A sole proprietor may also be able to deduct up to 20% of his or her net business income. As a sole proprietor, you’ll have to take care of this on your own.

One good thing about being a sole proprietor and running a business is that you can claim certain deductions to offset your.

Tax deductions for sole proprietorship. Sole proprietorships, llcs, and partnerships cannot deduct charitable contributions as a. Know where you can save money and grow your profits 1. As a sole proprietor, you likely use your personal vehicle for your business, whether frequently or infrequently, or you may have a separate vehicle exclusively for business use.

When your tax refund is finalized, it will feel like you are still under the benefits of employment, but. If you dont have a lot of money, you can start your business as a sole proprietorship, and then transition to an llcwhen youre ready. Potential tax deductions for sole proprietorships.

In addition to its expiration date of november 30, congress may extend the deduction to 2026 or beyond based on its discretion. With this deduction, eligible taxpayers —. Any business that does not pay direct.

The deduction allows eligible taxpayers to deduct up to 20 percent of their qualified business income (qbi), plus 20 percent of qualified real estate investment trust (reit) dividends and. Personal tax deductions for business owners charitable contributions. A sole proprietor is someone who owns an unincorporated business by himself or herself.

One good thing about being a sole proprietor and running a business is that you can claim certain deductions to offset your. As a sole proprietor, you’ll have to take care of this on your own. Tax deductions for sole proprietorships.

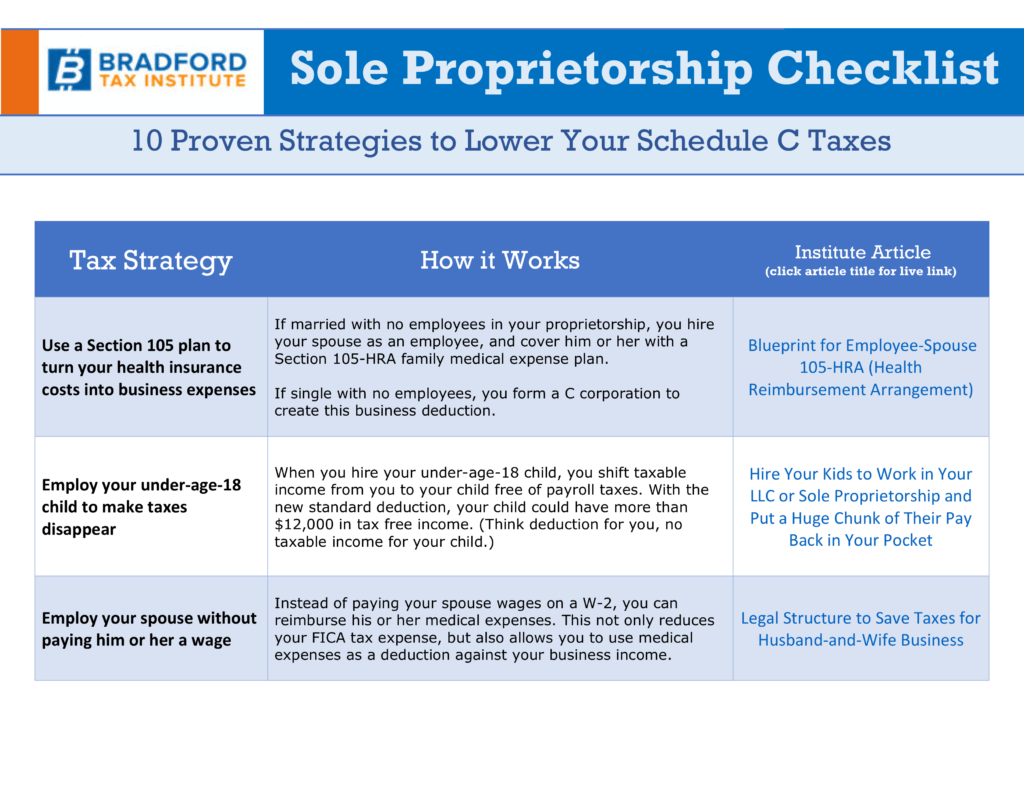

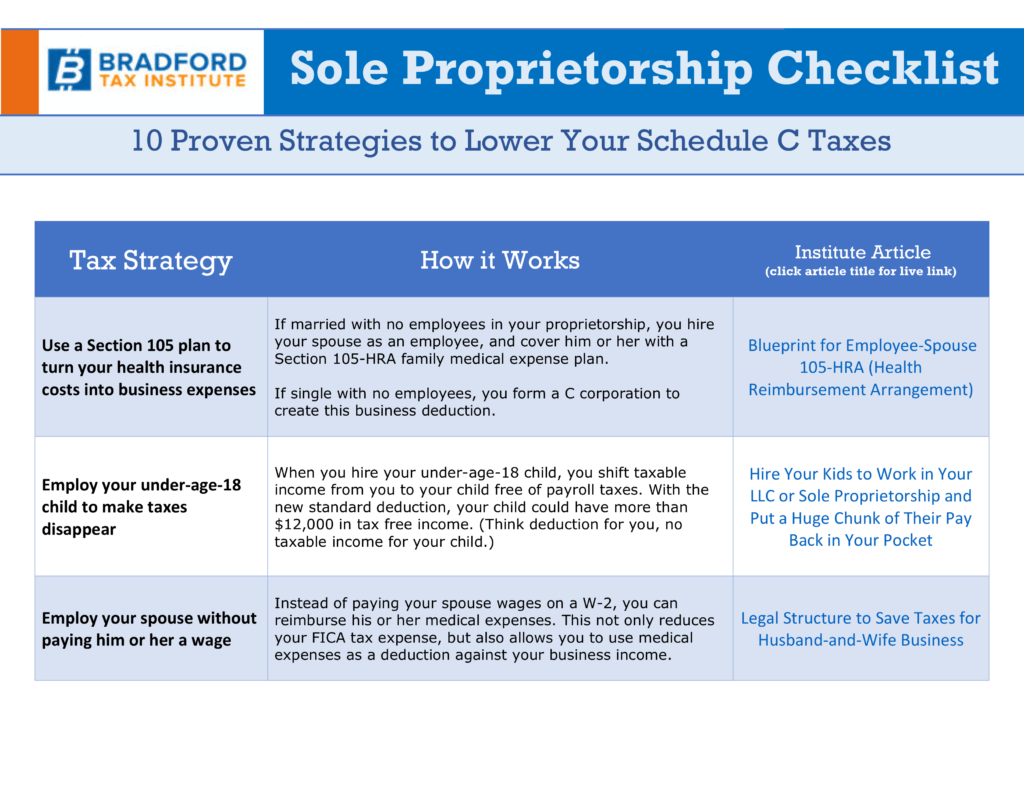

A sole proprietor may also be able to deduct up to 20% of his or her net business income. The qualified business income (qbi) deduction. Tax tips for sole proprietors health insurance deduction.

Personal deductions for sole proprietor taxes may include health insurance premiums paid out of pocket, child and dependent care expenses, mortgage interest if you own. One of the best tax advantages of a sole proprietorship is that you can deduct health insurance for yourself, your spouse, and your dependents—and you can claim this deduction even if you’re. Additionally, social security contributions max out when your income reaches.

However, if you are the sole member of a domestic limited. The tax cuts and jobs act of 2017 created a new deduction for business owners: One of the main tax advantages of running a sole proprietorship is that you can deduct the.

After hearing about all the different taxes you have to pay as a sole proprietor, it’s understandable that you’re feeling.