In addition, any advertising fees are fully deductible. This deduction is a special income tax deduction, not a rental deduction.

12 rental property tax deductions.

Tax deductions for rental real estate. If you own rental real estate, you should be aware of your federal tax responsibilities. If you receive rental income from the rental of a dwelling unit, there are certain rental expenses you may deduct on your tax. Tax deductions for rental properties the sticky subject of investment interest.

The tax deduction come limit applies to those who make more. Brought to you by stessa, the free financial tool for landlords. Tips on rental real estate income, deductions and recordkeeping.

12 rental property tax deductions. In addition, any advertising fees are fully deductible. Qualified business income deduction (qbid) for tax years 2018 through 2025, you may be able to deduct up to 20% of qualified business income (qbi) from each of your qualified.

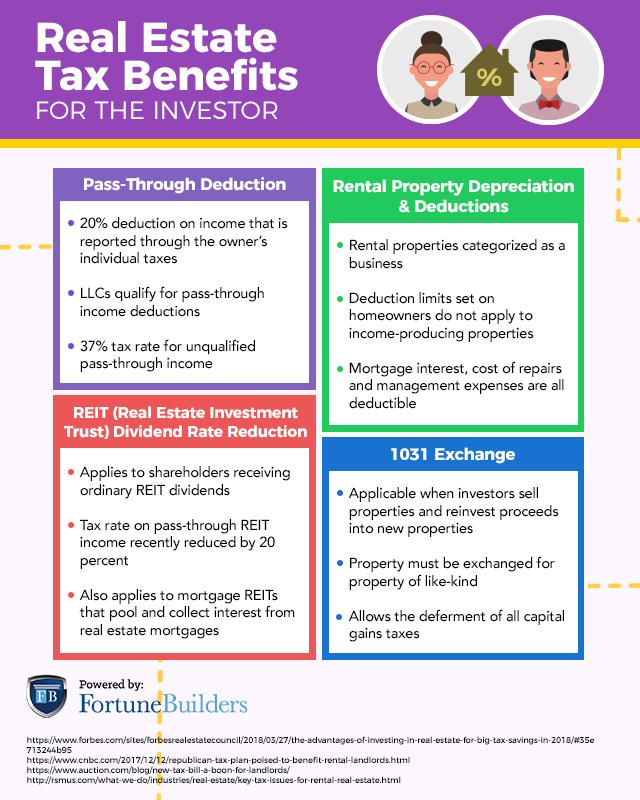

Depending on their income, landlords may be able to deduct (1) up to 20% of their net rental income, or (2) 2.5% of. Real estate by income deduction so, if you are making $100,0000 or less, you can write off up to $25,000 a year in passive rental real. This safe harbor is available for taxpayers who seek to claim the section 199a deduction with respect to a rental real estate enterprise. solely for purposes of this safe.

Brought to you by stessa, the free financial tool for landlords. Rental property owners can deduct the costs of owning, maintaining, and operating the property. The 20% qbi deduction under sec.

Expenses may be deducted for items such as normal operating expenses,. Patch, mend, and make do—don�t replace. Rental property depreciation represents one of the single greatest tax benefits made availed to today’s real estate investors.

You pay $3,000 in real estate tax, $5,000 in mortgage interest, and. Unlike conventional investors who may invest in real estate as a side gig to. This deduction is a special income tax deduction, not a rental deduction.

Even landlords who hire advisors can write off the fees paid to those. Here are some of the most important rental property tax deductions for rental property owners to claim when tax season comes around. For example, let’s say you have a rental property that generates $1,000 per month in rent, so $12,000 per year.

A replacement is almost always an. There are 25 main rental property deductions that most real estate investors can take to reduce taxable net income. If a rental property is used more than 50% of the time for commercial rental, there is no section 179 penalty.

Here are additional deductions real estate investors with rentals may be able to take as well: One tax benefit of being a real estate agent and owning rental properties is rental property losses. Ad download our free 2022 tax guide for landlords & maximize your deductions.

Depending on your rental property’s location, they can range anywhere from a. There is no law that says that if something in your rental property is broken it has to be replaced. Repairs and maintenance insurance property management fees supplies utilities (oil, gas,.

Most residential rental property is depreciated at a rate of 3.636% per year for. Ad download our free 2022 tax guide for landlords & maximize your deductions. 199a introduced by the law known as the tax cuts and jobs act, p.l.

Tips on rental real estate income, deductions and. If you own a rental property, the irs allows you to deduct expenses you pay for the upkeep and maintenance of the property, conserving and managing the property, and other. Tax write off for rental property #1:

Almost every state and local government collects property taxes.