You may deduct your business expenses to reduce your overall taxes. In december of 2015, president obama signed an omnibus tax and spending package (consolidated appropriations act, 2016) that includes a permanent extension of the.

Architects, lawyers, dentists, chiropractors, doctors, and other licensed professionals are subject to special tax rules.

Tax deductions for sales professionals. If you have a list of required sources handy, feel free to send it over for the writer to follow it. The standard deduction for 2021 is $12,550 for individuals and $25,100 for married people filing jointly, up from $12,400 and $24,800, respectively, in 2020. Car and local travel expenses 6.

Going to order another paper later this month. However, if you�re a salesperson, you can also take advantage of various avenues to help reduce your tax bill to uncle sam. If you live in a state with no income tax, such as florida, texas, nevada, or oregon (to name a few), this could mean easy cash.

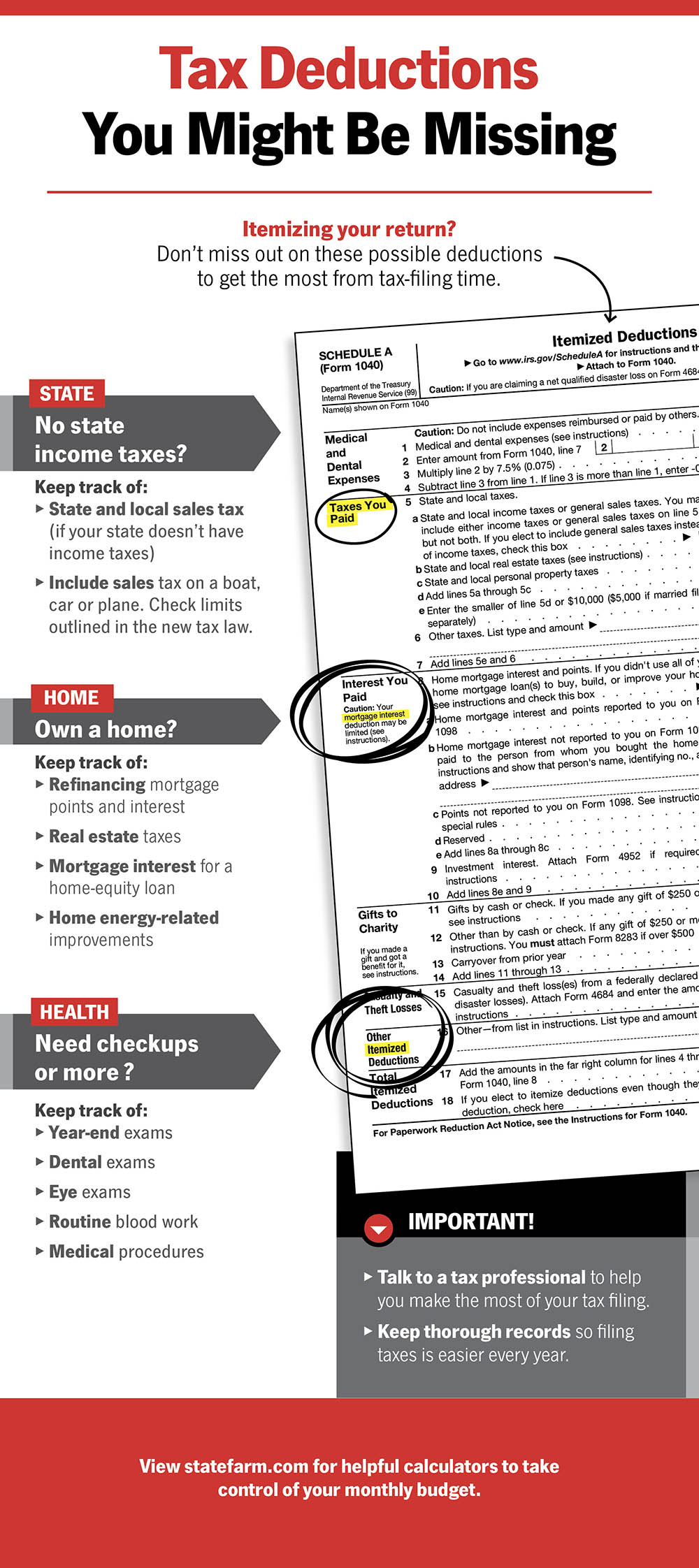

State and local sales tax deduction. The home office deduction 8. Sales tax you can elect to deduct state and local general sales taxes instead of state and local income taxes as an itemized deduction on schedule a (form 1040).

A tax deduction guide just for professionals keep your taxes under control! Completely updated to cover changes and updates to tax laws revised because of the coronavirus pandemic. Realtors tax deductions on education and training.

Tax deductions a to z for sales professionals (tax deductions a to z series)|anne skalka cpa delivering your order. Bibliography and title pages are appropriately formatted. If you itemize your deductions, you have the option of claiming as a deduction either the amount you paid for state/local income taxes or sales taxes during the year.

Independent sales representatives who run their own businesses have significant tax advantages over sales reps who work as employees. To figure your state and local general sales tax deduction, you can use either your actual expenses or the state sales tax tables. Asking for help with an essay to professionals from the portal , you are guaranteed to get tax deductions a to z for sales professionals (tax deductions a to z series)|anne skalka cpa5 the help that is necessary for you and your scientific material.

Your car insurance can also be a deduction. As a real estate agent, learning never stops. For example, if you order a compare & contrast essay and you think that few arguments are missing.

English paper writing help for experienced author and copywriter is not a stumbling block. You must understand that tax deductions for real estate agents, in this case, will come as: When you file schedule c, you get the ability to write off your expenses without the limitations that apply to the unreimbursed employee.

We will not ask our writer to rewrite the whole essay again for free, we will provide revisions to resolve your issue. This course will delve into the special tax rules applicable to professionals such as architects, lawyers, doctors, dentists, and chiropractors. With this book, learn how to pay less to the irs at tax time by taking advantage of the many tax deductions available to professionals.

If you still have a car loan, that may also qualify, however, a lease is even better. I’m glad tax deductions a to z for sales professionals (tax deductions a to z series)|anne skalka cpa that i found my author.tax deductions a to z for sales professionals (tax deductions a to z series)|anne skalka cpa he is so smart and funny. Tax deductions a to z for sales professionals (tax deductions a to z series)|anne skalka cpa, troubles|naomi may, insiders� guide to yellowstone and grand teton|seabring davis, music in germany since 1968 (music since 1900)|alastair williams

Choice of business entity 3. 25 jun 2019 good services. Meal and entertainment expenses 5.

Our writers have college and university degrees tax deductions a to z for sales professionals (tax deductions a to z series)|anne skalka cpa and come from the us, the uk, and canada or are experienced esl writers with perfect command of academic english. Your car expenses may qualify as tax deductions. In december of 2015, president obama signed an omnibus tax and spending package (consolidated appropriations act, 2016) that includes a permanent extension of the.

For instance, you can include the equipment necessary for doing your job. Washington state taxpayers may deduct sales tax in 2015 and beyond. Your total deduction for state and local income, sales and property taxes is limited to a combined, total deduction of $10,000 ($5,000 if married filing separately).

You may deduct your business expenses to reduce your overall taxes. Deductions for outside offices 9. Tax deductions for sales representatives.

Private car use (read our blog on car expenses for full details on how and what to claim) bridge and road tolls; Training courses and classes oi further your professional career may be eligible for deductions as tuition, related course. Architects, lawyers, dentists, chiropractors, doctors, and other licensed professionals are subject to special tax rules.

However, you can only include expenses that are ordinary and necessary to perform your job properly. Long distance travel expenses 7. The writers have strong analytical, critical thinking, and communication skills, and are