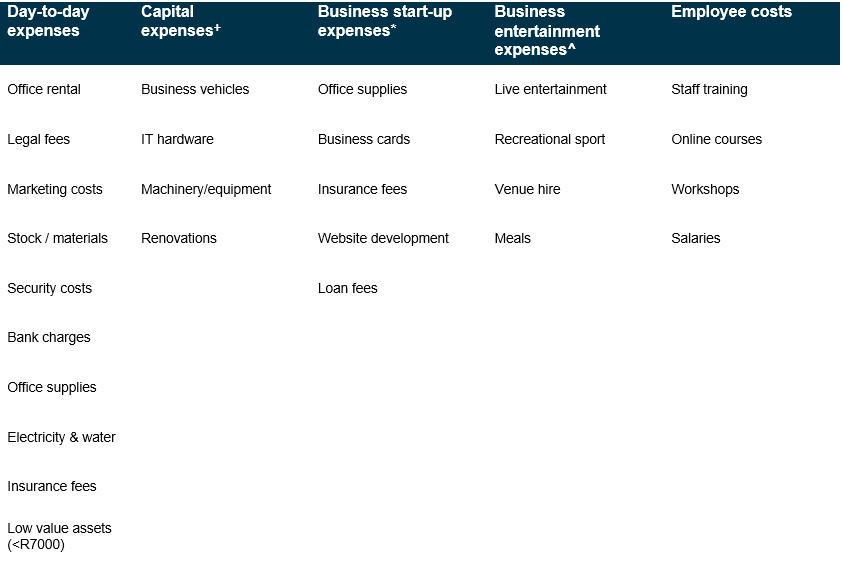

Top 25 tax deductions for small business. It’s clear that sars’ reasoning here is, they don’t want your business to get a tax advantage if it.

There are numerous deductions and allowances available to smes.

Tax deductions for small business south africa. Tax rates for small business corporations. Certain limited expenses may be deducted by employees from their employment income. 59 098 + 28% of taxable income above 550 000.

Expenses paid to power the business with internet and phone service can be written off to lower small business owners’ tax liability. While the main rate of corporate tax in south africa is 28%, company income up to zar550,000 (approx. Small businesses are required to follow the same tax processes as.

20 248 + 21% of taxable income above 365 000. If you have a home office, you can also claim a percentage of your home expenses. Turnover tax is an alternative simplified method of business tax in south africa because it is a tax for small businesses in south africa with an annual turnover of r1,000,000.

Although businesses are generally subjected to a flat corporate income tax rate of 28%, a small business corporation (sbc) may. The top 17 small business tax deductions. Business tax refers to a tax levied by the south african revenue services (sars) on the profits made by businesses.

Top 25 tax deductions for small business. In respect of expatriate employees), subject to certain conditions and limitations. A depreciation (wear and tear) allowance may be deducted on movable assets used for the purpose of trade.

7% of taxable income above 75 750. It’s clear that sars’ reasoning here is, they don’t want your business to get a tax advantage if it. Preface this guide is a general guide dealing with the taxation of small businesses such as sole proprietors,.

To get your business ready for operation, you’ll need to buy equipment like treatment beds, ultrasound machines, and a computer. Tax guide for small businesses (2020/2021) i tax guide for small businesses. Each of these expenses are tax deductible.

A basic guide to small business tax considerations. Within south africa or their usual place of residence outside south africa (i.e. It is in your best interest to familiarise yourself with them to ensure you never pay more tax for your.

Small businesses can write off a number of expenses as tax deductions to help lower the amount they owe on their income tax. Us$43,000) is taxed progressively for companies. There are numerous deductions and allowances available to smes.

Use our small business corporation income tax calculator to work out the tax payable on your business taxable income. These expenses need to be added back to your profit when calculating your income tax liability.