Here�s a list of the top tax deductions for those over 50. As a senior, you may be eligible for benefits and credits when you file your return, such as the:

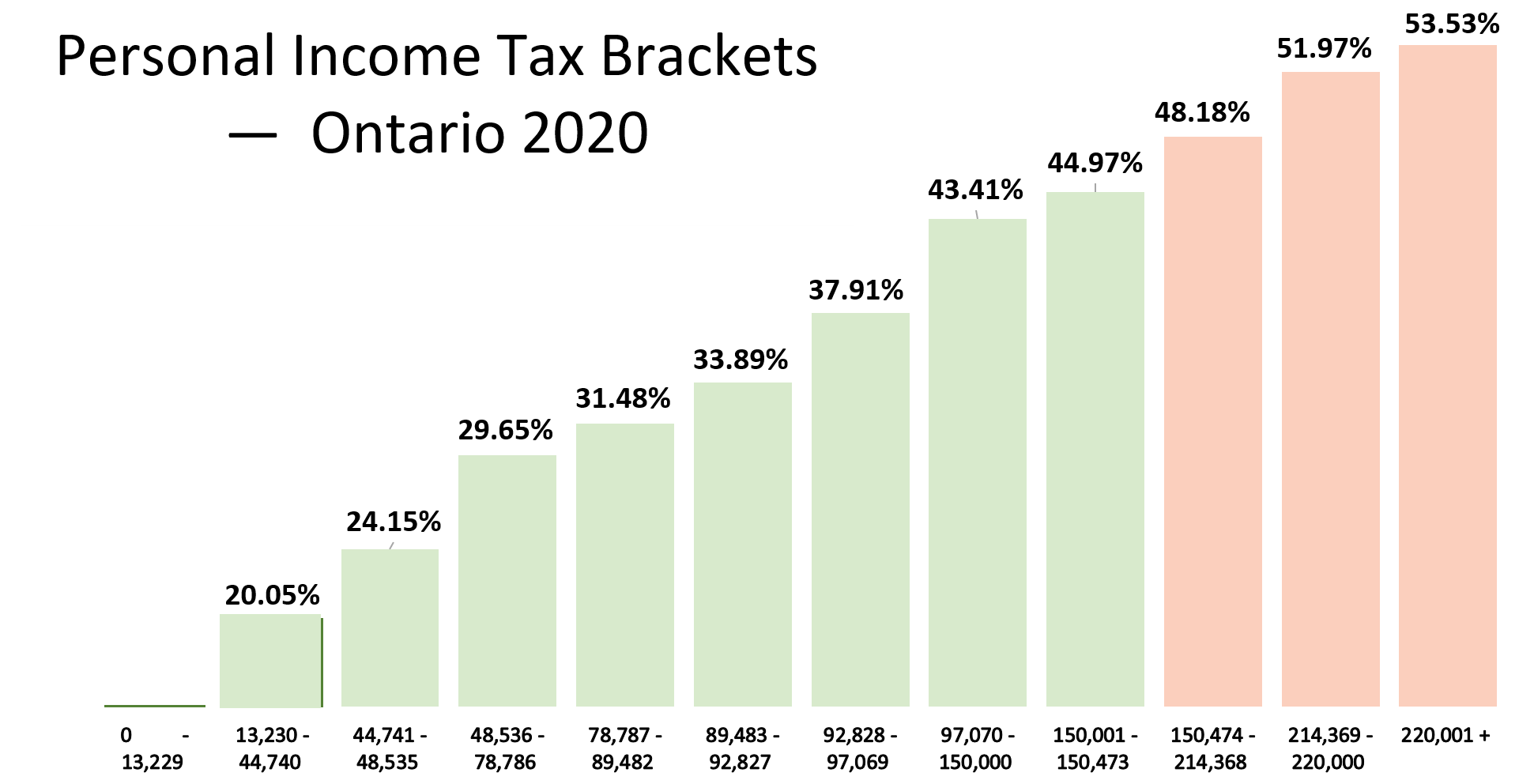

This marginal tax rate means that your immediate additional income will be taxed at this rate.

Tax deductions for seniors in ontario. If your income is between $38,893 and $90,313, the cra will phase out your age tax credit at 15% of. Your eligibility is based on your family’s net income from the previous tax year. For instance, ontario has a personal amount of $10,783, which allows you to reduce your provincial tax bill by $544.5.

The cra’s a ge amount tax credit the cra adds another tax credit called. That means that your net pay will be $37,957 per year, or $3,163 per month. Here�s a list of the top tax deductions for those over 50.

Your average tax rate is 27.0% and your marginal tax rate is 35.3%. Seniors can avail of 25% of eligible expenses up to $10,000, which is a maximum tax credit of $2,500. And the northern ontario energy credit;

An extra 10% supplement goes to residents of small, rural communities. 10 tax deductions for seniors you might not know about. Your eligibility depends on which province or territory you live in.

If your taxes are relatively simple — you’re not a small business owner, don’t give large sums to charity, and don’t. Every person who files income tax has certain basic deductions, and you may qualify for additional deductions for being a senior, living in the north, or qualifying for a disability exemption. What is the extra deduction for over 65 in 2020?

5 taxable social security income your social security benefits might or might not be taxable income. Goods and services tax / harmonized sales tax credit related provincial or territorial benefits and credits if you owe money this year, you may be able to claim credits that will lower what you owe at tax time. Your taxes may also be increased by $2,600 if both you and your spouse are over 65 and each other is over 65.

The maximum amount you may be able to claim is $7,033. Seniors and their families would be eligible for up to $2,500 in a tax credit, if they spend $10,000 on home improvements to make their living space more comfortable, including grab bars around. As a senior, you may be eligible for benefits and credits when you file your return, such as the:

That may mean a lower tax bill, a refund or a bigger refund, depending on the rest of your taxes. If you live in new brunswick, ontario, manitoba or saskatchewan, the climate action incentive payment reduces your taxes. Every taxpayer can either take the standard deduction or itemize his or her personal deductions on irs schedule a.

Getting all the benefits and credits to which you may be entitled to as a senior is not only top of mind for you, but for us as well! There are many provincial tax credits available to seniors who paid for ease of living or lifestyle improvements this year. The ontario energy and property tax credit (oeptc) the ontario sales tax credit;

For example, the seniors’ home safety tax credit is available in ontario for any households with residents 65 years or older. A $1,300 increase in the standard deduction may be granted by seniors over 65 in 2019. Home accessibility tax credit (hatc)

Ontario guaranteed annual income system If you make $52,000 a year living in the region of ontario, canada, you will be taxed $14,043. The seniors’ home safety tax credit would be a fully refundable tax credit for the 2021 tax year worth 25% of up to $10,000 in eligible expenses to make homes “safer and more accessible.” expenses would be eligible if they are paid or become payable in 2021.

When you donate to charity, you can receive tax benefits for your donations. These expenses must be focused on improving safety and accessibility for ontario seniors which. The following tax tips were developed to help you avoid some of the common errors dealing with the standard deduction for seniors, the taxable amount of social security benefits, and the credit for the elderly and disabled.

There are several credits and benefits designed for seniors. We have some tips to help you avoid interruptions to your benefit and credit payments. In addition, you�ll find links below to helpful publications as well as information on how to obtain free tax assistance.

It depends on your overall earnings. If you’re both 65 or older, your deduction could be $27,800. This marginal tax rate means that your immediate additional income will be taxed at this rate.

If you’re a senior, here are some tips to help you this tax season! If your 2021 net income is below $38,893, the cra will give you a complete $1,157 age tax credit. What is the standard tax deduction for seniors over 65?

Beginning july 2021, seniors whose 2020 income does not exceed $24,115 (individual) or $30,143 (couple) are eligible to receive $26 monthly ($52 monthly for couples). There are also deductions for rrsp or pension contributions, and any cpp or employment insurance payments you made.