Section 179 of the irs code allows you to deduct as much as $25,000 of any money you spend for business equipment in 2014. Small businesses are displacing the traditional employer/employee relationship at a staggering rate.

Complete list of small business tax deductions.

Tax deductions for small business 2014. This newer option lets small business owners write off $5 per square foot for up to 300 square feet of office space in a home. Other common small business tax deductions include: Small businesses are displacing the traditional employer/employee relationship at a staggering rate.

Employee office parties are 100% deductible. As with all telephone expenses, this deduction must clearly. How to calculate qualified business income (qbi) on the 1040 1 presented by:

As per the mb 2013 budget, the small business limit was increased from $400,000 to $425,000 on january 1, 2014. Here are many of the different costs that small business owners can claim as tax deductions: There are two ways that you can deduct office furniture.

For 2021, the maximum deduction amount is $1,050,000. The yukon 2014 budget announced that the small business income tax rate. The cost that you bear to initiate your business or expand it.

Tax year 2021 small business checklist. Which small business tax deductions are you eligible for? But, like most deductions, there is a maximum.

The following list gives you the complete rundown of possible. Twenty percent small business deduction: State income tax can be deducted on your federal return as an itemized deduction, not as a business expense.

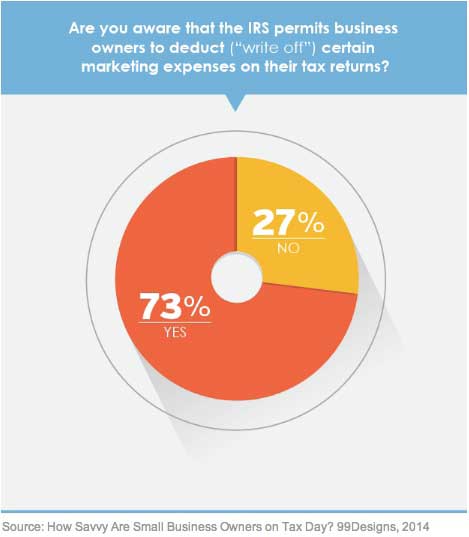

It just so happens that the holy grail of tax deductions is also a small business. It’s a good thing the money you spend promoting your products and/or services is 100% tax deductible, given that the u.s. Small businesses can write off a number of expenses as tax deductions to help lower the amount they owe on their income tax.

Small business administration (sba) recommends. Complete list of small business tax deductions. Advertising business use of your home (mortgage insurance, interest, utilities, repairs, and depreciation) licenses.

To claim the home office. The april 15th tax deadline is rapidly approaching so let’s take a closer look at 3 of the most popular small business tax deductions. Unlike business depreciation, the section 179 deduction cannot create a tax loss, so the amount you can claim is limited to the.

Meals and snacks for employees at the office are 50% deductible. This deduction will be applied in. A business dinner with a client is 50% deductible.

Small businesses can elect to expense assets that cost less than $2,500 per item in the year they are purchased. Federal income tax paid on business income is never deductible. Client(s) who actually operate business.

Section 179 of the irs code allows you to deduct as much as $25,000 of any money you spend for business equipment in 2014. Ohio small business investor income deduction; May 15, 2014 leave a comment;

Top 25 tax deductions for small business. Larry gray, cpa, cgma national association of tax professionals. 75% of line 13 or 75% of line 14, whichever is less (maximum deduction is $187,500 for married fi ling jointly or single/head of.

You can read more about the de minimis safe harbor election in. First, you can deduct the entire cost of the furniture in the year that it was purchased.