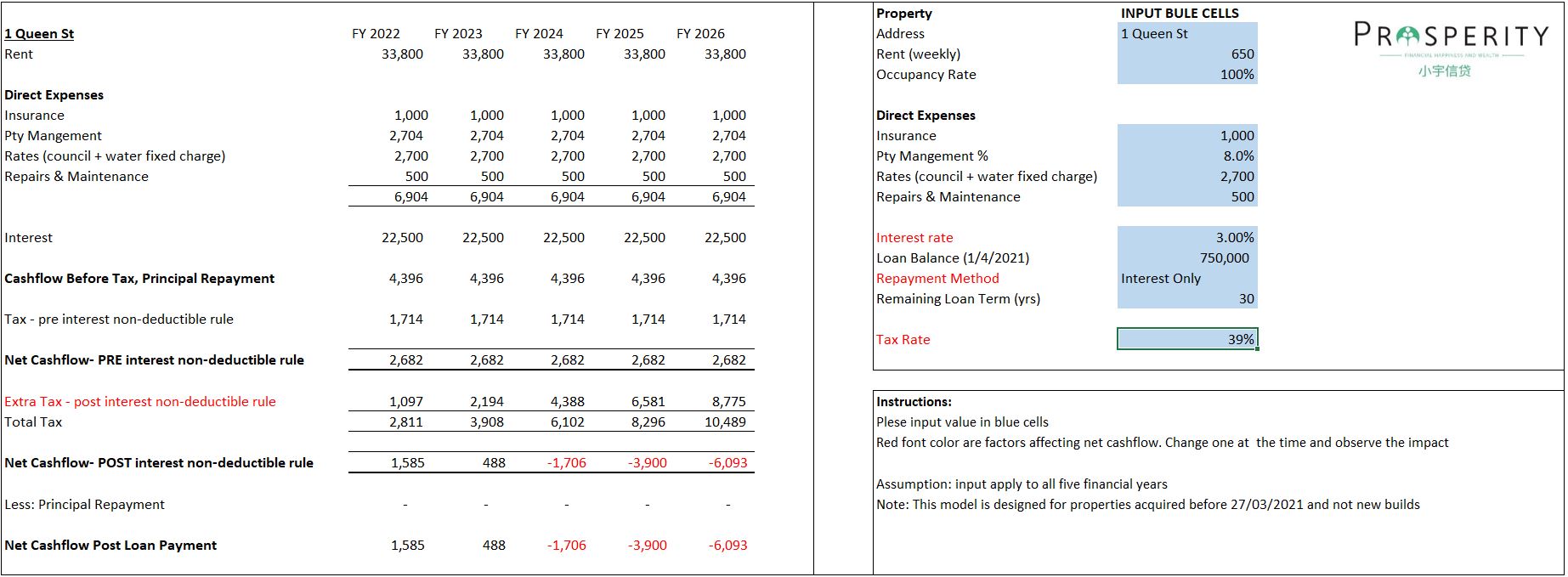

Trying to claim for every little item No interest deductions for residential rental property acquired on or after 27 march 2021 and for already acquired properties a phase out of interest deductions over four years. Full information on when a property is acquired is found in qb 17/02 on taxtechnical.ird.govt.nz.

With our experience in rental property accounting, our team will ensure you’re not paying more tax than you need to. Many new zealand landlords got a bit of a fright on 24 march 2021 when the government announced the new housing policy for property investors. For tax purposes, a property is generally acquired on the date a binding sale and purchase agreement is entered into (even if some conditions still need to be met).

Turbotax® premier is the resource needed to file your investor taxes easily & confidently. Intuitively that should also include any interest costs, but this is. Payments to agents who collect rent, maintain your rental, or find tenants for you;

The rates for the property; Nor can you claim a tax deduction on putting the house back in order after a tenancy and before you sell it, despite the fact the tenants have caused the damage. Rental property insurance & rent default insurance 12.

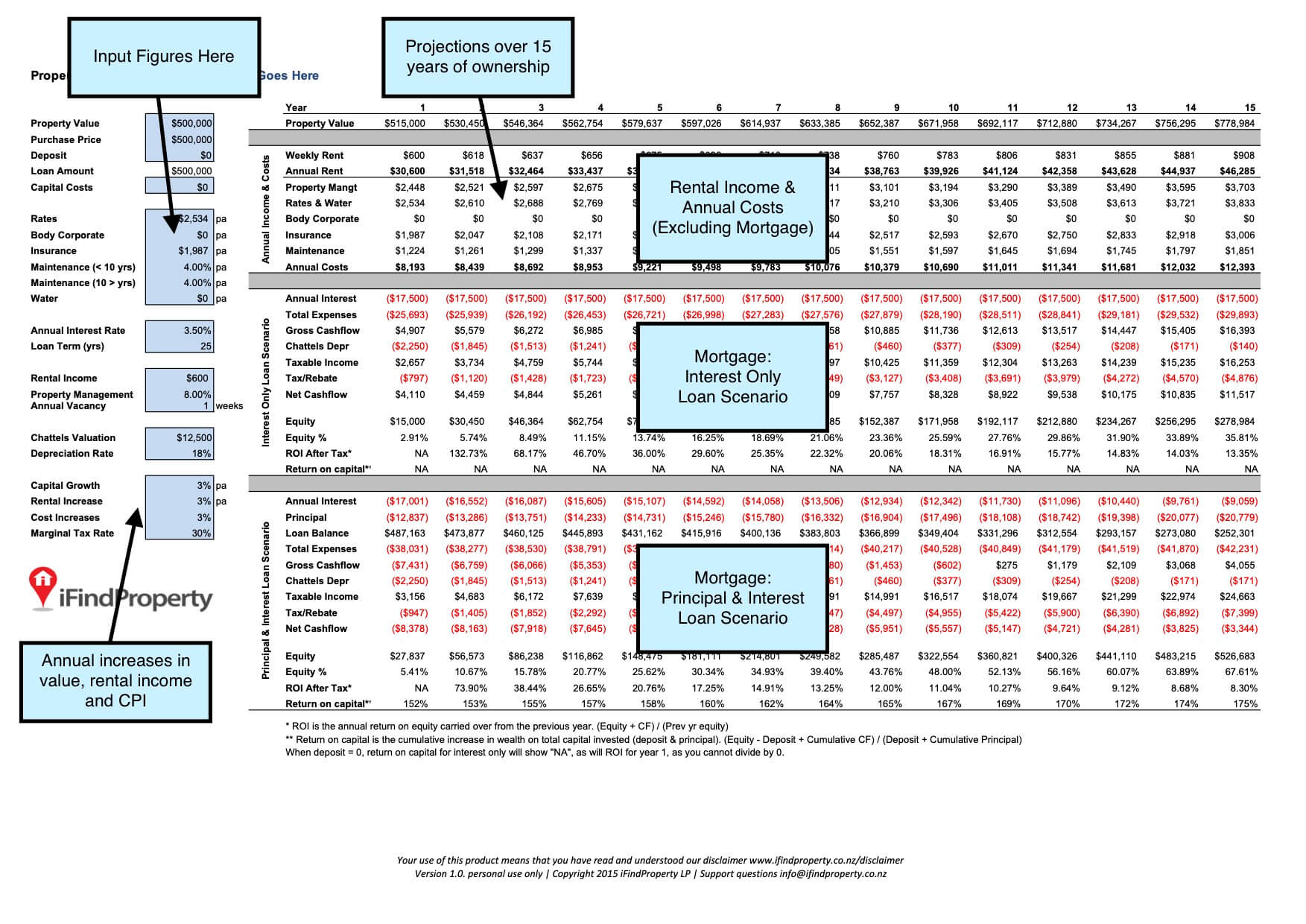

Maia owns a rental property valued at $500,000. Fees paid to an accountant for managing accounts, preparing tax returns and advice; You can claim deductions up to the amount of rental income you earn in a year (including income from the sale of a property).

The cost of insuring your rental property; Tax deductions are a vital aspect of owning a rental property. Just take one of these statements and find your monthly interest payment area.

Generally, you work out what tax there is to pay by deducting your allowable rental expenses from your gross rental income. Then, multiply this figure by 12, and this is the amount you can deduct. The way you work out income and expenses is not the same for all residential property.

Rental property deductions are available for necessary expenses for managing and maintaining a property. In addition to mortgage interest, you can deduct origination fees and points used to purchase or refinance your rental property, interest on unsecured loans used for improvements and any credit card interest for purchases related to your rental property. Ad we�ll search hundreds of tax deductions to get every dollar you deserve.

Expenses may be deducted for items such as normal operating expenses, owner. To guarantee you claim all the tax deductions you are entitled to, talk to the team at tax link hamilton. The expenses you can deduct from your rental income are:

A property that received its code compliance certificate after march 27 this year will be eligible to deduct interest for up to 20 years from the time the property�s code compliance certificate was. Losses from theft or casualty 2. Furthermore, any origination fees, credit card interest, and refinancing your rental property are.

Because rental deductions can now only be claimed against rental income, you can no longer offset excess deductions against other income such as salary or wages. A recent announcement from the new zealand government has changed the landscape with regards to property tax, read more about it on this article. Expenses deductible from your rental income include mortgage repayment insurance accounting fees for the preparation of accounts for your northland rental property taxes rates and insurance depreciation (but not building depreciation).

If a rental property is used more than 50% of the time for commercial rental, there is no section 179 penalty. She secures a $200,000 loan against her rental property to buy a food truck and other equipment to start a business. You can only claim repairs and maintenance costs if they were carried out when the tenants were living there or the house was available to rent.

Your total allowable rental expenses and total rental income you earn go in the tax return you must fill in every year. Property acquired on or after 27 march 2021. Maia will be allowed to claim interest charged as an expense on her $200,000 business loan.

While it’s not always possible to completely avoid paying tax on rentals, here are three simple strategies to minimize rental property tax.