Tolls are indeed tax deducible. And whichever type of deduction you claim, it�s critical that you keep thorough records.

The first question every rideshare and food delivery driver wants to know:

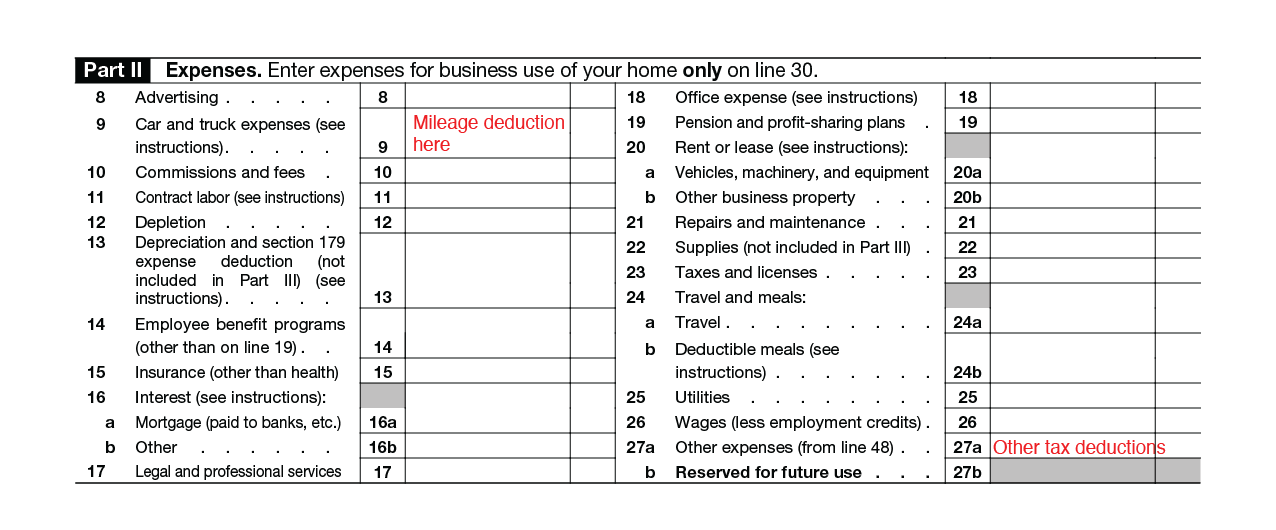

Tax deductions for ride sharing. Did you buy something to help keep your ride clean for customers? The expenses you incur in the course of a side hustle may be tax deductible. There are a number of apps you can use to help you accurately record your rideshare driving expenses as well, saving you a lot of time and stress as april 15th rolls around.

Tolls are indeed tax deducible. If you used stride to track your mileage, the amount is listed at the top of your stride app mileage and expense report. What tax deductions can i claim for uber?

As of 2019, the irs allows you to deduct $0.58 per mile driven on a vehicle for business purposes, but in order to do this, you must keep detailed records. At the end of the year, you will receive a form 1099 showing the gross earnings of your rideshare. They offer a ‘self employment’ tax filing program as well.

That’s also why you’ll file taxes as an independent business owner when tax season rolls around. Use these tax tips to navigate your way through filing your. Almost anything you pay for that is necessary to conduct your rideshare business can be written off as a deduction.

Your etax accountant will quickly help you work out how much you can claim, if you’re not sure. This can include costs related to maintaining or operating assets, such as a car or mobile device. A few car related expenses you could claim.

That said, if this is your first time claiming business expenses related to a side hustle, you may want to consider hiring a tax professional for help filing your. When you’re a driver for lyft, the most important thing to understand is that ridesharing drivers are independent contractors, not employees. If you claim a goods and services tax (gst) credit for gst paid on an expense, you can only claim the remaining amount (the total cost minus gst) as an income tax deduction.

If you exclusively use music apps and other paid apps for your ride share business then those subscription costs are deductible. The ultimate guide to graphic designer tax deductions. The irs could disallow any tax deductions you can�t support with:

You can deduct your gas costs as long as its business related. Multiply your total mileage by $0.575 to find the tax deductible amount. Get the free stride app.

You will need to keep a logbook to claim all these running expenses and you can claim only the ride sharing percentage. And if you play your cards right when filing your taxes , you may be able to eke out even more savings. The first question every rideshare and food delivery driver wants to know:

Tax deductions for uber drivers. Car washes, car repairs, passenger amenities, and cellphone bills can all be tax deductible for rideshare drivers. Claim the deductions you�re entitled to.

This is tax deductible because it is a business expense! This may include car payments, insurance, dmv registration fees, etc. Water, gum or snacks for passengers tolls and parking fees

The deduction should be limited to the percentage used for business. Up to 25% cash back your rideshare company will probably directly deduct the commissions you pay to drive for them right from your check. That’s why lyft doesn’t withhold taxes from your rideshare payments.

Many expenses related to your job as a ride sharing driver are claimable as a deduction on your tax return. This means that you can deduct gas costs that you incur while picking up customers and driving them to their destinations. Tax, taxes, taxes aly keller november 29, 2020.

Turbotax is one of the most popular tax filing programs and with good reason. If you make more than $600 in one year as a driver for any ridesharing company, the companies will send you a 1099 tax form. And whichever type of deduction you claim, it�s critical that you keep thorough records.