Purchase software, materials, or pay for advertising?keep your receipts, log your expenses, and. Do you travel to meet clients?

Private car use (read our blog on car expenses for full details on how and what to claim) bridge and road tolls;

Tax deductions for sales reps. The irs gives you two options: So, as an important tool for any sales rep, the monthly fee for sales navigator would be an expense that you could claim as a deduction on your return. Your auto expense is based on the number of qualified business miles you drive.

Include them as business miles. This means that $575, on average, is added to an employee�s salary every month. Your auto expense is based on.

Sales representatives deal with selling of goods to the customer. If you are a statutory employee, you�ll have to report your income on a schedule c. Tax deductions for sales people being a salesperson means you may receive commissions as much as your regular salary.

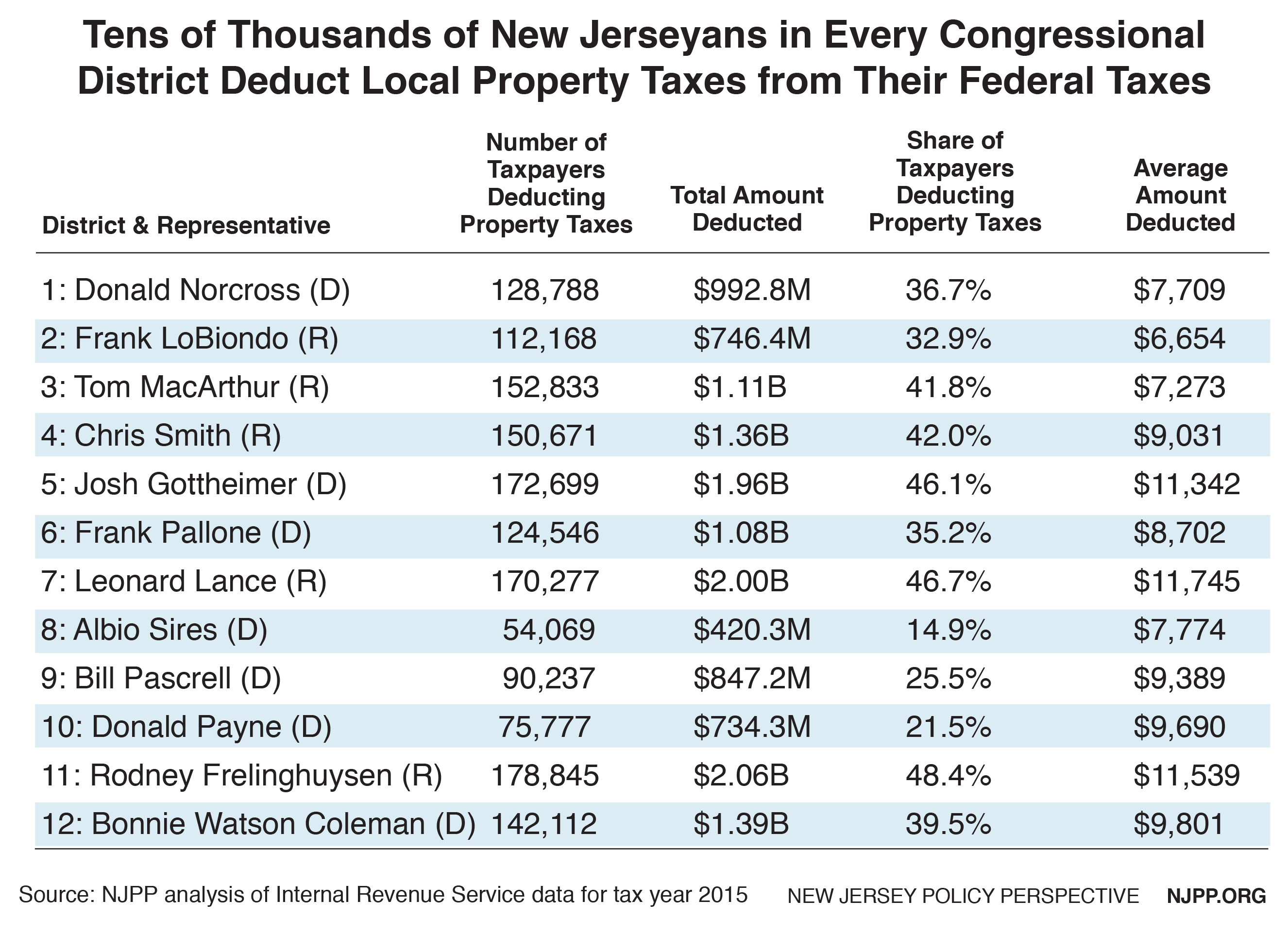

Your total deduction for state and local income, sales and property taxes is limited to a combined, total deduction of $10,000 ($5,000 if married filing separately). Purchase software, materials, or pay for advertising?keep your receipts, log your expenses, and. What that means is it will be even harder for sales reps to claim any itemized deduction that could somehow qualify:

The only major change is in the standard deduction. Expenses for travel between business locations or daily transportation expenses between your residence and temporary work locations are deductible; Sometimes there is confusion regarding the special set of tax rules that applies to direct sellers.

Tax deductions for sales reps. If the reimbursement by an employer is for the cost of a depreciable item (e.g., tools and equipment), a deduction is allowable to the employee sales representative for depreciation. Sales reps are still not allowed business expenses incurred out on the road.

Client samples and demonstration equipment. Normally using the log book method maximises the deduction. After paying social security and income taxes, the employee ends up with $393 per month.

Use your home as your office? From simple to complex taxes, filing with turbotax® is easy. Independent sales representatives who run their own businesses have significant tax advantages over sales reps who work as employees.

What does this mean when it comes to tax? When you file schedule c, you get the ability to write off your. If you work as a sales representative, sales or marketing manager, some of the tax deductions you may be able to claim on your personal tax return are:

You may deduct your business expenses to reduce your overall taxes. Sales navigator is already a very competitively priced app, and becomes even more so when factoring in that the monthly subscription is tax deductible. They are known as direct sellers.

Motor vehicle travel to and from work if having either shifting workplaces (working at more than one site each day before returning home), or transporting bulky equipment when visiting clients, i.e. Tax deductions for sales representatives auto travel: Do you travel to meet clients?

Tax deductions for sales reps. It’s estimated that roughly 95% of households will use the standard deduction this year. Tax deductions for sales representatives march 10, 2018 in tax central by fiducial auto travel:

A deduction may be allowable for the actual expenses incurred. In other words, you can deduct gas, oil, oil changes, tire rotations, car washes and other expenses directly related to your work vehicle, or you can track your mileage and use the standard mileage rate. Meals and travel the cost of buying meals when you work overtime, provided you have been paid an allowance by your employer (you can claim for your meals without having to keep any receipts, provided you can show how you have.

Monitoring clients� changing needs and competitor activity, preparing sales reports and submitting records of business expenses incurred. For additional details as to specific business expenses, the records required and the various governmental regulations, Ad turbotax® makes it easy to get your taxes done right.

Private car use (read our blog on car expenses for full details on how and what to claim) bridge and road tolls; The average monthly car allowance for sales reps is $575 per month. Motor vehicle expenses incurred visiting clients and attending training.

What is the average car allowance for sales reps? Sales representatives deal with selling of goods to the customer.