Learn the key issues retirees face & strategies you can use to avoid mistakes. A charitable contribution of a remainder interest in a home, vacation home, or farm.

Contributing to a regular ira after taxes would.

Tax deductions for retirement. Learn the key issues retirees face & strategies you can use to avoid mistakes. Pension and annuity income general pension and annuity exemption the income tax on pension and annuity income for taxpayers. Ad turbotax® makes it easy to get your taxes done right.

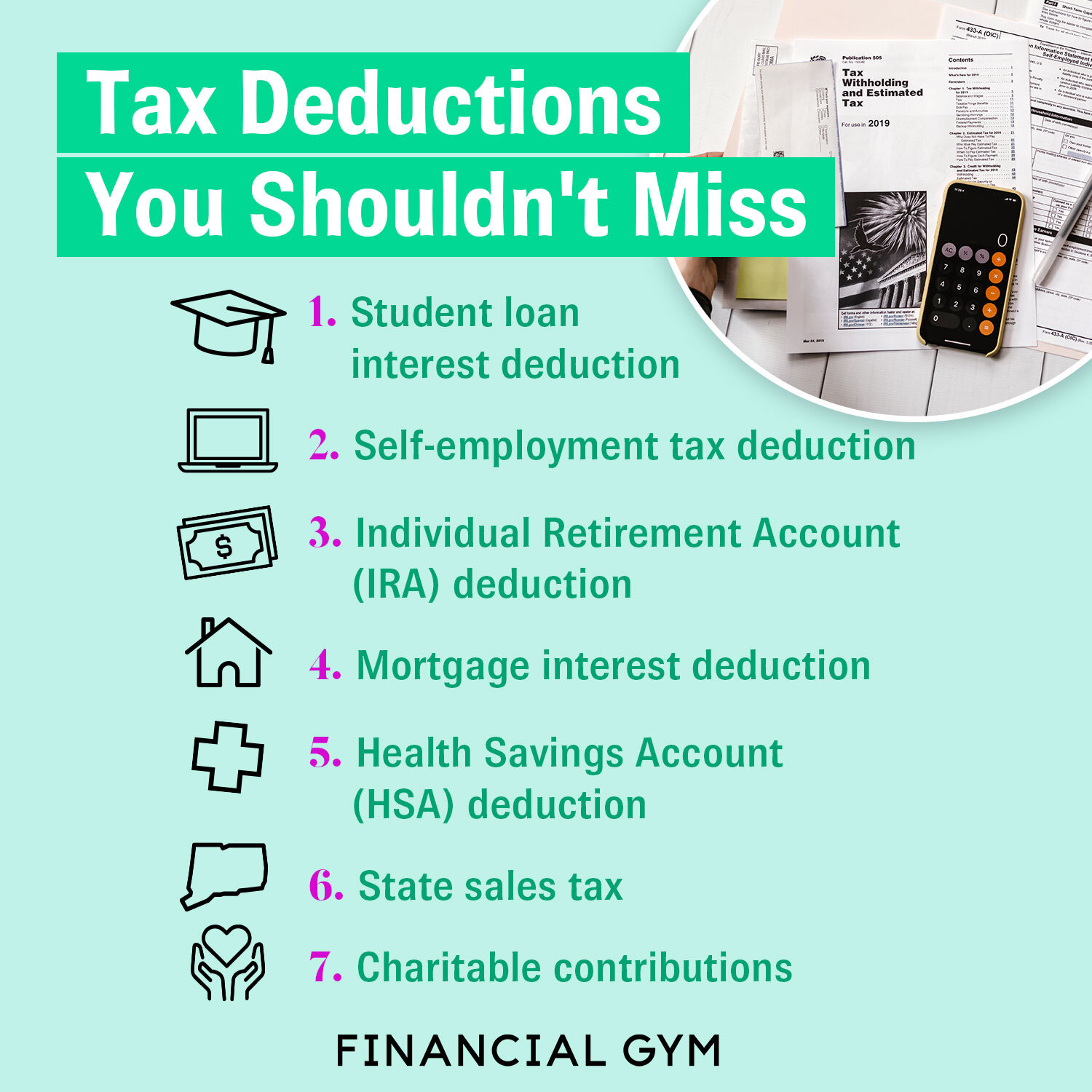

Nonetheless, it can also include parking, car insurance, and maintenance fees. For owners of sole proprietorships, partnerships, s corporations, and certain trusts, estates, and limited liability companies (llcs), this deduction provides a great benefit. If you contribute $2,000 to a regular ira and are eligible for the maximum $2000 tax deduction, your tax savings will be $2,000 x 30%, or $600.

This is true for anyone, whether. For one, you can contribute as much as $57,000 for those under 50 or $63,500. Independent living monthly deduction is 38%.

At least one of these tax benefits can be reaped without giving up any cash or property: More than $198,000 but less than $208,000. If your medical expenses over the course of a tax year exceed 7.5 percent of your adjusted gross income (agi), you can deduct that difference.

Contributing to a regular ira after taxes would. 9 rows a full deduction up to the amount of your contribution limit. Washington — the internal revenue service reminds taxpayers they may be able to claim a deduction on their 2021 tax return for contributions to.

Answer simple questions about your life and we do the rest. If you are a sole proprietor, a partner in a. That $6,000 or $7,000 is the total you can deduct for all contributions to qualified retirement plans in 2021 and 2022.

For 2021 you may subtract all qualifying retirement and pension benefits received from public sources, and may subtract private retirement and pension benefits up to $54,404 if single or. Learn the key issues retirees face & strategies you can use to avoid mistakes. A charitable contribution of a remainder interest in a home, vacation home, or farm.

1 having a 401 (k) account at work doesn�t affect your. The question taxpayers often ask is what portion of the fees paid to retiree communities, such as.