This means that if you purchase photocopier systems software for $600, you may write off 20 percent, or $120, each year for five years. You also have the option of claiming them in one tax year only, using section 179 expensing, which allows you to claim the total upfront cost immediately up to a $1,050,000 limit for 2021.

Engineers design, construct, and maintain products, machines, and structures.

Tax deductions for software engineer. The deduction reduces the top effective rate on qbi income to 29.6% (which is 80% of the top 37% rate). Important case law relied referred: How can i use these software development tax deductions?

$100 x 0.60 = $60. Skill level bachelor degree or higher. Business equipment (section 179) licenses, software, & subscriptions.

Travel to and from work, and client’s premises, while transporting bulky. 10 tax deductions for software & web developers. Over one year, your deduction is twelve times the business portion of your monthly bill, or $720.

This rarely comes into play for. Abcaus case law citation abcaus 3497 (2021) (04) hc. Tax authorities will automatically deduct a lump sum of 1000€ from your yearly taxable income, with no proof to submit to take advantage from it.

You can deduct unreimbursed employee expenses on line 21 of schedule a to the extent that those expenses exceed 2% of your adjusted gross income. If you earn your income as an employee engineer, this information will help you to work out what: In addition, the 20% deduction (under section 199a of the tax law) can now be applied towards qualified business income (qbi).

Software engineer in a software industry is a workman for the purpose of deduction u/s 80jjaa so long as it does not discharge any supervisory role. File your own income tax return using the deductions. An online tool like bonsai accounting and taxes.

Some companies will offer you the free access to. It is not required that workman works for entire 300 days in a previous year. Utilize the services of a paid accountant.

If you prefer to live alone like me in an apartment within the second ring road, you have to spend at least 2000 on rent, plus 1000 or more on meals, 100 on utilities and 100 on transportation if you don’t take taxi that often. This means that if you spent $600 on software in this category, you may write off $180. Engineers design, construct, and maintain products, machines, and structures.

Software and the section 179 deduction an increasingly popular use of the irs §179 deduction is for software. An often missed tax deduction for engineers and science workers. Always use a new copy for preparation of it bill.

An alternative to section 179 expensing is bonus depreciation. Instructions should be followed for using the it software which was given in it program file. Income and allowances to report.

As a business, you can reimburse owners for things like home internet and home office expenses, and those reimbursements are tax deductible. This means that if you purchase photocopier systems software for $600, you may write off 20 percent, or $120, each year for five years. If you use an exclusive area of your home to conduct business, you may be able to deduct related expenses on your tax return as.

Records you need to keep. You also have the option of claiming them in one tax year only, using section 179 expensing, which allows you to claim the total upfront cost immediately up to a $1,050,000 limit for 2021. Needless to say, no one wants to pay more tax than they have to.

See publication 529 (2012), miscellaneous deductions for a detailed description of what this entails. A standard deduction is a fixed dollar amount defined by the irs that varies based on your filing status. I know there�s a 2k a year (thought it was 4k.) deduction for continuing education that i hope to do something with, but what i would really like would be able to get tax deductions for airfare, lodging, so that i can go to a bunch of software.

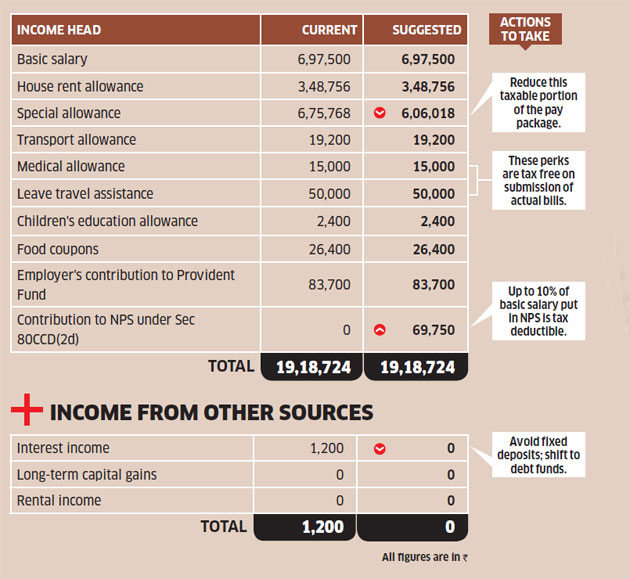

Taxspanner estimates that menon can save almost rs 19,000 if his salary structure is rejigged and his company offers him the nps benefit. Furthermore, required items to complete training like textbooks, software and stationery can be included as well. If you are completing further training, or attending work related events or conferences, these are tax deductible.