It�s up to you to. Lucky for you, rideshare drivers enjoy loads of tax deductions including the following:

Phone & service if you have to use a phone for.

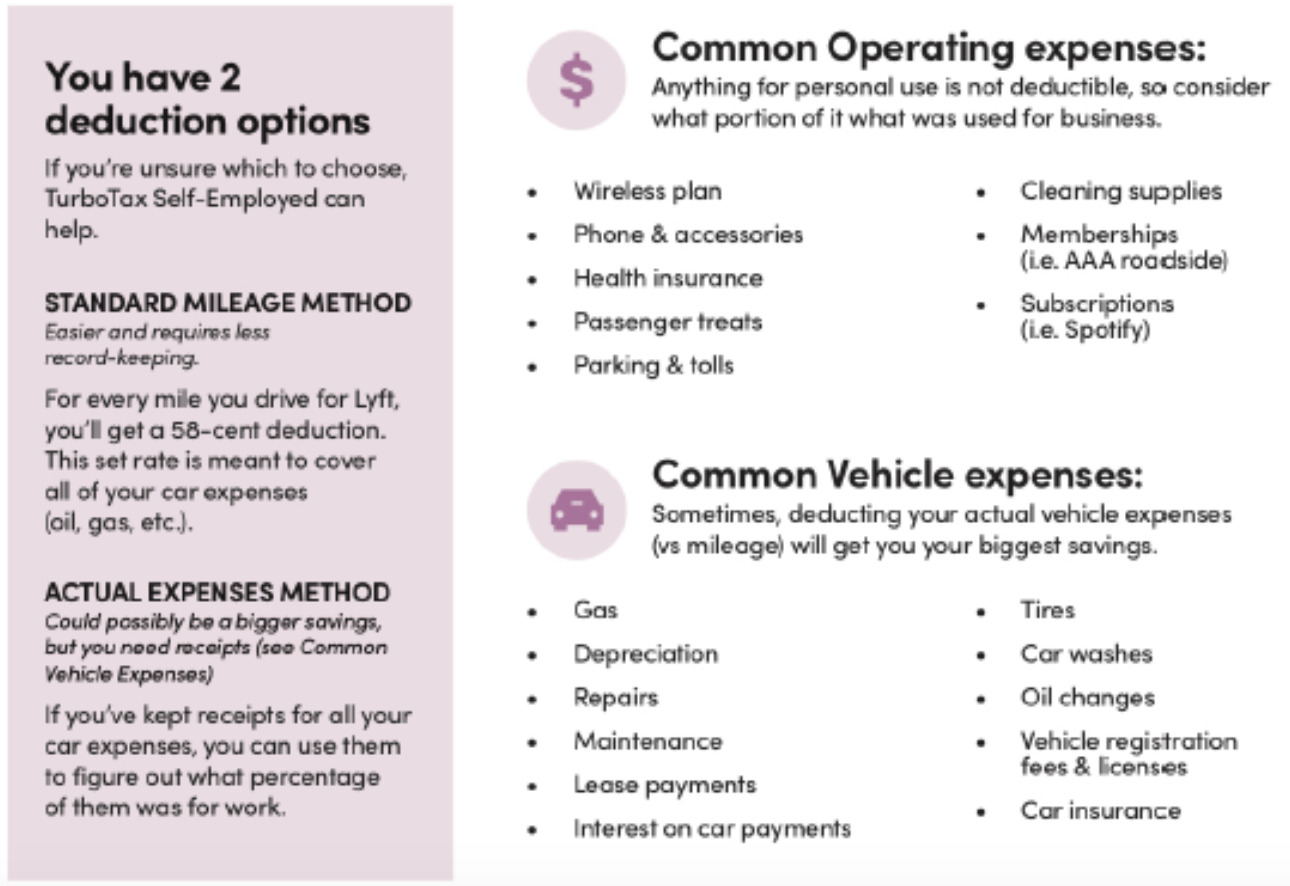

Tax deductions for rideshare drivers. Phone & service if you have to use a phone for. For example, you can easily. As a rideshare driver, you can claim a tax deduction for the miles you drive on the job.

If you are not tracking your miles, you are leaving money on the road. These include car chargers, phone mounts,. Turbotax is one of the most popular tax filing programs and with good reason.

The irs allows you to report and claim all of the specific fuel and maintenance costs associated with running. The easiest and most straightforward benefit, the mileage. Lucky for you, rideshare drivers enjoy loads of tax deductions including the following:

Your cell phone holder, charger, aux cord, and any other accessories that are ordinary and neccessary to run your rideshare business are all tax deductible. They offer a ‘self employment’ tax filing program as well. As a rideshare driver, you can deduct the complimentary goodies that you offer your passengers like bottled waters, mints and halloween candy.

If you earn income transporting strangers from point a to point b, chances are you’re already aware of the most common tax deductions for rideshare drivers: You may deduct up to 20% of your business income from your overall taxable income. When it comes to taxes, tracking your mileage is an important part of being a rideshare driver.

It�s up to you to. Rideshare driver tax deductions mileage. As of 2019, the irs allows you to deduct $0.58 per mile driven on a vehicle for business purposes, but in order to do this, you must keep detailed records.

Mileage on your car, filling. The 1099 the companies provide you with if you earn more than $600 as a rideshare driver will reflect the amount that uber or lyft received for your rides. And for miles driven in 2020, this rate is $0.575 per mile.

If you use the standard mileage rate, you’ll deduct $0.575 per mile driven for business. To claim the deduction as a rideshare driver, your taxable income can’t be more than.