For single filers, the $4,000 deduction is available for a magi up to $65,000. For single filers, the $4,000 deduction is available for a magi up to $65,000.

For single filers, the $4,000 deduction is available for a magi up to $65,000.

Tax deductions for students. These tax deductions can apply to any age group. Students who qualify can receive credit for 20% of the first. There are two special kinds of.

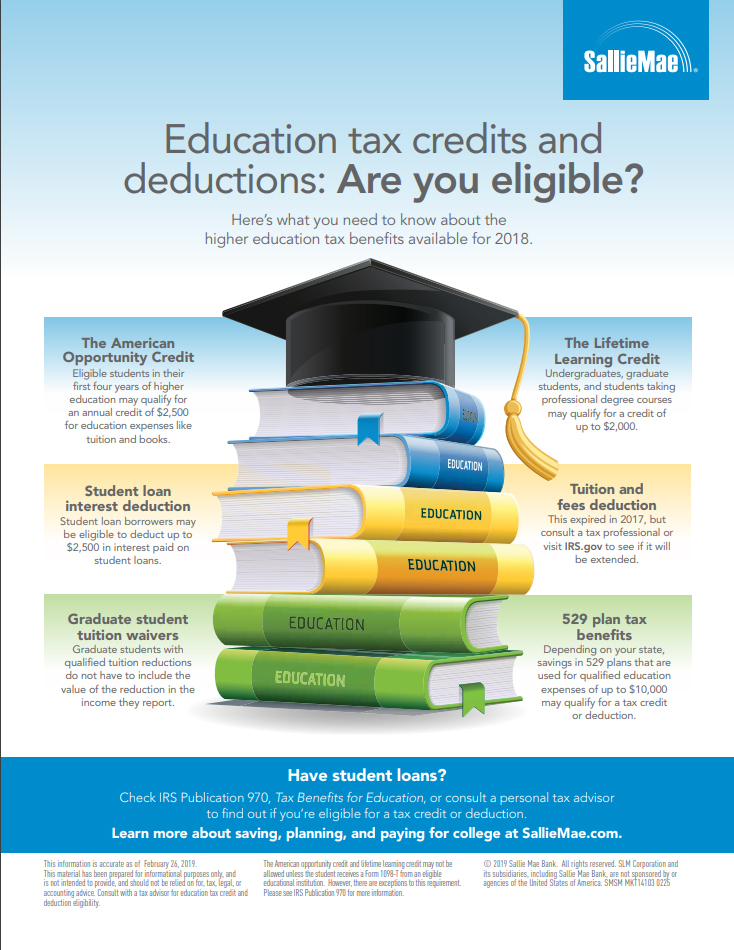

Here are the 2021 tax credits and deductions. The most important tax benefits for students to consider include the tuition deductions and/or credits. Students have access to a few tax deductions and credits that can help offset the cost of college.

The maximum deduction is $2,500. These credits or deductions generally cover things like qualifying tuition, books, and. Students who are single and earned more than the $12,550 standard deduction in 2021 are required to file an income tax return.

Tax credit options such as the american opportunity tax credit and lifetime learning credit allow you to deduct portions of tuition and fees, books, supplies, and. Student loan interest deduction you may be able to deduct interest you pay on a qualified student loan. This deduction can be taken by the person who is claiming the student as a dependent and is legally obligated to pay the student loan interest.

It is $2,000 between $65,000 and $80,000. Student loan interest tax deduction. If you have student loans or pay education costs for yourself, you may be eligible to claim education deductions and credits on your tax.

Joint filers can deduct $4,000 for a magi up to. If you are a student or a parent of a student and made payments on a qualifying student loan, you can deduct up to $2,500 of the interest. College student tax deductions include the following:

Below are common tax deductions for university students. The tuition and fees deduction expired in 2020. Child care expenses moving expenses

This deduction can reduce your taxable income by up to $2,500, and you can claim it even if you. Tax exclusions are parts of your income that do not have to be included in your gross income on your tax. We will cover the following tax deductions for university students:.

Tax deductions for uni students. The student loan interest deduction helps cover the interest you pay on your student loans. Generally, the amount you may deduct is the lesser of $2,500 or the.

If you meet one of the four criteria above, then there are a range of uni student tax deductions you might be able to claim. According to the irs, students must meet the. For single filers, the $4,000 deduction is available for a magi up to $65,000.

But you can claim up to $4,000 in deductions on your taxes. That $12,550 includes earned income (from a. The most common deductions that apply to students are:

Tax benefits for higher education.