As with every profession, there are ways to reduce your annual tax bill each year. For simplicity�s sake, it may make sense to have a dedicated phone for work.

Here are four you may be eligible to claim.

Tax deductions for ride sharing drivers. At shared economy cpa, we’ve had the opportunity to help hundreds of rideshare drivers with their taxes and finances.from this, we’ve seen common issues that individuals face from a tax and financial perspective. 13 critical tax deduction tips for rideshare drivers (2020 update) 1. Similar to passenger goodies, only 50% of the cost for these items can be deducted.

Up to 25% cash back photo credit: For these reasons alone, we’ve teamed with shareable to provide you. Deductions for the standard mileage rate.

Your cell phone holder, charger, aux cord, and any other accessories that are ordinary and neccessary to run your rideshare business are all tax deductible. Alan cleaver via foter.com / cc by. Driving rideshare, your car gets really dirty with so.

What tax deductions can i claim for uber? • water, gum or snacks for passengers Meals that you purchase while recruiting other drivers are also tax deductible.

For simplicity�s sake, it may make sense to have a dedicated phone for work. A few car related expenses you could claim. This means that you can deduct gas costs that you incur while picking up customers and driving them to their destinations.

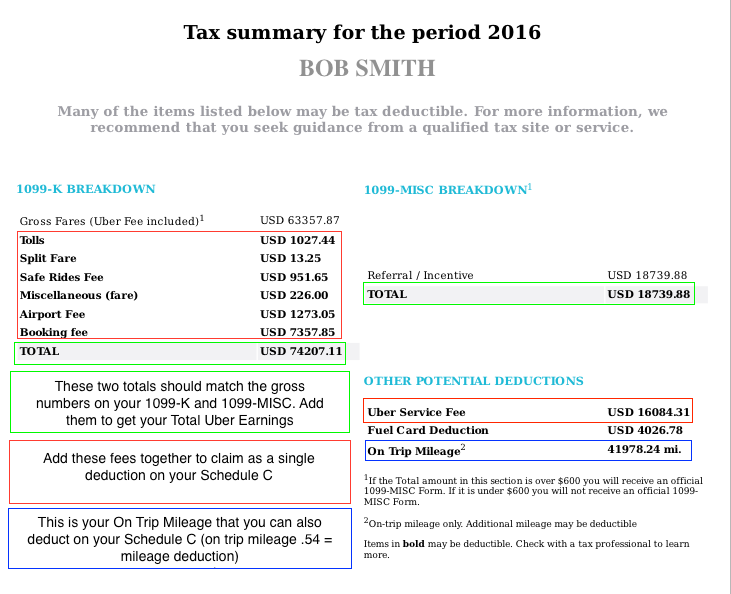

You drove 5,000 miles and paid $300 in tolls and parking fees. Most drivers will end up with a higher deduction using the. For example, you can easily put over 500 miles on your car for the week.

Drivers try to deduct personal expenses a lot of rideshare drivers ask us if they can deduct expenses like charitable contributions, student loan interest, and health insurance. They offer a ‘self employment’ tax filing program as well. If you are not tracking your miles, you are leaving money on the road.

Yes but not as a business expense! Rideshare companies have referral programs that reward drivers with cash bonuses when their driver referrals sign up to drive with uber/lyft. 9 can i write off my car payment as a business deduction?

Tax deductions for uber drivers. Keep a detailed mileage log. When it comes to taxes, tracking your mileage is an important part of being a rideshare driver.

As with every profession, there are ways to reduce your annual tax bill each year. Many expenses related to your job as a ride sharing driver are claimable as a deduction on your tax return. The first question every rideshare and food delivery driver wants to know:

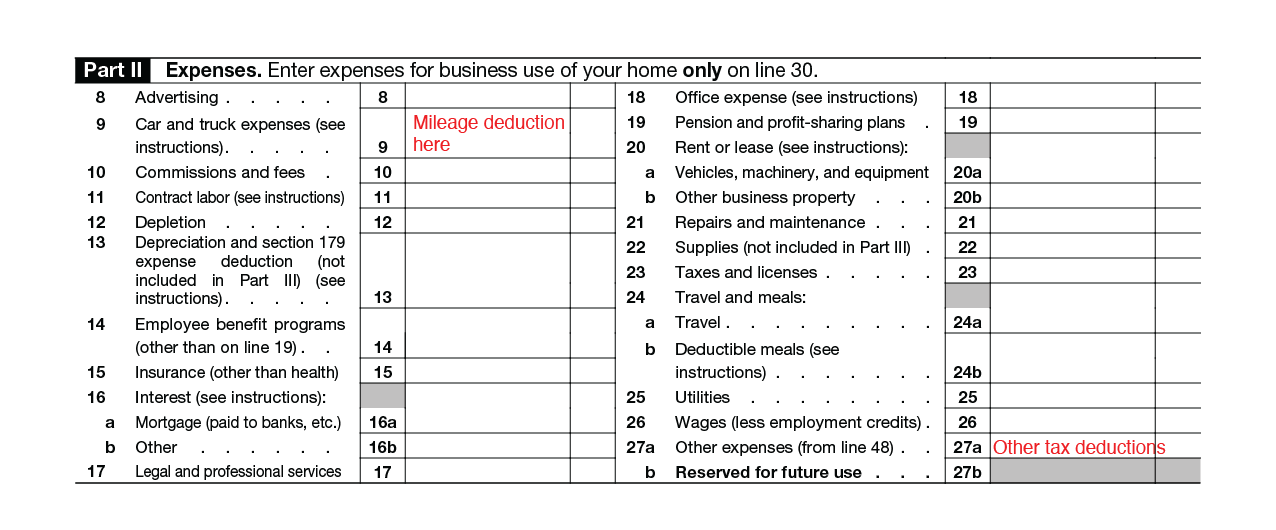

Turbotax is one of the most popular tax filing programs and with good reason. Here are four you may be eligible to claim. The mileage deduction enables you to write off a set dollar amount for every mile that you drive for business purposes.

You can deduct your gas costs as long as its business related. For the 2018 tax year, you may write off $0.545 for every mile you drove as. The standard mileage rate is often the best choice for rideshare drivers.

That could translate to a $290 deduction each week, which adds up to over $15,000 through the year. There are a ton of deductions that you can take as a taxpayer in general, even outside the scope of rideshare taxes. Although it’ll take a bit of your time, keeping a mileage log is imperative.

You can also include the amount you spent in tolls and parking fees. The irs expects independent contractors to pay their tax bill quarterly (in 4. The standard irs mileage deduction often results in a higher deduction, and it’s generally the easier option.

To calculate your deduction, multiply your total business miles by the irs rate. Tax deductions for ride sharing drivers.