Interest on home equity loans and home equity lines of credit can be deducted, but only if. If you are single or filing separately, you can deduct up to $5,000 in property taxes.

State or local income taxes and sales taxes charitable donations medical and dental costs that aren’t reimbursed

Tax deductions for single homeowners. Previously, there was never any cap. The tax cuts and jobs act (tcja), passed in december 2017, made several significant changes that impacted homeowners, beginning with a massive increase in the standard deduction available to all taxpayers. Don’t forget to include any taxes you may have reimbursed the seller for.

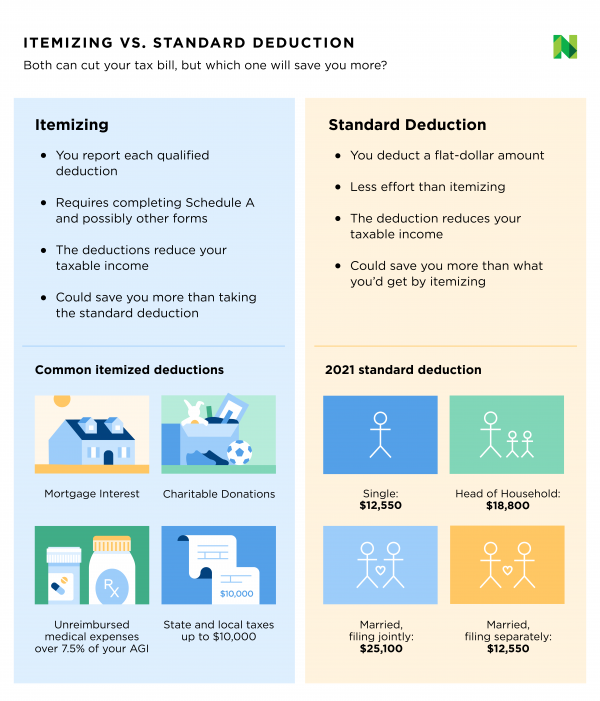

This is usually the biggest tax deduction for homeowners who itemize. For the 2020 tax year, the federal standard deduction is $24,800 if you’re married filing jointly, $12,400 if you’re single or married filing separately, and $18,650 if you’re filing as head of household. Other than deductions for homeowners, some of the most common itemized tax deductions include:

The rules changed after that date and now, married couples are limited to a debt of $750,000 when accounting for their mortgage deduction. To claim the deduction, you need to complete two tax forms: The tax cuts and jobs act of 2017 (tcja) took away the home office deduction for employees.

(keep in mind that the 2014 standard deduction is $6,200 for single people and $12,400 if filing jointly.) however, remember that you can only begin writing off expenses after you reach two percent of your adjusted gross income (agi). However, two single people can each own a portion of a. Taxpayers who are single or married filing jointly can deduct up to $10,000 in state and local taxes (salt).

If you itemize your personal deductions, interest that you pay on your mortgage is tax deductible,. Deductions can reduce the amount of your income before you calculate the tax you owe. You do not need to itemize to claim the tuition and fees deduction.

The mortgage interest on your primary residence, as well as on a second residence. If you are single or filing separately, you can deduct up to $5,000 in property taxes. If you’re filing jointly with your spouse, the maximum property tax deduction available is $10,000 per.

Each mortgage payment includes an interest. The standard deduction for a single taxpayer for the 2012 tax year is $5,950. Schedule 1 and form 8917, tuition and fees deduction.

This limit applies to the total of your property taxes and any state or local income and sales tax you paid throughout the year. This is the biggest deduction available for homeowners. The standard deduction, that amount everyone gets, whether they have actual deductions or not, nearly doubled under the new law.

In 2016, the standard deduction was $6,300 for single filers, and $12,600 for married couples filing jointly. The fourth item on the homeowner tax deductions list is the interest on a home improvement loan of up to $750,000 (per changes in the tax code that took effect in 2018). If you have a mortgage on your home, you can take advantage of the mortgage interest deduction.

(there are limits, but relatively few. Now, this cap lasts from 2018 to 2025. The following can be eligible for a tax deduction:

Credits can reduce the amount of tax you owe or increase your tax refund, and some credits may give you a refund even if you don�t owe any tax. Tax deductions for homeowners 1. As a married couple filing jointly, you can deduct up to $10,000 of your property taxes.

Tax deductions for homeowners mortgage interest. Homeowners can deduct interest expenses on up to $750,000 of mortgage debt from their income taxes, though when they itemize these deductions, they forgo the standard deduction of $12,550 for individuals or married couples filing individually, $18,800 for head of household & $25,100 for married filing jointly. Both the standard deduction and itemized deductions come off your taxable income, reducing it.

If you don�t have this much in itemized deductions, you�ll pay taxes on more income if you itemize. Owning a home can be expensive. From simple to complex taxes, filing with turbotax® is easy.

Credits for individuals family and dependent credits income and savings credits homeowner credits health care credits 8 tax breaks for homeowners 1. Paying for property taxes, repairs and homeowners insurance can significantly reduce what you can spend on luxury items and discretionary goods and services.fortunately, homeowners may be able to recoup some of the money they’ve lost by claiming tax deductions and credits.

There’s no index for inflation, and both single and married taxpayers have the same limit. As a homeowner, though, you may have enough in eligible expenses to itemize your deductions. Ad answer simple questions about your life and we do the rest.

Interest on home equity loans and home equity lines of credit can be deducted, but only if. It’s $18,000 for heads of household (up from. A portion of every mortgage.

Private mortgage insurance ( pmi) is often required when a home purchaser borrows more. As a homeowner, you pay property taxes at both a state and local level. A home equity loan is essentially a second mortgage on your house.

You can only claim the deduction if your gross income is $80,000 or less for single filers and $160,000 or less for joint filers. Tax deductions for homeowners mortgage interest. Now, you can only deduct up to $10,000 from property tax, state income tax, and state/local sales taxes.

Each month, part of your mortgage payment goes toward the principal (the amount. 7 tax deductions for homeowners 1. So if your agi is $60,000, the first $1,200 worth of itemized expenses don’t even count.

The trick here is what qualifies as “necessary.” Many people find it necessary to take out a loan to make repairs or improvements to their homes. State or local income taxes and sales taxes charitable donations medical and dental costs that aren’t reimbursed