The head of household filing status seems to very much like a single filer except you get a few higher amounts, like an $19,400 standard deduction versus the single filer’s. The standard deduction—which is claimed by the vast majority of taxpayers—will increase by $800 for married couples filing jointly, going from $25,100 for 2021 to $25,900 for.

As of 2015, the standard.

Tax deductions for singles. Tax deduction tips for singles. For the 2021 tax year (filed in. Despite the fact that many single women don’t have as many tax deductions available to them as married women, there are still plenty of opportunities and many online tax.

Turbotax® makes it easy to find deductions to maximize your refund. 4 rows deduction for state and local taxes. The standard deduction—which is claimed by the vast majority of taxpayers—will increase by $800 for married couples filing jointly, going from $25,100 for 2021 to $25,900 for.

The head of household filing status seems to very much like a single filer except you get a few higher amounts, like an $19,400 standard deduction versus the single filer’s. Credits can reduce the amount of tax you owe or increase your tax refund, and some. Ad we maximize your tax deductions & credits to ensure you get back every dollar you deserve.

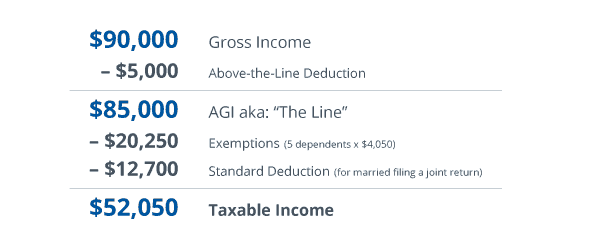

As of 2015, the standard. If you are covered by a retirement plan at work, for single filers the tax deduction begins to phase out at a modified annual gross income of $60,000 and phases out completely. Deductions can reduce the amount of your income before you calculate the tax you owe.

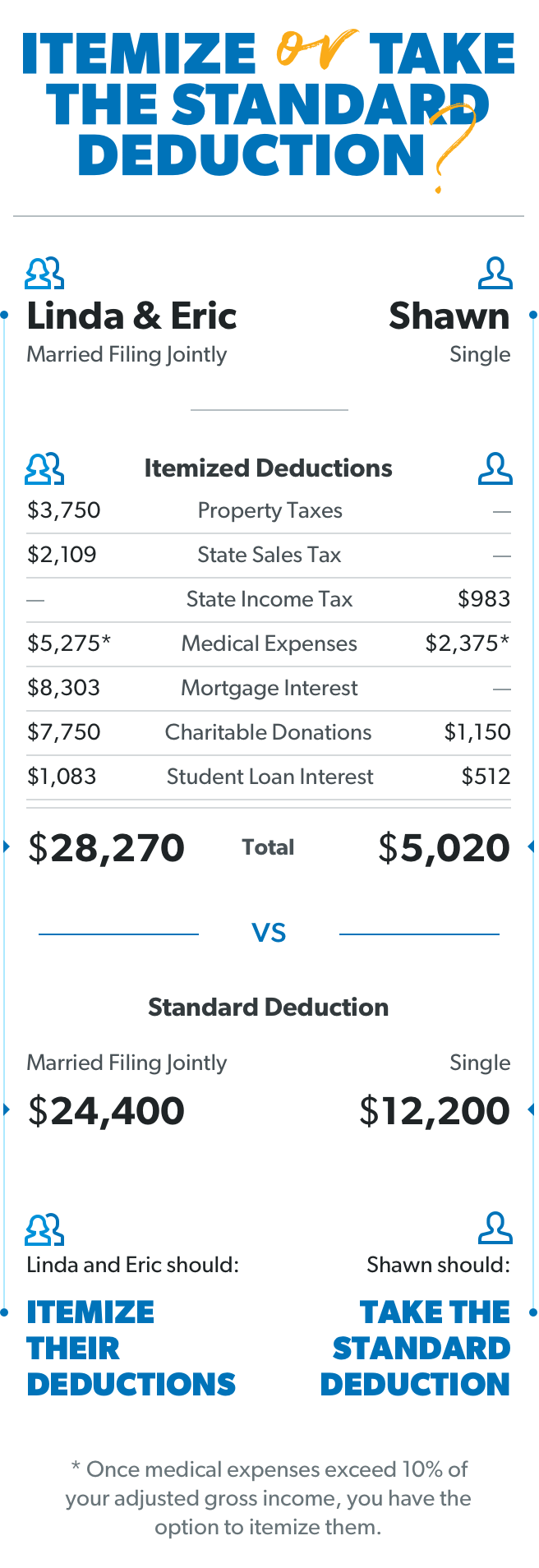

This act “significantly raised the standard deduction amount for both households filing together and single individuals filing alone,” fan says. For single taxpayers and married individuals filing separately, the standard deduction rises to $12,550 for 2021, up $150, and for heads of households, the standard. The standard deduction for a single filer is $12,550 for tax year 2021.

For the 2021 tax year, the standard deduction is $12,550 for single filers and married filing separately, $25,100 for joint filers and $18,800 for head of household. Ad we maximize your tax deductions & credits to ensure you get back every dollar you deserve. 4 rows what are the standard deduction and tax brackets for single filers?

Use a roth to save. Tax savings for single people work. Turbotax® makes it easy to find deductions to maximize your refund.

The new child tax credit was made fully refundable in 2021 and increased to up to $3,600 per year per child through age 5, and up to $3,000 per year for. You can only claim the deduction if your gross income is $80,000 or less for single filers and $160,000 or less for joint filers. If you’re single and earning some kind of education, there are many credits and deductions available from the irs.

If you got a big tax refund this year, it meant that you�re having too much tax taken out. To claim the deduction, you need to complete two. If you don�t have this much in itemized deductions, you�ll pay taxes on more income if you itemize.

Single parents that meet the eligibility requirements are rewarded with a lower tax rate and standard deduction compared to single filers and married filers. For single taxpayers and married individuals filing separately, the standard deduction rises to $12,950 for 2022, up $400, and for heads of households, the standard. The standard deduction for a single taxpayer for the 2012 tax year is $5,950.

Common schedule 1 deductions for 2021 are:. You may deduct up to $10,000 ($5,000 if married filing.