A single parent who has more than 50% custody gets to claim head of household. A single parent who has more than 50% custody gets to claim head of household.

And it could be higher if you’re 65 or older or are blind.

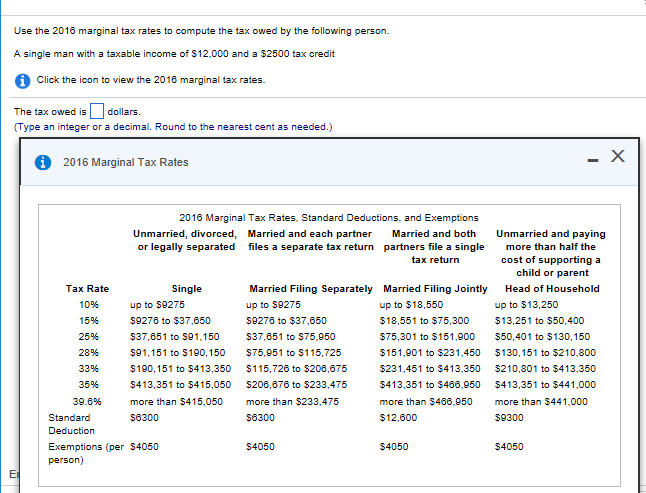

Tax deductions for single male. If your filing status for the 2020 tax year is single, you can take a standard deduction of $12,400. Similarly, singles are taxed at the lowest marginal tax rate of 10% on just their first $9,950 in income in 2021 (increasing to $10,275 in 2022), while. What kind of tax deductions are for a single person with no dependents & no house?

Lets start our review of the $60,000.00 salary example with a simple overview of income tax deductions and other payroll deductions for 2022. The other parent, who has less than 50% custody, cannot file as head of household. From simple to complex taxes, filing with turbotax® is easy.

By following a few simple tips, single women can make the most of their deductions and reap the highest tax benefits. On a federal level, the irs allows the taxpayer to deduct. A single parent who has more than 50% custody gets to claim head of household.

Taxpayers with the least income qualify for the greatest credit—up to $1,000 for those filing as single, or $2,000 if filing jointly. You are unmarried you can claim a qualifying dependent As a single person claiming no dependents, you can skip section 3.

Video of the day sorry, the video player failed to load. Ad turbotax® makes it easy to get your taxes done right. $18,800 for heads of household.

$25,100 for married taxpayers who file jointly, and qualifying widow (er)s. And it could be higher if you’re 65 or older or are blind. $12,550 for single taxpayers and married taxpayers who file separately.

Despite the fact that many single women don’t have as many tax deductions available to them as married women, there are still plenty of opportunities and many online tax tools to save when tax day arrives. For 2021 the maximum income for the savers tax credit is $33,000 for single filers, $49,500 for heads of household, and $66,000 for those married and filing jointly. Deductions can reduce the amount of your income before you calculate the tax you owe.

Tax code is progressive, meaning the highest tax bracket your income falls into isn’t the only rate that gets applied to your taxable income. The table below provides the total amounts that are due for income tax, social security and medicare. To be considered the head of household filing status, you must:

Pay more than half the household expenses, be “considered unmarried” for the tax year, The head of household filing status seems to very much like a single filer except you get a few higher amounts, like an $19,400 standard deduction versus the single filer’s $12,950 deduction. Schedule 1 and form 8917, tuition and fees deduction.

The standard deduction for the 2021 tax year, due april 15, 2022. Know who claims the child tax credit. You do not need to itemize to claim the tuition and fees deduction.

The internal revenue service gives taxpayers the option of claiming a standard deduction or. The first $9,950 is taxed at 10% the balance up to $40,525 is taxed at 12% the remaining balance over $40,525 is taxed at 22% the standard deduction for a single filer is $12,550 for tax year 2021. If you are covered by a retirement plan at work, for single filers the tax deduction begins to phase out at a modified annual gross income of $60,000 and phases out completely when modified agi.

To claim the deduction, you need to complete two tax forms: The standard deductions after the bonus are: The standard deduction for single seniors in 2021 is $1,700 higher than the deduction for taxpayer younger than 65 who file as single or head of household.

You can only claim the deduction if your gross income is $80,000 or less for single filers and $160,000 or less for joint filers. Once of all that is calculated and subtracted. Single $12,000 (+ $1600 65 or older) married filing separately $12,000 (+ $1300 65 or older) married filing jointly $24,000 (+ $1300 each spouse 65 or older) head of household $18,000 (+ $1600 65 or older) 2019 standard deduction amounts single $12,200 ($16,500 65 or older)

If you are married filing jointly and you or your spouse is 65 or older, your. Single parents that meet the eligibility requirements are rewarded with a lower tax rate and standard deduction compared to single filers and married filers. Tax deductions tax savings for single people reduce the amount you owe to uncle sam by adjusting your withholding, switching to a roth 401(k) and making ira contributions sooner rather than later.

If you elect to itemize your deductions, you can subtract from your income. Tax deductions for things like child care and home mortgage interest get a lot of attention in the press, and for people with houses and children, these can represent a. In general, the standard deduction is adjusted each year for inflation and varies according to your filing.

Single filers who make less than $75,000 a year ($150,000 for married filers and $112,500 for heads of household) might be eligible for the. Your standard deduction consists of the sum of the basic standard deduction and any additional standard deduction amounts for age and/or blindness. As of 2015, the standard deduction is $6,200 for single filers, $12,400 for married filers and $9,100 for head of household filers.

Credits can reduce the amount of tax you owe or increase your tax refund, and some credits may give you a refund even if you don�t owe any tax. The standard deduction is a specific dollar amount that reduces the amount of income on which you�re taxed.