If you�re an employee for a construction company, rather than an. Equipment hired for this job (‘plant hire’) manufacturing or prefabricating materials.

/how-to-report-and-pay-independent-contractor-taxes-398907-FINAL-5bb27d1846e0fb0026d95ba3.png)

Regardless of your trade in the construction industry, allowable tax deductions can lower your tax liability and possibly lead to getting a tax refund.

Tax deductions for subcontractors. Depending on what type of work you do, you may need to have some kind of office to perform. How to make a cis deduction. You�re not entitled to paid leave if you get sick or injured.

Regardless of your trade in the construction industry, allowable tax deductions can lower your tax liability and possibly lead to getting a tax refund. Most all traveling expenses (when you’re on a work trip) are guaranteed deductions. Equipment hired for this job (‘plant hire’) manufacturing or prefabricating materials.

One of the largest expenses available to independent contractors to deduct is mileage. Tax deductions reduce net income,. Contract labor expenses contract labor involves the usage of independent contractors.

As a contractor, you�re running your own business. You have two options when it comes to this. When you work as a subcontractor, you can deduct many of the expenses that you incur throughout the.

I buy lunches for the crew of my sub contractor a couple of days a week so they don�t have to leave the job site. Small businesses often utilize subcontractors to meet their labor needs. Entrepreneurs often use their vehicle as a second office, as they spend a large portion of their time traveling for their business.

Some posts that have june 2019 dates are really. How do i determine whether my worker is an employee or subcontractor? If you�re an employee for a construction company, rather than an.

Can i deduct this expense? If you work from home, you can also deduct your internet costs. Tax deductions for independent contractors as an independent contractor, you can deduct reasonable and necessary expenses related to running your business.

Equipment which is now unusable (‘consumable stores’) fuel used, except for travelling. You can deduct common expenses such as tools and materials, and even certain other items that come in handy in your business or on the job. The rate for cpp contributions in 2021 is 10.9%, up to an annual maximum of $6,333 (if you were working for an employer your.

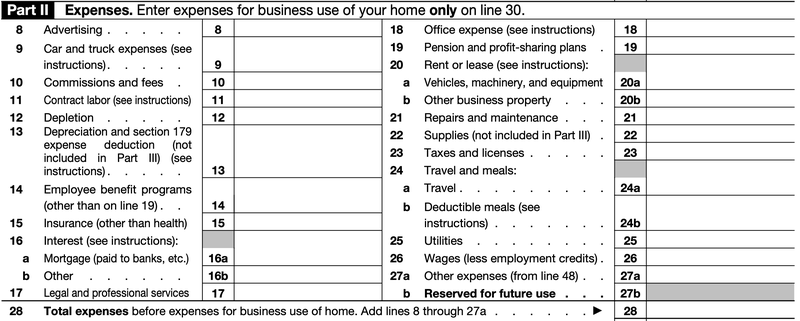

Subcontractor payments contractors may deduct from their business tax base amounts actually paid during the business tax period to a subcontractor that holds a business license, or who is licensed by the state board for licensing contractors, for performing the activities descri bed in tenn. Medical one of the more popular 1099 contractor deductions is any and all medical expenses. Record contract labor expenses on line 11 of your schedule c.

Contractors have different tax and super obligations to employees. You need an australian business number (abn), and you need to pay tax and super. Many times, subcontractors are also brought in for specialty or highly technical aspects of the job.

If the worker is a subcontractor, what forms do i complete and file to report his earnings? If you hire independent contractors yourself, such as a designer to create a brochure or a web developer to build a website, you can claim a deduction on their fees. Subscriptions to relevant content contractors typically subscribe to magazines or newsletters that are relevant to the construction industry.

Remember, any expense incurred for the purpose of earning income, as long as it�s reasonable, has the potential to be deductible. Insurance & registration car insurance, roadside assistance, registration costs, etc. Simply put, if 20% of one’s home space is used as an office, then 20% of the house’s annual rent is deductible on the business taxes.

Provided that you follow the appropriate steps, the cost of this labor is generally deductible. Canada pension plan (cpp) payments. You may have to pay the cost to fix anything you damage in the course of your work.