Ad find out what tax credits you qualify for, and other tax savings opportunities. Two types of small business tax deductions.

• 20% deduction • qbi deduction • code §199a deduction • deduction for qualified business income •.

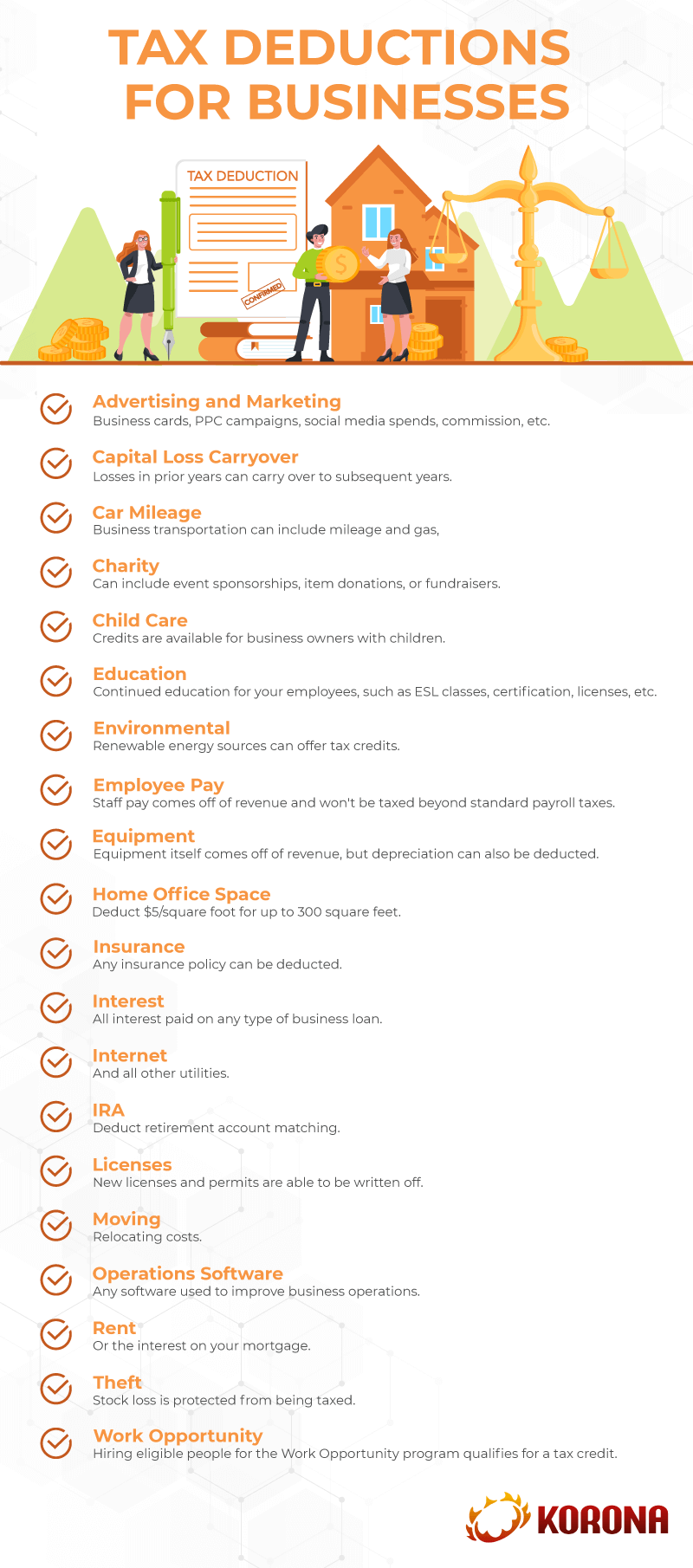

Tax deductions for small business. Following are the major ones. The cost of advertising and promoting your business is typically 100 percent deductible. Guaranteed 100% accurate tax preparation.

Some of the common small business tax deductions include: • 20% deduction • qbi deduction • code §199a deduction • deduction for qualified business income •. Under the new tax law, most small businesses.

The simplified option has a rate of $5 a square foot for business use of the home. Make your appointment with a block advisor now. Discover the right location, the best talent, & all of the incentives available to you.

Guaranteed 100% accurate tax preparation. The maximum deduction under this. The maximum size for this option is 300 square feet.

Ad participating companies are eligible to receive significant tax breaks & cash grants. Ad download the tax 101 tip sheet for an overview on the types of taxes businesses must file. If you’re just starting out, the irs offers some valuable tax breaks for new small business owners.

This article, “tax deductions for your startup,” can help you. Ad our tax advisors are dedicated to finding every tax deduction your business deserves. While there are a few prerequisites to consider, the costs.

Make your appointment with a block advisor now. Small business tax deductions related to your staff if you have any employees, including yourself, there are several deductions available to you. If you’re just starting your business, you can claim up to $5,000 before the launch of your business in startup expenses.

Download tip sheets on managing taxes from aarp�s small business resource center. Ad our tax advisors are dedicated to finding every tax deduction your business deserves. Small business owners can benefit from two types of deductions:

Get a personalized recommendation, tailored to your state and industry. There are conditions, of course, but most small businesses can deduct up to $5,000 on your first year’s return. Ad find out what tax credits you qualify for, and other tax savings opportunities.

Two types of small business tax deductions. 19 small business tax deductions 1. Office supplies and expenses rent family members’ wages advertising and marketing banking fees car expenses.

As long as your startup costs total $50k or less, you can claim the business startup deduction.